In the evolving landscape of cryptocurrency, Bitcoin’s journey appears to be hitting a rough patch, particularly as it hovers beneath the daunting $88,000 threshold. Current market conditions are riddled with fear and uncertainty, making it tough for investors to commit to buying. Following a volatile series of sell-offs, the price remains tightly bound to critical support levels, as buyers are increasingly hesitant and sellers capitalize on any uptick. Furthermore, while market focus is drawn to macroeconomic risks and derivatives pressures, emerging on-chain data adds another layer of complexity to the existing situation.

Leading cryptocurrency analysts, such as Darkfost, are observing significant indicators that reflect the health of Bitcoin’s underlying network. One notable metric is the hashrate, which provides insight into the total computational power dedicated to securing the Bitcoin network. In general, a sudden downturn in hashrate might indicate that miners are shutting down operations due to unfavorable conditions, often coinciding with periods of market lows.

Recent trends are illustrating a concerning development, as Bitcoin’s hashrate has plummeted dramatically in a short span, declining from 1.133 ZH/s to 690 EH/s. Such a swift decrease is rare and begs the question, what could be driving it? Darkfost emphasizes that this particular downturn diverges from typical miner capitulation trends usually prompted by declining prices or unfavorable profit margins.

The washrate drop is primarily attributed to unexpected disruptions rather than mounting economic pressures. This distinction is crucial as Bitcoin’s market struggles below $88K; the sudden hashrate decline introduces a new dimension that could sway miner behavior, influence short-term market trends, and reshape investor psychology as conditions evolve.

Weather-Related Disruptions Exceed Market Pressures

As noted by Darkfost, the unexpected dip in Bitcoin’s hashrate seems to have been triggered by external weather events rather than miner capitulation. An intense ice storm recently swept through areas of the United States, impacting key mining operations, considering the nation contributes significantly to global Bitcoin hashrate. The nature and timing indicate that environmental factors, not voluntary miner shutdowns, are primarily responsible for the disruption.

Texas, recognized as a central hub for Bitcoin mining, has been hit especially hard, with key companies like MARA and Foundry Digital facing serious challenges related to the regional power grid. Reports indicate that MARA experienced a staggering fourfold decrease in its hashrate over just three days, compared to its typical monthly average—demonstrating the severity of the situation.

Extreme cold can lead to significant strain on power supplies, requiring grid operators to limit non-essential power consumption, while escalated demand causes electricity prices to soar. These dynamics make it financially untenable for miners to continue operating, propelling widespread shutdowns.

This has ramifications; block production times may extend and mining difficulty adjustments are anticipated, with predictions indicating a decline of around -4.54%. If the harsh weather persists, there is a potential risk that some miners might have to liquidate Bitcoin holdings to cover basic operational costs, introducing yet another strain on the overall market.

Market Dynamics and Bitcoin’s Future Outlook

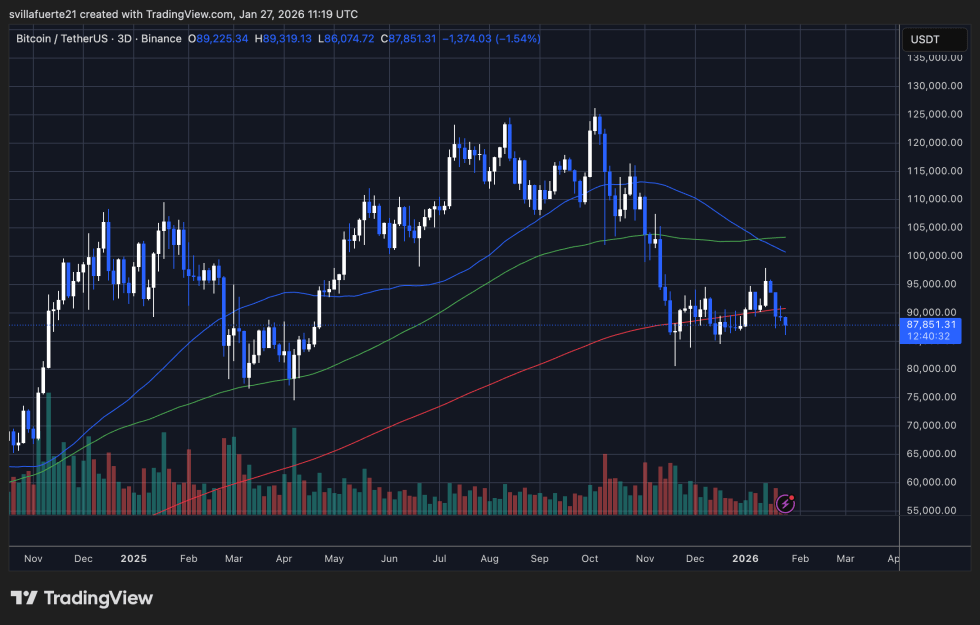

Currently, Bitcoin is hovering around $87,850 in the three-day chart, situated at a pivotal turning point following a lengthy corrective trend. Historical price movements show that Bitcoin peaked around the $125K region in late 2025, later entering into a sustained decline, characterized by sharp downward movements and weak recovery attempts. While the price has managed to stabilize in the mid-$80K territory, momentum indicators suggest fragility, keeping bullish sentiment limited.

Analyzing the market trends, moving averages clearly illustrate the prevailing conditions. Bitcoin currently trades below its 50-period moving average, signifying a barrier to upward movement near the low-$90K area. Meanwhile, the flattening of the 100-period moving average indicates diminishing strength in the medium-term trend, confirming the loss of prior upward momentum.

Recent market activity has shown consolidation rather than capitulation. A decrease in volatility and trading volume compared to past selloffs hints at less aggressive selling pressure. For traders and investors, maintaining levels between $86K and $88K is critical to avoid a deeper market decline.

A significant move back above the $90K to $92K range is essential for changing market sentiment and indicating a potential recovery. Failure to achieve this may open up risks toward the low-$80K region, adding further challenges to Bitcoin’s market landscape.

Image courtesy of ChatGPT, chart adapted from TradingView.com.