As the cryptocurrency market continues to evolve, Chainlink (LINK) stands out as a significant player in the altcoin arena. The aftermath of the October 10 market downturn has not deterred interest; rather, it has enhanced Chainlink’s visibility. Investors are closely monitoring its trajectory, positioning themselves for potential gains as the next bullish wave approaches. Chainlink’s robust network and increasing activity point towards its potential as a market leader in the recovery phase.

Recent trends indicate a clear accumulation pattern among high-net-worth individuals and significant investors, suggesting a growing confidence in Chainlink’s enduring value. This trend reinforces the notion that the current market presents an opportunity rather than a threat, with many large holders enhancing their LINK investments since the downturn.

Market analysts posit that once volatility diminishes and Bitcoin establishes its forthcoming direction, Chainlink could rebound remarkably. This recovery would be fueled by its solid fundamentals and the rising adoption of its oracle technology. Chainlink’s expanding influence in decentralized finance (DeFi), asset tokenization, and integration of real-world data underscores its critical role in the Web3 landscape.

As the market seeks stability, Chainlink’s steady accumulation could set the stage for a remarkable resurgence during the next bullish phase. Investors are keenly observing its developments.

Whale Movements Signal Confidence — Over $190M in LINK Withdrawn

Recent data from Lookonchain indicates an impressive movement of funds, where 39 new wallets collectively withdrew approximately $188 million worth of LINK from Binance post-crash. This large-scale withdrawal hints that whales are taking a strategic position in Chainlink as they anticipate a market recovery.

Withdrawals of this magnitude are commonly viewed as a bullish indication, as investors often withdraw assets from exchanges to hold them for the long term, reducing immediate selling pressure. This reflects a rising confidence among larger investors, who regard current pricing as a strategic entry point amidst widespread market hesitance.

The implications of this pattern extend beyond mere price movements. The accumulation of LINK suggests a strong belief in Chainlink’s vital function in the DeFi ecosystem and for asset tokenization. As the foremost oracle network, it plays a crucial role by securing data feeds and facilitating blockchain interoperability, establishing itself as an essential layer in Web3 infrastructure.

If this trend of accumulation endures and market sentiment stabilizes, LINK could rank among the top performers in the upcoming crypto cycle. Historically, significant accumulation has preceded prior spikes in Chainlink’s value, particularly during times when exchange reserves dip but on-chain activity surges.

In summary, this withdrawal wave of $188 million illustrates that major investors are confidently accumulating LINK, which could tighten supply and lessen selling pressure—an ideal setup for notable upward movement once market conditions shift positively.

Chainlink Maintains Key Support Levels Amidst Whale Accumulation

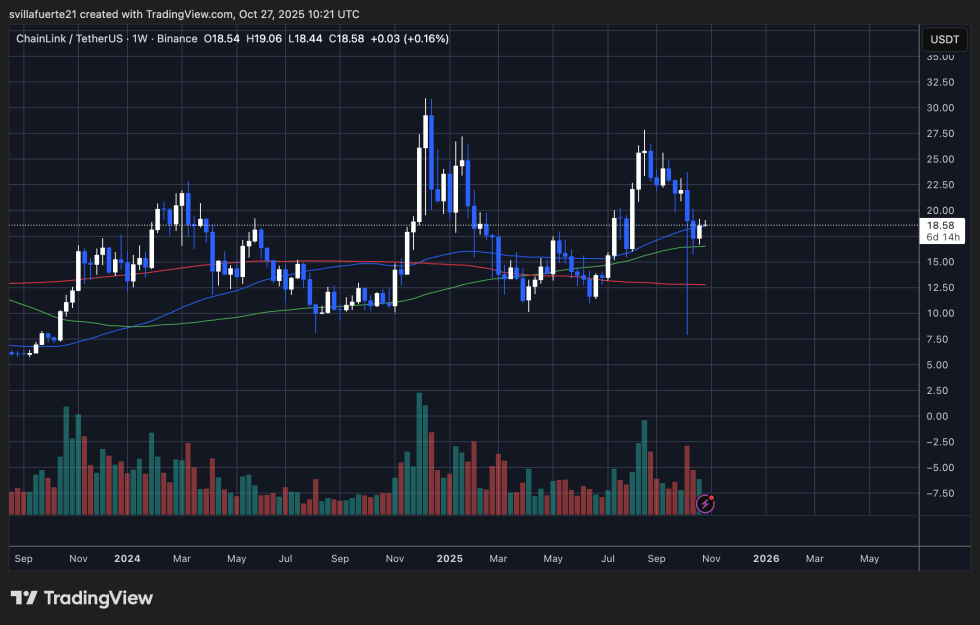

The latest weekly charts show Chainlink (LINK) trading around $18.58, demonstrating resilience following the volatility of recent weeks. Despite overarching market uncertainties, LINK has sustained its support zone near $16, which coincides with the 200-week moving average—a significant long-term marker for traders.

Current price action suggests a phase of consolidation above this support level, with the 50-week moving average stabilizing and aligning with the 100-week average. This configuration often indicates the groundwork for a base structure before a potential breakout, contingent on increasing buying momentum. Additionally, the substantial withdrawal of LINK by whales reinforces the narrative of accumulation, which can serve to tighten supply and alleviate selling pressure.

Moreover, trading volume has settled after a surge during the crash, indicating the cessation of panic selling. For a confirmed bullish shift, LINK must reclaim resistance in the $20–$22 range, a level that has previously acted as both support and resistance during mid-year rallies.

The charts reflect a period of constructive consolidation bolstered by accumulation on the blockchain. Should Bitcoin find stability and macroeconomic conditions improve, LINK might be poised to lead the rebound among altcoins, further extending its long-term upward trajectory.

Featured image from ChatGPT, chart from TradingView.com