The recent downturn in the cryptocurrency market has left many investors reeling, with figures indicating around $1.4 billion in liquidations affecting numerous traders as Bitcoin and other prominent altcoins take a significant hit.

Bitcoin Faces a Sharp Decline Below $100,000

The start of November has ushered in troubling trends for the digital currency market. Bitcoin, a major player, has dropped to around $99,500, marking a significant setback. This decline represents a staggering fall of close to 12% within the week and is the lowest point since early October.

Before this recent decline, Bitcoin had not seen such low levels since late June. Should the current trend continue, we may witness a broader market correction not seen for several months.

In tandem with Bitcoin, Ethereum has also struggled, plummeting to $2,800, a stark dip not seen since July. With its weekly return plummeting nearly 18%, Ethereum mirrors the struggles faced by many other cryptocurrencies, contributing to widespread market instability.

Liquidation Figures Reach Nearly $1.4 Billion in Just One Day

Data sourced from CoinGlass reveals that the past day has seen staggering liquidations in the crypto derivatives arena, nearing $1.4 billion. This figure reflects the forced exits of various trading contracts after exceeding allowable loss thresholds.

As market prices have dipped, the majority of these liquidations have predominantly affected bullish positions.

Analysis shows that around $1.25 billion were linked to long positions, making up approximately 90% of the total liquidations. This trend indicates many traders had anticipated a market recovery and engaged in leveraged trading, only to face significant losses as prices fell.

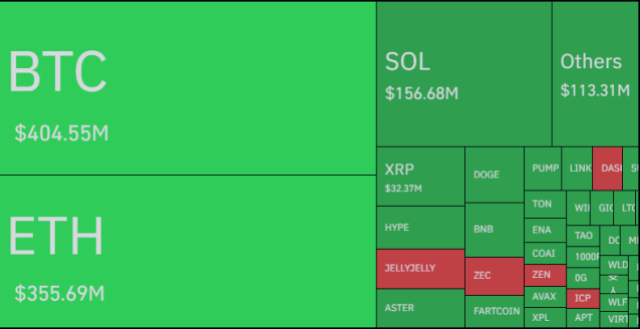

Specifically, Bitcoin and Ethereum accounted for the highest liquidation amounts at roughly $420 million and $375 million respectively.

Among altcoins, Solana experienced the most liquidation at around $160 million, significantly outpacing XRP’s approximate $30 million. Solana’s 9% decline over the last 24 hours highlights its vulnerability in the ongoing market turmoil.

A situation like today’s is often described as a “squeeze,” particularly when it centers on long positions, hence termed a long squeeze.

In the fluctuating world of cryptocurrency, events such as futures squeezes are not highly unusual due to inherent volatility and the prevalence of overleveraged positions. However, large-scale liquidation incidents, like this one, remain relatively uncommon.