Undeniably, the evolution of Bitcoin has been remarkable, transforming skeptics into advocates across the financial landscape.

A notable pivot comes from Allianz, a major player in the asset management sector with a portfolio worth approximately $2.5 trillion. Their recent report, titled ‘Bitcoin and Cryptocurrency: The Future of Finance,’ suggests that Bitcoin has emerged as a credible store of value.

What adds to this evolution is that Allianz previously discouraged investments in cryptocurrencies in 2019 due to concerns about volatility and regulatory frameworks.

Continue exploring this article to uncover the reasons behind Allianz’s newfound enthusiasm for Bitcoin, along with insights into the promising future ahead for the cryptocurrency sector.

We’ll also share tips on how to capitalize on the current crypto boom by investing smartly in top-tier cryptocurrencies.

Key Factors Behind Allianz’s Shift on Bitcoin

A significant driver of Allianz’s recent support for Bitcoin is the rapid acceptance by institutional investors.

The report highlights how corporate treasury allocations to Bitcoin are eclipsing that of exchange-traded funds (ETFs), marking a true shift in financial strategy.

In recent months, publicly traded companies have amassed over 240,000 BTC, underscoring a trend that shows no signs of slowing.

Additionally, Allianz has drawn attention to several pivotal aspects propelling Bitcoin’s ascent:

- Statements from influential figures like Federal Reserve Chairman Jerome Powell acknowledging Bitcoin’s role as a modern gold alternative.

- Advancements in regulated exchanges and institutional custodians that have fostered trust and brought significant legitimacy to the crypto market.

- The low correlation of Bitcoin with traditional asset classes, establishing it as a compelling diversification option within investment portfolios.

Allianz also predicts that trends like real-world asset tokenization and the rise of decentralized finance (DeFi) will further broaden the market for cryptocurrencies.

In closing, Allianz expresses confidence that Bitcoin will solidify its position within the global financial framework, provided no unforeseen catastrophic events transpire.

This newfound recognition from institutional giants presents a prime opportunity for investors to enhance their portfolios — not only through Bitcoin but by exploring promising altcoins that could offer superior returns.

1. Bitcoin Hyper ($HYPER) – A New Era of Bitcoin Features

Bitcoin Hyper ($HYPER) stands out as an exceptional opportunity due to its transformative approach aimed at boosting the Bitcoin network.

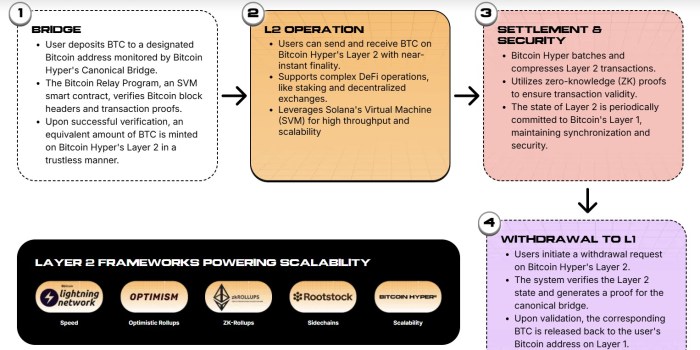

The project proposes a next-gen Layer 2 solution that integrates with the Solana Virtual Machine (SVM), promising unprecedented speeds and cost-effectiveness.

Currently, Bitcoin’s transaction rate is notably slow, capable of handling just about seven transactions per second. In contrast, advanced networks like Solana and Ethereum can manage thousands of transactions per second.

Moreover, Bitcoin’s capabilities for smart contracts and decentralized applications are severely limited; however, $HYPER aims to remedy this situation completely.

Its innovative Web3 environment will address Bitcoin’s key challenges, positioning it for advanced use cases including DeFi, NFTs, and more.

The introduction of a non-custodial bridge will allow users to convert Layer-1 $BTC into Layer 2 $BTC, fully eligible for participation in $HYPER’s ecosystem.

Predictions for $HYPER indicate a potential surge of nearly 2,400% by year-end 2025, with projections of reaching $0.32.

Now is the time to invest at a very accessible price of $0.012775 per token with an enticing staking yield of 97% APY. The presale has already generated over $11.3 million!

Learn more about Bitcoin Hyper on their official site.

2. Best Wallet Token ($BEST) – Revolutionizing Crypto Accessibility

The recent growth of Bitcoin and other altcoins has fueled a surge in the cryptocurrency wallet sector, which is projected to expand at a remarkable CAGR of 31.9%.

Investors looking to tap into this booming market should consider adding Best Wallet Token ($BEST) to their portfolios.

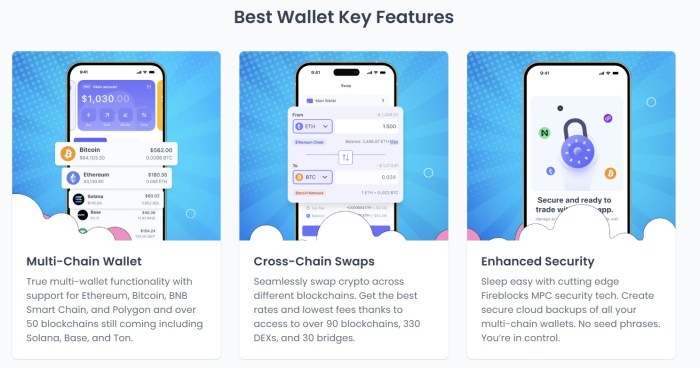

This innovative cryptocurrency supports Best Wallet, an advanced wallet application that combines top-notch security features with seamless usability.

As a non-custodial wallet, it allows users to maintain sole control over their private keys, ensuring enhanced safety against unauthorized access.

Best Wallet also incorporates innovative multi-factor authentication, offering users unparalleled security while facilitating hassle-free transactions.

In today’s rapidly evolving financial landscape, the integration of digital currencies is more crucial than ever. With the rise of decentralized finance, having a strong understanding of various authentication methods is essential for safeguarding your assets.

Security features such as biometric logins and advanced encryption protocols provide users with peace of mind, ensuring that their transactions are shielded from potential threats. This increases not only individual security but also enhances trust within the crypto community.

An innovative vetting system is now part of many platforms, paralleling Best Wallet’s meticulous approach. This internal team thoroughly scrutinizes new tokens before listing, significantly reducing the risks associated with fraudulent projects.

Furthermore, the platform’s

Presale Aggregator allows users to invest in upcoming cryptocurrencies seamlessly. This feature minimizes the need for users to navigate various external sites, making the process smoother and more efficient.

Investing in tokens like $BEST opens doors to exclusive rewards, enhancing the investment experience:

- Access to new token presales before the general public.

- Attractive staking yields, with current rates around 90%.

- Lower trading and gas fees for active traders.

- The ability to vote on important platform developments.

There has never been a better time to participate in the presale for $BEST. With over $15 million raised and an introductory price of just $0.025515, this opportunity is one to consider carefully. Users can also benefit from a competitive 89% APY on staked tokens.

For more insights and updates, visit the official $BEST website.

Exploring the Potential of Solana ($SOL)

As noted, Bitcoin surges often trigger movements in other significant cryptocurrencies like Solana ($SOL), which can achieve impressive returns. Recent performance indicates that Solana consistently outperforms Bitcoin during upward trends.

The numbers speak volumes: since April, Solana has skyrocketed by approximately 80% to 90%, while Bitcoin saw a more modest 50% increase. Such comparative data highlights Solana’s strong potential during bullish market phases.

Looking ahead, the anticipated approval of a Solana ETF in 2025 could serve as a significant catalyst for growth.

Forecasts from platforms like Polymarket suggest a robust likelihood of SEC approval, with odds exceeding 99%. This development could elevate Solana’s profile in the market and attract greater institutional interest.

The technical landscape for Solana looks promising:

- The recent rally is supported by a crucial support level that previously initiated a remarkable 170% increase in August 2024.

- Current price action respects a well-defined upward trend, which suggests sustained momentum.

Given this combination of support and growth, Solana may readily approach the pivotal $300 benchmark in the upcoming months.

Final Thoughts

The shift in recognition by institutions like Allianz, now embracing Bitcoin as a credible asset, marks a watershed moment in the cryptocurrency space.

For those ready to capitalize on this momentum, consider diversifying into promising low-cap tokens like Bitcoin Hyper ($HYPER) and Best Wallet Token ($BEST).

For those preferring a more established route, adding Solana ($SOL) could create a balanced investment strategy.

However, it’s paramount to remember that this content is for informational purposes only. The cryptocurrency market is inherently volatile, so conduct thorough personal research before engaging in any investments.