Recent trends indicate that the Options Open Interest in Bitcoin is experiencing significant growth, reaching unprecedented levels.

Shifting Dynamics in Bitcoin Options Trading

The latest findings from Glassnode reveal that ongoing market fluctuations have led to increased activity in the options market. Options trading allows investors to speculate on potential future movements in Bitcoin prices, offering versatility in trading strategies. An options contract provides the investor with the choice—either to buy or sell Bitcoin at a specified price before a set expiration date. Calls denote bullish bets, while puts express bearish sentiments.

Historically, the BTC derivatives landscape was dominated by futures contracts, but of late, options have emerged as a competitive force, significantly boosting overall Open Interest.

Open Interest serves as a critical metric, indicating the total number of outstanding positions within the market across all centralized exchanges. Below is a visual representation sourced from Glassnode, illustrating changes in the Bitcoin-denominated options market over the previous year.

The chart clearly indicates a notable rise in the Bitcoin Options Open Interest, suggesting that traders are actively opening new positions. This heightened activity correlates with the recent price fluctuations of BTC. The increase has been remarkable enough to lead to a new all-time high (ATH). According to Glassnode, this phenomenon is driven by factors such as volatility-arbitrage tactics and a renewed focus on managing risk.

In contrast, while there has been impressive growth in the BTC-denominated Open Interest, the USD-denominated equivalent remains subdued compared to the highs observed in late October.

This disparity highlights that even though interest is rising in BTC, overall USD capital remains limited. “This lays the groundwork for the approaching key expiry, which is poised to be particularly significant moving forward,” noted the analytics firm.

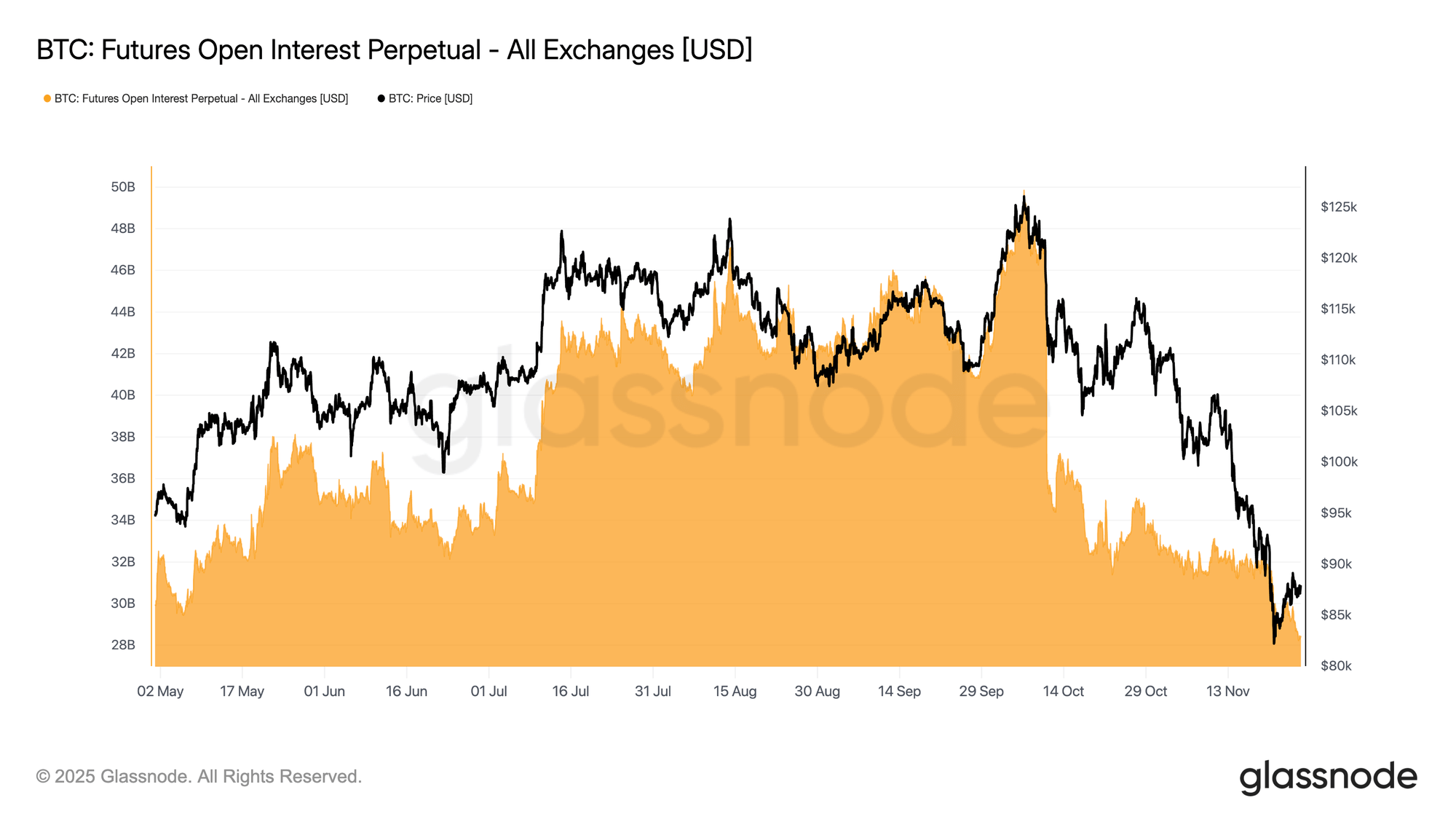

Furthermore, similar trends can be observed in the perpetual futures market, which has also shown a downward trend in Open Interest recently.

Bitcoin Futures Oi" width="2000" height="1125" title="Bitcoin Options Skyrocket As Oi Hits All-Time High-Bitrabo">

Bitcoin Futures Oi" width="2000" height="1125" title="Bitcoin Options Skyrocket As Oi Hits All-Time High-Bitrabo">

The above illustration demonstrates a persistent decline in Bitcoin Futures Open Interest, particularly following the notable deleveraging event in October. The steadiness of this decline suggests that investors are exercising caution and strategically managing their risks rather than facing abrupt liquidations.

The report summed up the situation as follows:

The market has settled into a leaner leverage structure, significantly reducing the potential for volatility driven by liquidations and reflecting a more prudent stance within the futures arena.

Current BTC Market Position

Bitcoin prices recently rebounded to $91,300, following an impressive surge of 5% within a single day.