Recent statistics indicate that Bitcoin and Ethereum spot exchange-traded funds (ETFs) have been under pressure, reflected by their negative average net flows over the past 90 days.

Spot ETFs for Bitcoin & Ethereum Experience Challenges

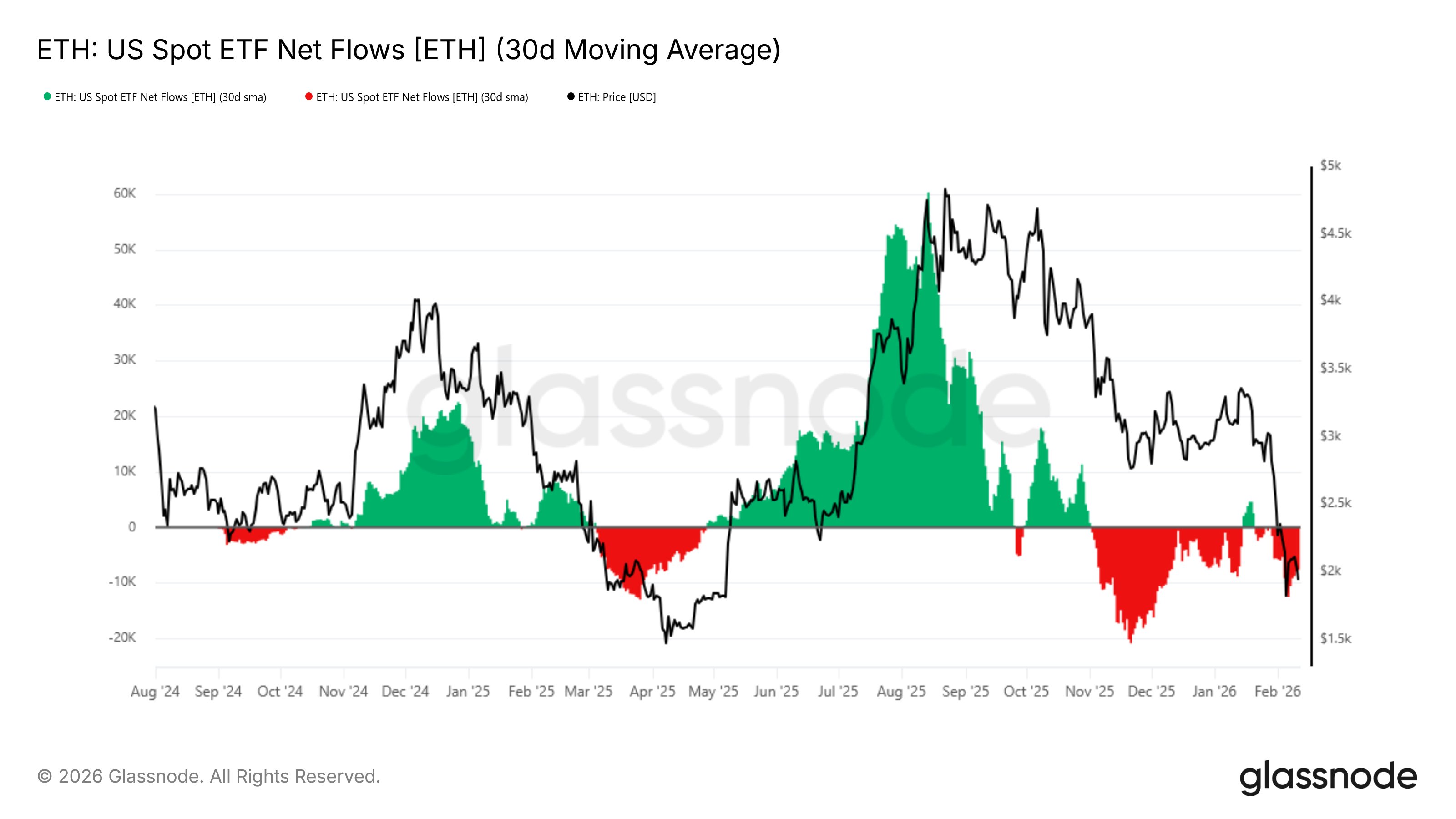

As noted by the blockchain analysis platform Glassnode in a recent report, the 30-day simple moving average (SMA) for the net flows of both Bitcoin and Ethereum spot ETFs remains in a declining trend.

Spot ETFs are innovative investment tools that provide a way for investors to engage with an asset class without the need to physically hold cryptocurrencies. In the U.S., the Securities and Exchange Commission (SEC) granted approval for Bitcoin ETFs in January 2024, followed by Ethereum ETFs in July 2024.

These ETFs simplify cryptocurrency investments by allowing traders to invest without managing wallets or navigating exchanges. Each investment in an ETF leads to the purchase of a corresponding amount of cryptocurrency, which is then securely held by the fund for the investors.

While the digital asset realm had previously deterred traditional investors due to complex blockchain technology, the introduction of ETFs has alleviated many concerns, catalyzing new interest in the sector.

Historically, both Bitcoin and Ethereum represented a robust inflow for ETFs. However, recent statistics suggest a worrying trend. Below is a graph showcasing the recent performance of U.S. Bitcoin spot ETF net flows shared by Glassnode, illustrating the 30-day SMA values over the last few years:

The graph clearly indicates that U.S. Bitcoin spot ETFs have consistently shown a negative net flow over the past three months. The only significant uptick occurred during a price recovery in January.

Several factors contribute to these outflows, primarily the downward price movement experienced by Bitcoin during this period. A similar bearish trend is observable in Ethereum, mirrored through the dynamics of its spot ETF net flows.

Throughout the last quarter of 2025, both cryptocurrencies encountered their highest outflows, a trend that still persists at a significant rate this February.

In light of these persistent negative net flows for both Bitcoin and Ethereum ETFs, analysts at Glassnode conclude that there has been no emergence of renewed demand within this market segment.

Current BTC Pricing Trends

As of this moment, Bitcoin is trading around $69,200, indicating an increase of more than 5% over the past week.