In recent developments, former President Donald Trump is considering launching a lawsuit against Federal Reserve Chair Jerome Powell, amidst ongoing tensions over monetary policy and its impact on the economy.

This comes at a critical time as new inflation metrics indicate a drop in consumer prices, leading many to speculate about the Fed’s potential strategies that could affect digital assets.

Impact on Bitcoin Due to Political Uncertainty

In spite of the political upheaval, the price of Bitcoin has surged closer to $121,000, reflecting a buoyant market sentiment.

Controversy Over Renovation Expenses

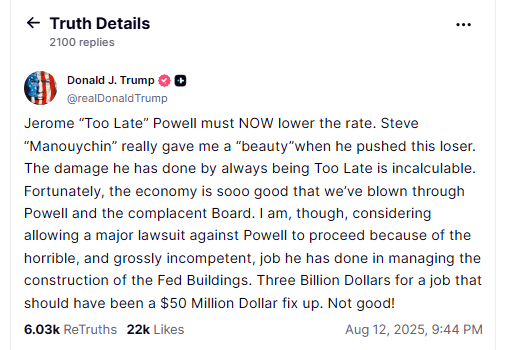

In a recent post on Truth Social, Trump claimed the Federal Reserve’s renovation expenses should not have exceeded $50 million, contrasting sharply with the reported $3 billion price tag.

This discrepancy has drawn scrutiny, as some sources indicate that Powell might have been referred to the Department of Justice concerning allegations of perjury linked to these financial miscalculations.

During a visit to scrutinize the renovations, Trump urged Powell to enact immediate rate cuts, criticizing the Fed’s delayed actions and declaring the resulting economic consequences as “incalculable.”

Such rate cuts often serve as a positive signal for risk-friendly investments, including Bitcoin and other cryptocurrencies, as they typically lead to a weaker US dollar and pave the way for increased speculation.

Former President Donald Trump announced potential legal action against Jerome Powell, citing ongoing concerns over renovation finances.

— Bloomberg Law (@BLaw) August 12, 2025

Shifts in CPI Could Affect Future Rate Decisions

The latest Consumer Price Index (CPI) revealed a year-over-year increase of only 2.7% for July, falling short of expectations which predicted a rise of 2.8%. In addition, the monthly CPI change decreased from 0.3% to 0.2%.

Analysis from experts suggests that Trump’s tariff policies do not seem to have exacerbated inflation, counteracting previous concerns that might affect the Fed’s decision-making on rate cuts. Trump asserted that these tariffs are not burdensome on consumers, citing an influx of cash into the national economy.

A potential rate reduction could foster a more advantageous environment for cryptocurrency valuations, as more accessible borrowing and decreased yields in conventional financial avenues typically provoke greater interest in alternative assets like Bitcoin and Ethereum.

Support from Miran on Trump’s Economic Predictions

Stephen Miran, Trump’s nominee for a position on the Fed Board, expressed to CNBC that inflation levels appear manageable, estimating a stable annualized rate of 1.9% since Trump’s presidency began. He noted that the CPI figures are seldom altered and there are no tangible indicators of inflation instigated by tariffs.

His assertions resonate with Trump’s narrative and amplify expectations that the Fed may pivot towards easing policies sooner, sparking keen interest among crypto traders, as a softened Fed stance could provoke price increases across leading cryptocurrencies.

The interplay between political tensions, potential legal actions, and favorable inflation statistics places Powell in a precarious position. If the anticipated rate cuts are expedited, the crypto market could experience significant momentum, as indicated by Bitcoin nearing the $121,000 mark, suggesting that investors are already adapting to this prospect.

Image credits to Meta, with charting data from TradingView