The ongoing fluctuations in the cryptocurrency market underscore the intricate relationships between traditional financial dynamics and digital currencies. As traders closely monitor trends, the focus has shifted to factors that could influence both the Bitcoin sphere and foreign exchange rates. Economic signals, particularly concerning the yen and dollar, serve as critical indicators.

Recent discussions, prominently featuring insights from various analysts, have highlighted currency interventions as potential catalysts for market movements. The buzz around the Federal Reserve’s speculative actions has captivated traders and analysts, with many suggesting that this could lead to notable shifts in market sentiment. It was noted that these kinds of interventions can significantly impact liquidity across global markets.

Currency Trends and Market Sentiment

Market observers have pointed out that Japan’s long-term struggle with a depreciating yen has reached a tipping point, compelling policymakers to consider proactive measures. Factors such as persistently low bond yields and pressures from a hawkish Bank of Japan frame the backdrop for potential action. Historical instances of collaboration between the US and Japan—like landmark events from the late 20th century—illustrate the importance of joint efforts in stabilizing currency fluctuations.

Recent reports indicate that speculation about the yen gaining strength prompted a notable market response. The yen’s valuation surged amid expectations of possible intervention from Japanese authorities, with significant shifts observed within trading sessions. Analyst reports affirm the impacts of these developments, showcasing how a sudden realignment in currency strength can lead to rapid market reactions.

CAN CURRENCY INTERVENTION STABILIZE MARKETS?

Speculations about selling dollars to strengthen the yen could reshape market perceptions.

This… pic.twitter.com/7xFReOFoDo

— Market Insights (@MarketInsight) January 25, 2026

Debate amongst market participants centers on the implications of currency checks and their potential roles. Distinctions between public impressions and underlying mechanisms merit exploration. For instance, the involvement of the Federal Reserve could signify a more profound intent to stabilize international finances rather than merely responding to local challenges.

The considerations regarding Bitcoin cannot be understated, as the dynamics of currency strength directly affect investor sentiment towards riskier assets. The potential for a buoyed yen to influence Bitcoin’s value trajectory remains a point of contention, with various traders making predictions based on past performance correlations.

Insights from crypto analysts suggest that a shift towards yen strength might first create market turbulence before opening avenues for future gains. The historical context of similar currency movements indicates that waves of volatility often precede longer-term benefits. This cyclical behavior highlights the necessity for patience among investors navigating these uncertain waters.

Additional voices in the analytical sphere provide divergent viewpoints on the ramifications of currency policy. Some posit that economic indicators may prompt immediate reactions in the crypto markets, while others caution that timelines for significant appreciations often extend beyond initial shocks, demanding strategic foresight.

As market observers continue to sift through these complexities, the interplay between economic policy, market psychology, and the evolving digital asset landscape creates an atmosphere ripe for both risks and opportunities. The broader implications of sustained dollar weakness remain to be fully understood, especially as regulatory developments and global events unfold.

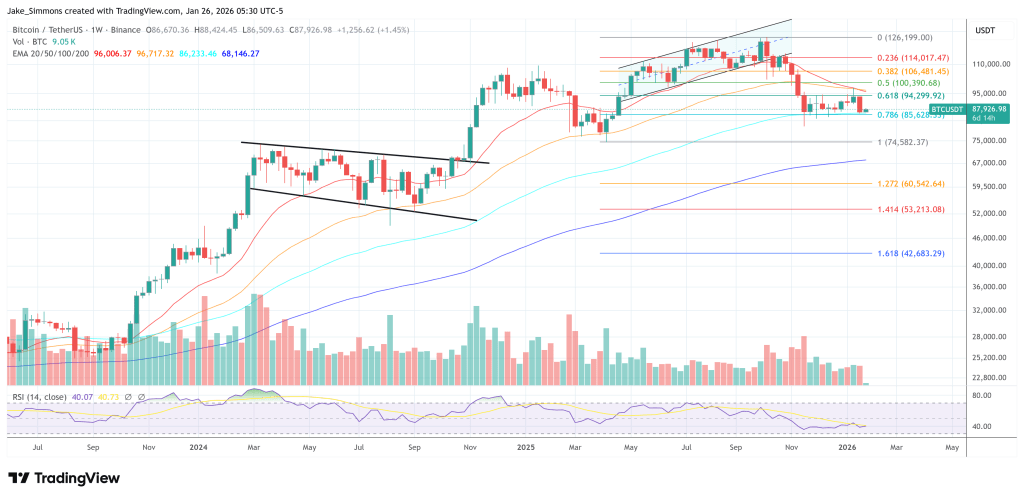

As the latest market quotes arrive, Bitcoin is trading at approximately $87,926, marking a crucial moment for analysis and potential strategic investment.