As the financial landscape evolves, there is growing optimism regarding Bitcoin’s future, particularly in traditional financial sectors. The momentum appears to be building for increased institutional investment in cryptocurrency.

During a recent discussion, notable financial analyst Jordi Visser remarked:

We are nearing a pivotal moment where traditional finance will elevate its Bitcoin allocations significantly before this year concludes.

Visser’s comments were echoed by Anthony Pompiliano, who suggested that bearish predictions regarding Bitcoin are misguided. He emphasized the potential that lies ahead, arguing that shifts in investor sentiment are on the horizon. While Bitcoin currently faces challenges such as muted trading activity and market uncertainty, Visser remains confident about a surge in investor interest.

Innovative projects like Bitcoin Hyper ($HYPER) could further catalyze growth, aiming to enhance transaction efficiency while reducing costs.

The Coming Revival of Bitcoin

Bitcoin’s price trajectory has been relatively stable recently, oscillating between $100K and $123K since late last year. This trend is expected to shift as we enter Q4, partly due to a rise in both retail and institutional participation.

Among the leaders, Strategy’s $BTC holdings stand out, boasting over $74 billion in assets. The aggregate holdings among public companies are also impressive, amounting to over 1 million $BT, which represents nearly one-third of the existing Bitcoin supply of 3.71 million coins.

While many companies are ramping up their Bitcoin acquisitions, it’s noteworthy that Strategy leads the pack with its considerable reserves. Its closest competitor, MARA Holdings, holds significantly less than 10% of Strategy’s total assets.

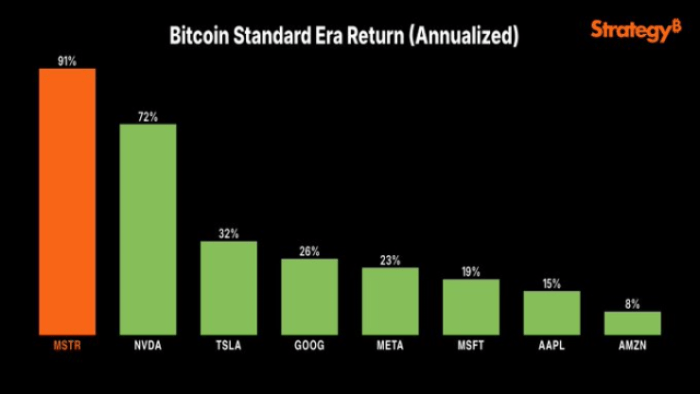

Michael Saylor, co-founder of Strategy, recently shared insights on social media, comparing Bitcoin’s allure to some of the biggest players in the market. He highlighted Strategy’s impressive ROI, positioning it favorably against traditional asset groups.

This focus on accumulation reflects a broader trend among corporations looking to capitalize on Bitcoin’s long-term potential, as indicated by the trajectory of increasing demand.

Moreover, innovative solutions such as Bitcoin Hyper are poised to revolutionize transaction processes, promising a smoother user experience starting in 2026.

Bitcoin Hyper ($HYPER): Transforming Transactions

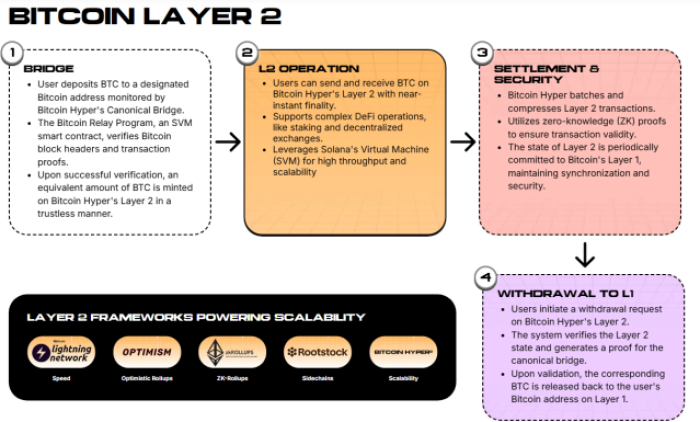

Bitcoin Hyper ($HYPER) addresses key challenges faced by the Bitcoin network, particularly regarding its transaction speed, which is currently capped at just 7 transactions per second (TPS). This limitation restricts Bitcoin’s viability compared to more agile platforms.

To put this in context, Bitcoin ranks poorly in transaction speed, falling behind competitors like Ethereum and Solana. This necessitates a transformation, and Hyper proposes an effective solution.

Utilizing technologies like the Canonical Bridge and the Solana Virtual Machine (SVM), Bitcoin Hyper aims to overcome these limitations.

The Canonical Bridge effectively mints user Bitcoins into Hyper’s faster Layer 2 network once transactions are verified, allowing for seamless interaction between ecosystems. Users can choose to operate within the Hyper layer or revert to Bitcoin’s original network at their discretion.

This setup leads to advantages such as rapid transaction finality and enhanced scalability, effectively alleviating congestion on the Bitcoin network. No longer will users have to experience delays while waiting for transaction approvals.

Moreover, the integration of the SVM facilitates the execution of smart contracts and decentralized finance (DeFi) applications at unparalleled speeds, thereby improving Bitcoin’s appeal to developers and users alike.

The current presale for $HYPER is particularly appealing, having already surpassed $15.6 million, establishing it as a notable player in the presale landscape of 2025.

For those considering an investment, the upcoming Q4 represents an opportune moment, especially with Bitcoin on the verge of testing critical price thresholds. As it approaches $116K, many eyes are on the market to see how it will respond.

$HYPER is currently priced at $0.012915, with expectations of robust performance post-launch, aiming for a significant market presence.

Based on our analysis and the generating potential of the project, estimates suggest $HYPER could reach $0.32 by year-end and potentially soar to $1.50 by 2030, contingent on sustained community backing and successful execution.

Be sure to consult our guide on acquiring $HYPER and visit the presale page to join this exciting journey.

While this piece offers insights, please remember it’s essential to conduct thorough research (DYOR) before making financial commitments.

Written by Bogdan Patru, Bitrabo –