Bitcoin is currently navigating a challenging landscape as it fights to retake the crucial $70,000 threshold after bouncing back from a recent low of $60,000. This endeavor highlights a market still in search of stability. The recent upswing provided a glimmer of hope following significant sell-offs; however, the momentum appears delicate, with resistance levels effectively hindering further upward movement. Volatility in the market remains high, as investor confidence has not yet fully rebounded from the steep declines that prompted prices to hit multi-month lows.

In this atmosphere of uncertainty, new data reveals that the Binance SAFU Fund has acquired an additional 4,225 BTC, an investment worth approximately $299.6 million. This acquisition draws significant attention, particularly as overall market sentiment remains lukewarm. Analysts closely monitor such institutional movements, which can affect liquidity and positioning trends. Historically, large purchases during downturns have been precursors to stabilization, although such actions do not ensure an immediate reversal in price direction.

Market participants are left to speculate whether this accumulation signifies long-term faith from major players or if it is merely opportunistic positioning in the midst of a sustained correction phase. Some analysts view the acquisition as a positive indicator, whereas others express skepticism, highlighting that macroeconomic conditions, exchange activity, and derivatives trading remain key factors influencing short-term price movements. The ability of Bitcoin to maintain a recovery above essential resistance could ultimately dictate whether this rebound becomes sustainable or is merely a fleeting bounce.

Signs of Institutional Accumulation Amid Uncertain Market Dynamics

Recent data from Arkham shows that Binance’s SAFU Fund has amassed a total of 10,455 BTC, valued at around $734 million based on current market rates. This increase in reserves is particularly noteworthy given the market’s ongoing fragility, where liquidity pressure persists and investor sentiment is gradually mending from previous downturns. Actions from a major exchange fund can be critical as they often reflect strategic management of assets along with broader confidence in Bitcoin’s future stability.

From a market standpoint, these purchases have significant implications primarily due to their signaling power rather than their direct impact on supply. Although the total acquired represents only a small fraction of Bitcoin’s circulating supply, institutional acquisitions during downtrends have historically correlated with periods of market stabilization, especially when retail investors remain defensive.

However, it is essential to avoid interpreting this as an outright bullish signal. Factors such as exchange inflows, derivatives strategies, and global economic uncertainty continue to play pivotal roles in short-term price dynamics.

The market remains in a transitional state highlighted by heightened volatility, cautious strategies from traders, and selective accumulation from high-profile entities. Large institutions acquiring Bitcoin while prices linger below critical resistance zones suggest long-term confidence, but such optimism typically requires supportive liquidity conditions, reduced selling pressure on exchanges, and a resurgence in spot demand. Without these aligning factors, Bitcoin’s recovery remains highly tentative despite the visible interest from institutions.

Market Conditions Shift: Bitcoin Tests Key Long-Term Support Levels

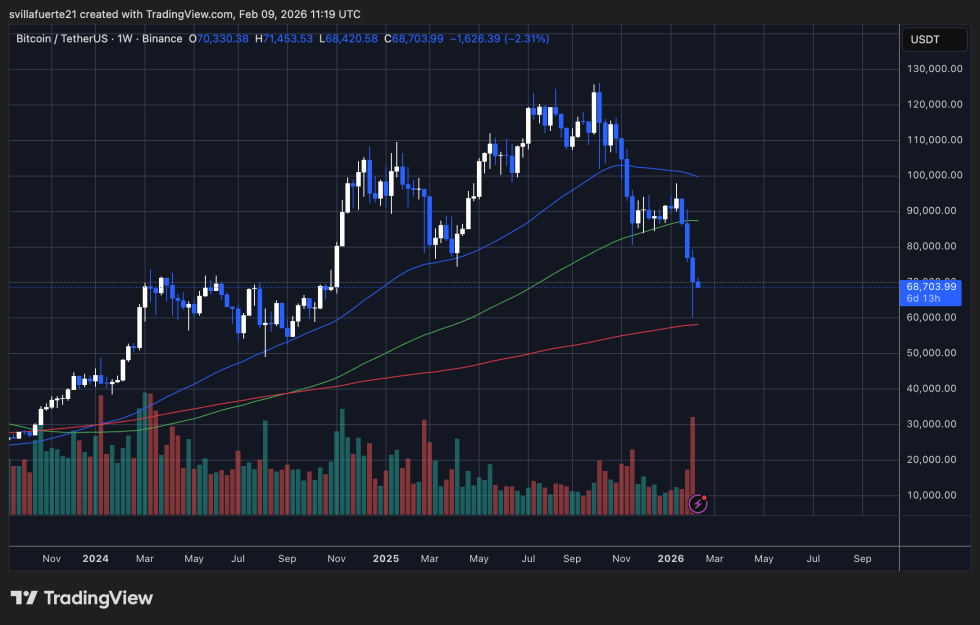

Bitcoin’s-weekly performance indicates a fragile attempt at recovery after a pronounced decline that forced prices below the $70,000 mark. The charts illustrate notable resistance at $90,000 earlier in the market cycle, indicating a series of lower highs and increasing selling momentum. This setup generally signals a distribution phase transitioning into a corrective trend rather than a simple market pullback.

At present, prices are trading below key short-term moving averages and nearing the long-term trend support denoted by the 200-week moving average. Historically, this level often serves as a structural foundation during deep corrections, but it does not promise an instant rebound. Momentum indicators suggest that sellers are still in command of the market dynamics.

Volume trends support this analysis, as the recent downturn was characterized by significant trading volume, often indicative of forced selling or repositioning from larger market participants rather than a gradual decline.

A potential consolidation phase could arise if Bitcoin stabilizes above the mid-$60K level. Conversely, a sustained breakdown below this threshold could potentially lead to deeper retracement levels, bringing Bitcoin closer to previous accumulation zones established earlier in this cycle.

Featured image from ChatGPT, chart from TradingView.com.