In recent days, Bitcoin has experienced notable fluctuations, bringing it down from a peak near $97,000 to approximately $87,000. This volatility has raised uncertainties among investors and prompted a defensive stance from bulls. The catalyst behind this movement seems to stem from increasing geopolitical tensions that have re-emerged, particularly between major players like the United States and the European Union. As trade discussions spiral into diplomatic concerns, market sentiment has undeniably shifted.

Despite these challenging conditions, on-chain metrics indicate a different narrative. Since the start of the year, significant holders, or “whales,” have been consistently accumulating Bitcoin during periods of price correction, showcasing resilience in market strength. This suggests that, rather than a full-scale collapse, the landscape is evolving. While smaller, retail investors might be retracting their strategies, larger investors are leveraging the situation to enhance their positions.

As Bitcoin stabilizes around a psychologically important threshold, it faces pivotal moments that will dictate future movements. The question lies in whether demand can rebound to validate this recent pullback or if it signals more profound weakness in the market.

Whale Activity and Market Resilience Amidst Price Challenges

Currently, Bitcoin is striving to maintain its position above the $90,000 mark. Following a tumultuous downturn, traders are eagerly seeking signs of recovery. This pivotal price point serves as both a mental barrier and a crucial juncture that could define the market’s next steps: whether to consolidate or experience further corrections.

In these dynamic market conditions, sentiment is easily swayed as liquidity decreases, often leading to sharper intraday fluctuations. Nonetheless, findings from a recent CryptoQuant analysis indicate stability in the market fundamentals. Despite the rise in global uncertainties affecting risk-taking behavior, whale activity has remained steady, highlighting the fortitude of large holders amidst the chaos.

This trend of significant accumulation among whales plays an integral role as it implies that supply is being absorbed at lower price levels, potentially reducing fears of a subsequent sell-off that could destabilize the market further. Observing whale movements provides insights into the market sentiment, with historical patterns revealing that whales tend to act strategically during downturns.

While retail investors may reduce their trades in uncertain times, institutional players often adopt a long-term perspective, capitalizing on opportunities created by volatility. Maintaining this positive trend in whale accumulation could lay the groundwork for a more robust price recovery when overall demand strengthens.

Market Conditions: Analyzing the Ongoing Consolidation

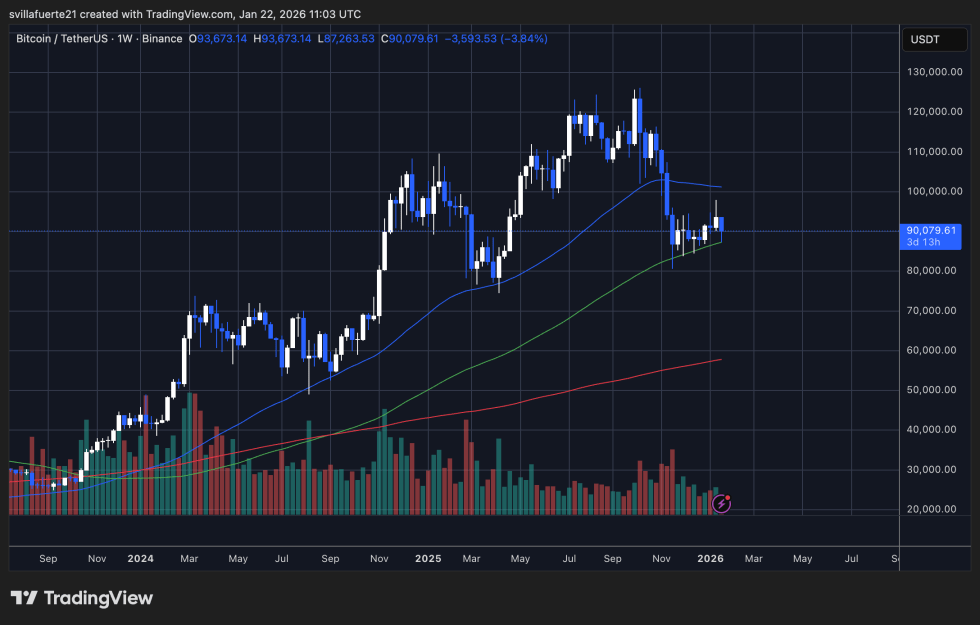

As Bitcoin explores the $90,000 territory, the aftermath of recent volatility has left lasting impacts on price dynamics. The weekly analysis reveals a higher-low formation since the significant price drop last November. However, the momentum remains tentative as sellers continue to challenge resistance levels. Although there has been a rebound towards the $90,000 mark after dipping into the mid-$80,000s, the latest weekly close indicates a cautious market atmosphere.

From a trend analysis perspective, BTC is operating below its short-term moving averages, which may complicate upward momentum. Although the recent rebound has shown potential, it remains within a corrective phase until a decisive breakout occurs above the identified trend line. Longer-term metrics, however, indicate an ongoing upward trajectory, underscoring that the market is merely transitioning into a slower consolidation phase rather than losing its overall bullishness.

The current trading volume reflects this uncertainty; sharp declines accompanied the initial downward swing, whereas recent recovery indicators exhibit a more subdued demand response. For market bulls, sustaining the $88,000 to $90,000 range is vital to avert deeper pullbacks. A solid weekly close beyond $92,000 would significantly enhance the short-term outlook and pave the way for a sustained recovery phase.

Image credits and data from TradingView were consulted for this analysis, supporting a comprehensive view of market conditions.