A recent analysis from CoinGate has provided valuable insights into the evolving landscape of cryptocurrency payments globally.

USDT Emerges as the Leading Cryptocurrency on CoinGate, Bitcoin Follows

The cryptocurrency payment processor CoinGate has released insightful statistics depicting the global preferences for digital asset transactions. Below is an overview illustrating the shifts in cryptocurrency order composition over the past few years.

Initially, in 2023, Bitcoin was a dominant player in the payment sector, accounting for approximately 35.4% of all transactions on CoinGate. However, its share fell significantly in 2024 to about 21%, while Tether (USDT) surged from 25.5% to 39.7%, taking the lead in the platform’s transactions.

By early 2025, USDT experienced a substantial decrease, dropping to 24.8% of payment usage. Nonetheless, it retained its dominant position as Bitcoin slightly improved its share to 23.3%.

Interestingly, Litecoin has shown a remarkable upward trend, maintaining a steady third-place position with an increase from 9.3% in 2023 to 13.6% in 2025, thanks to its reputation for efficient and low-cost transactions.

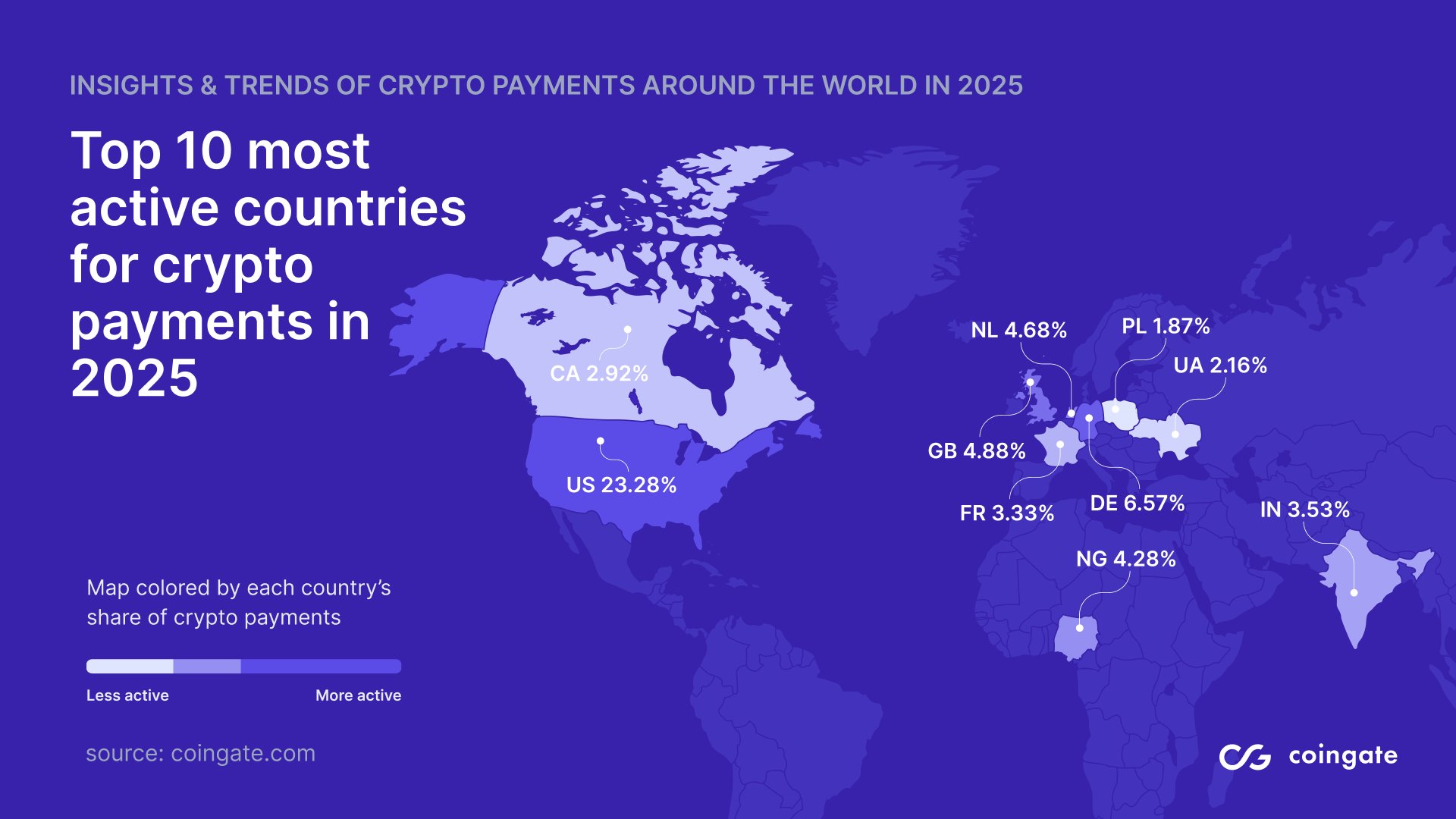

Here’s an infographic showcasing the top 10 countries by cryptocurrency payment usage in 2025:

The data reveals that the United States leads in digital asset transactions, representing 23.28% of all CoinGate orders worldwide, followed by Germany at 6.57% and the UK at 4.88%.

While these figures outline the overall transaction distributions, they do not delve into which cryptocurrencies are predominantly used in each country. According to CoinGate’s data, the preferences vary significantly across different regions.

For instance, Bitcoin remains the most popular option among American users, utilized in 40% of transactions. Notably, the U.S. also excels in Lightning Network engagements, accounting for more than half (54%) of all Lightning transactions globally, as noted by CoinGate.

In Europe, the landscape is more fragmented, with no single currency dominating the market and varying preferences observed among countries. Conversely, Asia shows a clear inclination towards stablecoins, with USDT constituting 50% of all orders in Hong Kong and 43% in India.

Moreover, Nigeria stands out in altcoin usage, comprising 8% and 7% of global orders for BNB and Shiba Inu, respectively. Meanwhile, in Latin America, Solana once led the Brazilian market in 2024 but faced a dramatic decline in 2025, plummeting from a 14% global share to a mere 2%.

Current Bitcoin Market Analysis

As of the latest updates, Bitcoin is trading around $119,100, reflecting a slight decrease of 1% over the past day.