Recent developments in the cryptocurrency futures landscape reveal a notable divergence, particularly between leading assets like Bitcoin and Solana, compared to others in the market.

Trends in Perpetual Futures Open Interest for Major Cryptocurrencies

According to insights shared in a recent post by the analytics platform Glassnode, there has been an interesting shift in the Open Interest for major cryptocurrencies, including Bitcoin.

The term “Open Interest” refers to the total number of outstanding contracts that are yet to be settled in the perpetual futures market across all major exchanges.

When the Open Interest rises, it typically signifies that investors are entering new positions, which may lead to an increase in market volatility as leverage builds up. Conversely, a falling Open Interest indicates either that traders are closing positions voluntarily or facing liquidations—an event that often stabilizes prices as leverage decreases.

Here’s an illustrative chart that outlines the movement in Bitcoin’s Open Interest over the past week:

The chart above reveals a downward trend in Bitcoin’s Open Interest during this period, indicating a reduction in the number of active positions.

Notably, this decrease has occurred alongside a price recovery for Bitcoin to about $117,000. Typically, price rallies trigger speculative trading, leading to increased Open Interest, but this pattern appears to have diverged in the current scenario.

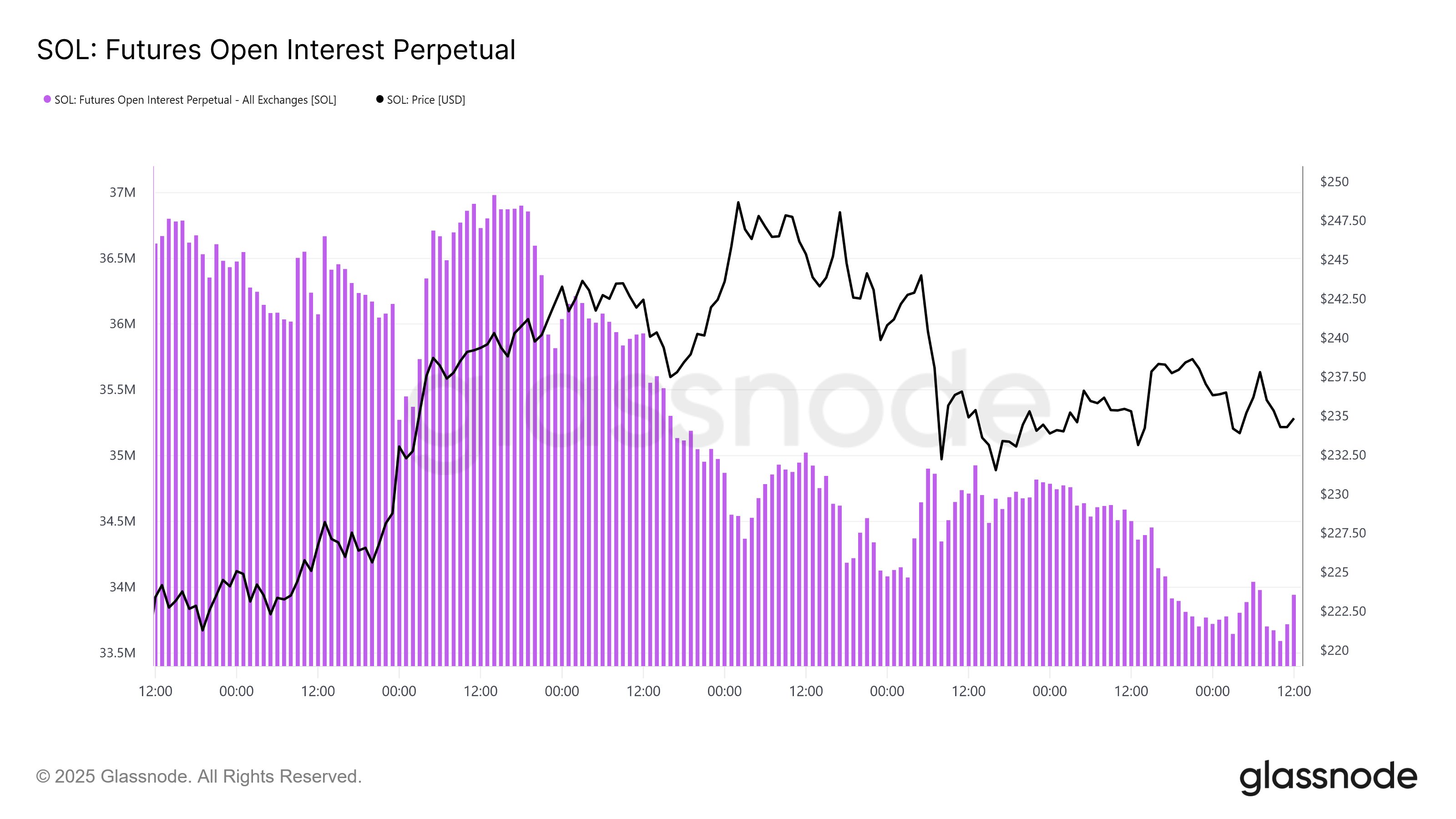

Similarly, Solana, presently the sixth largest cryptocurrency by market capitalization, has also experienced a decline in its Open Interest over the same timeframe, as depicted in the chart below.

This suggests a general cooling in speculative trading for both Bitcoin and Solana, despite the observed uptick in their prices over the past week. Interestingly, this trend diverges sharply from other cryptocurrencies in the top tier.

For instance, Ethereum, the second largest cryptocurrency by market cap, has seen a significant increase in Open Interest, which indicates a rising demand among traders for leveraged positions.

Furthermore, this behavior has also been observed in XRP and BNB, hinting at a potential increase in volatility for these assets compared to Bitcoin and Solana.

Current Bitcoin Price Analysis

As of Wednesday, Bitcoin briefly climbed to $117,900 but has experienced a minor pullback, settling back around $117,000.