Essential Insights:

- Ethereum’s base layer limits DeFi innovation. High gas fees, slower transactions, and limited scalability drive projects to explore alternatives like Solana, leading to liquidity fragmentation.

Dependence on centralized exchanges and liquidity pools creates barriers for users, complicating seamless participation across decentralized applications.

Dependence on centralized exchanges and liquidity pools creates barriers for users, complicating seamless participation across decentralized applications. Innovative Layer 2 solutions streamline transaction processes, offering reduced fees while ensuring a strong security framework through established blockchain protocols.

Innovative Layer 2 solutions streamline transaction processes, offering reduced fees while ensuring a strong security framework through established blockchain protocols. Proactive presale strategies and unique incentive structures enhance investor confidence and position these projects for long-term success in the crypto ecosystem.

Proactive presale strategies and unique incentive structures enhance investor confidence and position these projects for long-term success in the crypto ecosystem.

While Bitcoin stands strong in the realm of digital assets, its framework is increasingly challenged by the complexities of today’s blockchain activities.

With transaction speeds hovering at just a few per second, as confirmed by current metrics, users face delays and increased transaction costs, which hinder the usability of Bitcoin in daily transactions.

This is significantly below the demands placed by contemporary applications and international transactions.

During periods of heightened activity, transaction costs soar, making micro-payments and smaller transactions cumbersome and often unfeasible.

This limitation makes it challenging for innovative solutions to flourish directly on the Bitcoin network.

Moreover, Bitcoin’s lack of advanced programmability restricts developers, as it cannot support the complex smart contracts that many decentralized finance and gaming platforms operate on.

Consequently, developers often choose to relocate liquidity away from Bitcoin to access modern development tools.

This creates a scenario where Bitcoin liquidity is shifted to wrapped tokens and third-party systems, increasing the risk of counterparty issues. This is the fundamental challenge facing Bitcoin in the DeFi landscape today.

Ultimately, Bitcoin is solidified as a long-term store of value, while the dynamic operations take place on alternative networks.

Projects designed to bridge these gaps must ensure enhanced speed and reduced costs, all while maintaining the robust security of Bitcoin for final settlements.

Bitcoin Hyper ($HYPER) introduces an innovative Layer 2 solution that preserves Bitcoin for its settlement capabilities while facilitating execution in a high-performance setting. Transactions occur in a rapid virtual environment before being securely returned to the Bitcoin network for confirmation.

Unlike conventional custodial solutions, Hyper leverages a verified, programmatic bridge to anchor the integrity of $BTC, with systems designed to consolidate Bitcoin activity rather than distribute it across numerous networks.

The platform integrates the Solana Virtual Machine, allowing developers to deploy efficient Rust-based smart contracts and operate decentralized applications with minimal delay. An innovative bridge mechanism locks $BTC on the main chain while minting corresponding assets on Layer 2, ensuring seamless value transfer while upholding Bitcoin’s core settlement principles.

If successful, this real-time Layer 2 architecture could revolutionize transactions, DeFi operations, NFTs, and gaming on the Bitcoin network without compromising the features that make $BTC significant.

Learn further about Bitcoin Hyper in our in-depth resource guide.

Learn further about Bitcoin Hyper in our in-depth resource guide.

Understanding Bitcoin Hyper’s Mechanism and Its Implications for the Future of Bitcoin

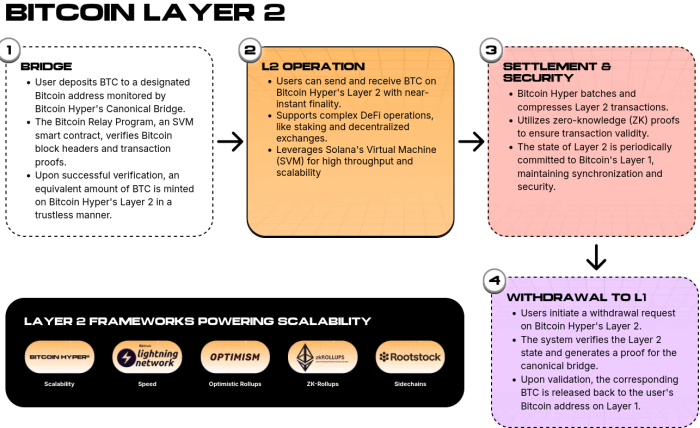

Bitcoin Hyper’s architecture focuses on efficient execution alongside a Canonical Bridge. Users begin by depositing $BTC into a designated monitored wallet, where deposit verification occurs via an SVM process, resulting in the minting of equivalent wrapped $BTC on the Layer 2 platform.

Transactions benefit from rapid finality, with batches regularly submitted back to Bitcoin, keeping the Layer 2 state in sync with the security provided by the main chain.

This approach aims to offer speed and affordability without sacrificing the foundational principles of Bitcoin settlements.

The accompanying whitepaper illustrates a virtual machine designed for speed, supporting decentralized exchanges, loaning services, payments, NFTs, and gaming functionalities.

Developers will have access to Rust-based tools along with a planned SDK and API to speed up new integrations, while transaction fees will be paid in $HYPER within the ecosystem.

Utility extends beyond simple transaction speeds; $HYPER will play a central role in transaction fees, staking capabilities, and governance within the ecosystem. Furthermore, $HYPER is set to fund development grants to expedite the launch of early dApps within the platform.

The validator network for Layer 2 operates on a proof-of-stake model, processing transactions while maintaining a secure anchor to Bitcoin for settlement, thereby optimizing energy consumption compared to Bitcoin’s main network.

For users prioritizing sustainability, this represents a significant positive aspect.

Owning $HYPER positions you strategically as this Layer 2 technology evolves, serving as the primary currency for the ecosystem.

The presale has already generated nearly $26M, highlighted by a recent transaction where a single investor contributed $130K. The project has captured significant interest from large-scale investors:

As Bitcoin Hyper gains traction, it is considered one of the most promising projects slated for 2025, making it a potential candidate for rapid growth within the crypto landscape.

Our guide on acquiring $HYPER provides easy steps to engage in the presale effectively.

Currently, one token is priced at $0.013225, with a scheduled increase in the next 24 hours. Getting in early provides a competitive advantage, made even attractive by the impressive 45% staking yield, underscoring potential returns.

Secure your $HYPER before the next price hike!

Written by Alex Stone, Bitrabo –

Disclaimer: This article offers information and should not be taken as financial advice. It is essential to conduct thorough research on audits, tokenomics, staking criteria, and associated risks before making any investment.