In the evolving landscape of technology and finance, entrepreneur Michael Saylor, co-founder of Strategy, has made headlines by entering the Bloomberg Billionaires Index with an impressive estimated net worth of $7.37 billion, landing him at the 491st position.

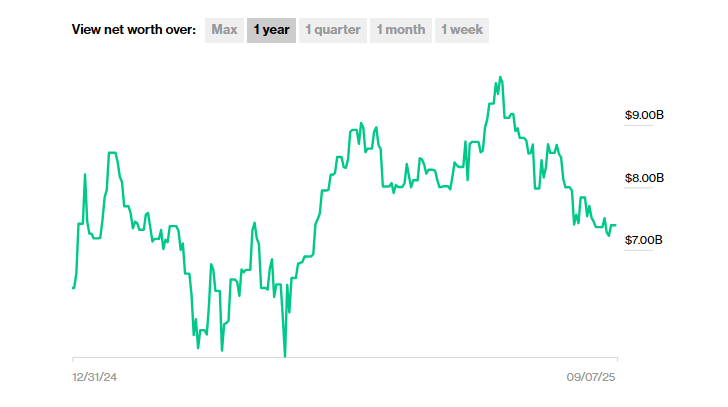

Recent analyses indicate that his wealth has surged by roughly $1 billion since early 2025, reflecting a remarkable growth of around 16% within this year alone.

The Financial Backbone of Strategy

According to comprehensive data from Bloomberg, a significant portion—approximately $6.70 billion—of Saylor’s wealth is linked to his equity stake in Strategy, while the remainder, about $650 million, is maintained as cash reserves. This distribution reveals that much of his wealth is intricately tied to the dynamic market valuation of the company’s stock, alongside its substantial holdings in Bitcoin.

Varied Estimates of Bitcoin Reserves

There is a noticeable discrepancy among various sources regarding Strategy’s Bitcoin assets. Some reports suggest they hold around 580,000 BTC as of May 2025, while others cite figures exceeding 630,000 BTC or even approaching 660,000 BTC, which can fluctuate based on external buying activities and timing.

This variation highlights the active nature of their purchasing strategy and the delays often encountered in public disclosures, leading to different estimates of the company’s Bitcoin holdings across different news outlets.

Dynamic Changes in Wealth

The Bloomberg live index highlights the volatility of Saylor’s fortune, with fluctuations in his net worth. Recently, it increased by approximately $167 million within a brief period, demonstrating how sensitive this figure can be to movements in Strategy’s stock and Bitcoin prices.

Analysts have pointed out that substantial changes this year correlate strongly with a surge in both Strategy’s share value and Bitcoin’s upward trajectory.

A Journey from Dot-Com to Cryptocurrency

Saylor’s journey to today’s billionaire status is a compelling narrative involving earlier successes and setbacks during the dot-com boom, leading to a pivotal strategic pivot in 2020 when Strategy initiated investments in Bitcoin as part of their treasury strategy.

This shift in the company’s focus is what many analysts emphasize when discussing the correlation between his public net worth and the company’s holdings rather than its cash or other assets.

Joining the Ranks of Crypto Visionaries

Saylor’s debut on the Bloomberg index places him alongside a roster of tech and cryptocurrency visionaries whose wealth is closely associated with digital currencies or blockchain enterprises.

His entry comes at a time when several publicly traded companies and their executives have experienced significant financial shifts in tandem with the volatility of Bitcoin.

As it stands, Saylor’s position on the index is merely a momentary snapshot—one that can swiftly elevate or diminish. Investors and market aficionados are keen on observing Strategy’s upcoming filings and Bitcoin’s price fluctuations for insights regarding the trajectory of his wealth.

Featured image courtesy of Sky History, with chart data sourced from TradingView.