Renowned asset management firm Choreo has made headlines by announcing a significant investment of around $6.5 million into various spot Bitcoin (BTC) exchange-traded funds (ETFs). With over $27 billion in assets under management, this move underscores the growing influence of cryptocurrency in traditional finance.

Choreo’s Strategic Move into Bitcoin ETFs

A recent SEC filing reveals that Choreo LLC has diversified its portfolio by holding stakes in multiple Bitcoin ETFs. The firm’s largest investment is in BlackRock’s iShares Bitcoin Trust ETF (IBIT), consisting of 51,679 shares valued at over $3 million as of June 30.

Furthermore, Choreo controls 22,976 shares of the Grayscale Bitcoin Trust ETF (GBTC), which is currently worth approximately $1.9 million. Additionally, the firm has 8,314 shares of the Grayscale Bitcoin Mini Trust ETF (BTC), valued at nearly $400,000. They also possess 13,607 shares of the Fidelity Wise Origin Bitcoin ETF (FBTC), representing an investment of about $1.3 million. Reports from SoSoValue indicate that BlackRock’s IBIT dominates the market with total net assets of $89.11 billion.

It’s worth noting that Bitcoin ETFs have recently displayed impressive performance, with positive inflows exceeding $17 billion from April to July. However, August brought a net outflow of $321 million. Still, the total net assets in spot BTC ETFs have soared past $155 billion, accounting for approximately 6.48% of Bitcoin’s total market capitalization.

In addition to private firms, several educational institutions, including well-known universities, are increasingly allocating their endowment funds towards BTC ETFs. Recently, Harvard University announced a substantial $117 million investment in BlackRock’s IBIT ETF.

Moreover, Norway’s sovereign wealth fund has raised its indirect exposure to Bitcoin by an astounding 192% year-over-year, now holding a total of 7,161 BTC. This trend highlights a notable shift in institutional behavior toward cryptocurrency investments.

Institutional Interest in BTC ETFs Accelerates

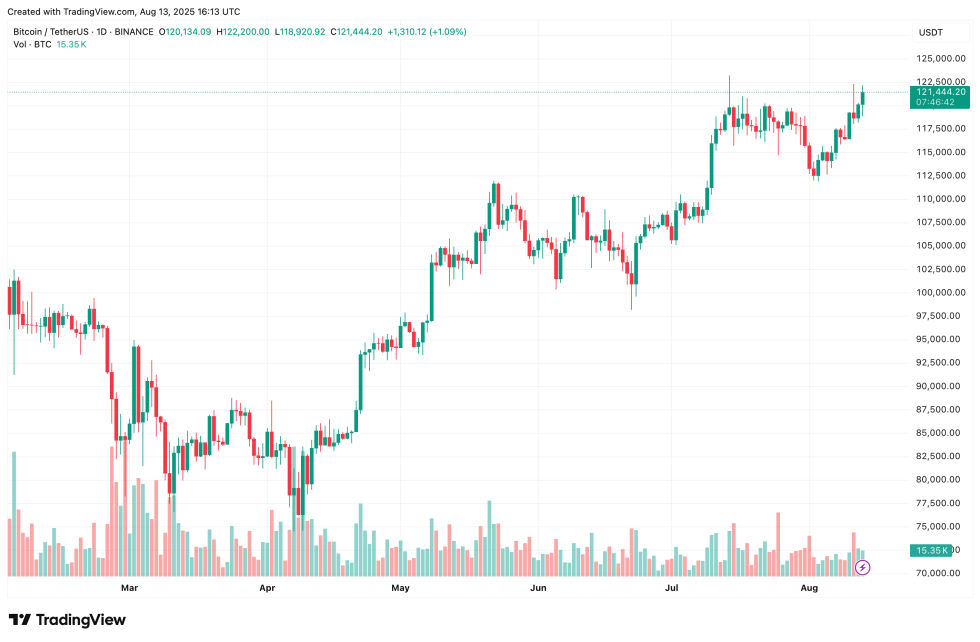

As Bitcoin hovers near a new all-time high of approximately $120,000, institutional interest in BTC ETFs is surging. Instances like BlackRock’s IBIT ETF amassing $70 billion in assets within a year showcase the rapid acceptance of regulated Bitcoin investment vehicles.

The landscape of cryptocurrency investment is also evolving beyond traditional methods. Following the recent election of US President Donald Trump, his social media venture, Trump Media, has expressed eagerness to enter the crypto arena by filing for a third ETF aimed at tracking a diverse range of cryptocurrencies.

However, the Securities and Exchange Commission (SEC) continues to approach new ETF applications with caution, given the volatility and risks associated with digital assets. Currently, Bitcoin trades around $121,444, marking a 1.1% increase in the last 24 hours.