As we venture further into the digital finance landscape, a striking new forecast for Bitcoin has emerged: a potential price of $1.3 million by 2035.

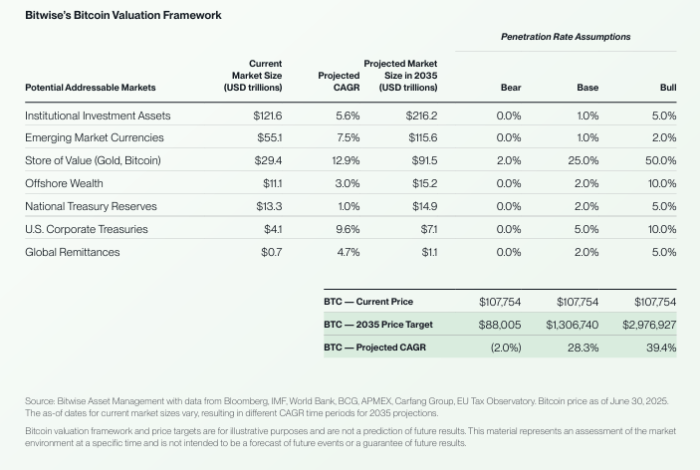

Once considered a fringe technology, Bitcoin has transformed into a cornerstone of institutional investment. According to insights from the crypto management firm Bitwise, Bitcoin’s growth trajectory is set to continue at an impressive compound annual growth rate (CAGR) of 28.3% over the next decade. This rate far surpasses traditional investments such as stocks (6.2%), bonds (4.0%), and even gold (3.8%).

The recently published Long-Term Bitcoin Market Study from Bitwise dives deeper into the rationale behind this bold prediction, emphasizing the substantial growth potential still present in the Bitcoin market.

It’s essential to note that Bitwise’s optimistic Bitcoin outlook does not yet reflect the possible impacts of emerging technologies, which may provide further momentum for Bitcoin prices.

A significant breakthrough could come from a project named Bitcoin Hyper ($HYPER), which has the potential to be a transformative force in the ecosystem.

The Economic Landscape: Opportunities Within Challenges

According to Bitwise, while the overall economic outlook appears favorable, several significant challenges loom.

A primary concern is the escalating national debt in the United States. Such financial conditions often prompt nations to lower interest rates and debase their currencies, artificially reducing the burden of debt denominated in local currency.

As highlighted in the Bitwise report, betting on these trends could be advantageous regarding Bitcoin’s future.

Lowering interest rates can stimulate consumer spending, which in itself could be beneficial for Bitcoin’s prospects. Investors eagerly await the upcoming Federal Reserve board meeting, where discussions about potential interest rate cuts led by Jerome Powell are anticipated.

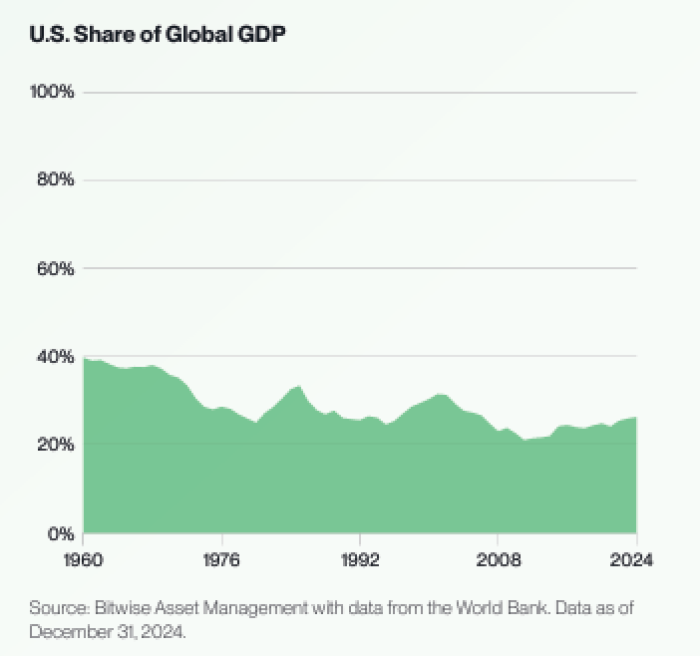

On a broader scale, the dominance of the US dollar in the global market is beginning to wane.

While this isn’t necessarily catastrophic for the US economy, it opens doors for alternative reserve currencies.

This presents an opportunity for Bitcoin to establish itself as a viable candidate. Notably, figures like Michael Saylor have popularized the idea of incorporating Bitcoin into corporate treasury strategies.

The Future Looks Bright for Bitcoin

Bitwise’s price forecasts are notably optimistic, supported by several key observations:

- The demand for Bitcoin is increasingly driven by institutional investors rather than just retail traders. Institutions now account for over 75% of the trading volume on major platforms like Coinbase.

- Public companies are rapidly increasing their Bitcoin holdings, with 44 corporations now owning at least 1,000 $BTC each.

- Bitcoin’s fixed supply underlines its appeal as a reliable store of value, with approximately 19.91 million $BTC of its total 21 million supply (94.8%) already in circulation.

As the US faces a skyrocketing national debt (currently at $36 trillion) and annual interest liabilities nearing $1 trillion, more investors are turning to assets with limited supply.

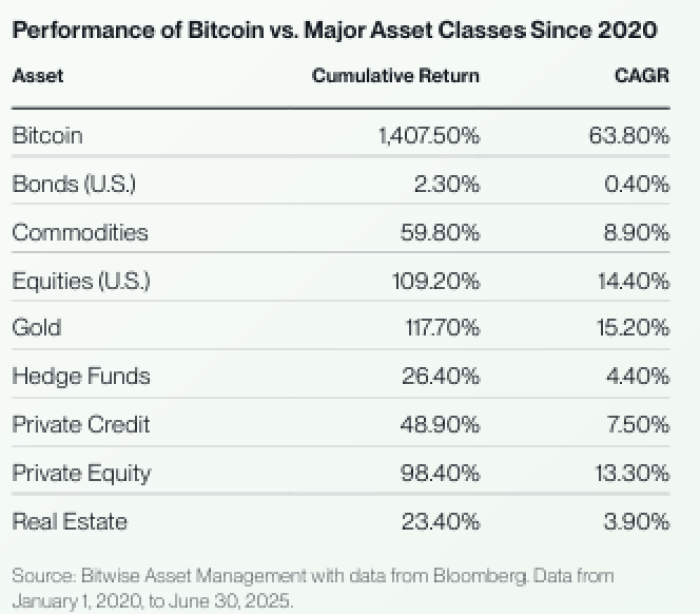

This paradigm shift can help explain Bitcoin’s astonishing performance since 2020:

With an anticipated CAGR of 28.3%, Bitcoin could very well reach $1.3 million by 2035; this is Bitwise’s conservative estimate.

In a more optimistic scenario, should the CAGR rise to 39.4%, Bitcoin could skyrocket to $2.9 million.

It’s important to recognize that Bitwise’s projections are based on solid analytical foundations. While some assumptions might be flawed, the reasoning is sound and structured.

Of course, should conditions change negatively, Bitcoin could underperform. In Bitwise’s more conservative outlook, the CAGR drops significantly, leading to a predicted price of around $88,000. However, new developments like a robust Layer-2 solution might drive Bitcoin prices even higher than anticipated.

Introducing Bitcoin Hyper ($HYPER): The Layer-2 Solution for Enhanced Bitcoin Performance

Bitcoin Hyper ($HYPER) combines the excitement of a meme coin with serious functionality and innovation.

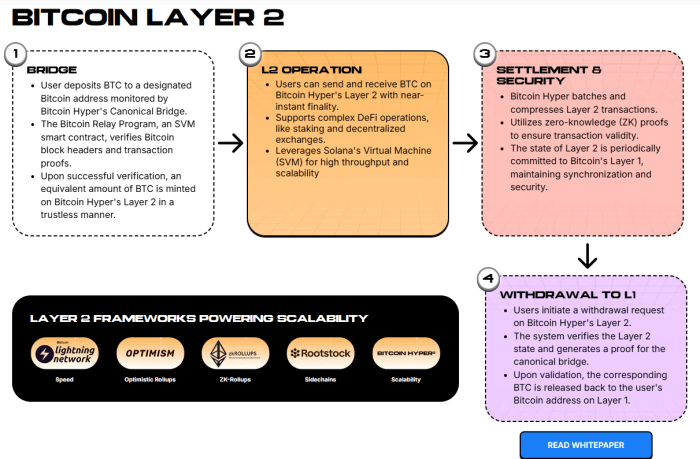

So, what is Bitcoin Hyper? It is a Layer-2 solution designed to solve crucial issues with Bitcoin’s transaction capacity, high fees, and scalability by employing effective new technology solutions that could further propel Bitcoin’s growth trajectory.

This project utilizes a hybrid framework that features a Canonical Bridge for transferring Bitcoin from the main layer to the Bitcoin Hyper platform (as wrapped $BTC). By integrating the Solana Virtual Machine, Bitcoin Hyper can achieve Solana’s remarkable transaction speeds and elevated throughput.

While Bitcoin averages a mere seven transactions per second (TPS), Solana boasts a theoretical maximum TPS of 65,000.

Moreover, settlement occurs on the Bitcoin blockchain, thereby capitalizing on Bitcoin’s well-established security and trustworthiness.

There is considerable enthusiasm surrounding the $HYPER token, serving as the currency for the Bitcoin Hyper Layer-2. You can learn how to acquire $HYPER and participate in the current presale, which has already garnered upwards of $12.6 million in investments.

Currently priced at $0.012825, $HYPER offers staking rewards at an impressive 88% APY. Our price forecast for $HYPER suggests it could climb to $0.32 by the end of 2025.

This would represent a staggering return on investment of 2,395%, significantly outpacing Bitcoin’s anticipated growth of 1,400% over the same period.

Check out the Bitcoin Hyper presale for updates.

Striking a Balance Between Optimism and Caution

Bitwise acknowledges that the inherent volatility of cryptocurrencies will likely persist. Financial models often come with uncertainties, and investors should be prepared for potential market corrections despite optimistic trends.

However, it’s crucial to remember that predictions can be wrong in both directions. Could Bitcoin Hyper ($HYPER) push Bitcoin beyond expectations, even exceeding Bitwise’s projections? Only time will reveal the answer, making $HYPER a notable project to keep an eye on.

Always conduct your own research before venturing into any investments. This content is not intended as financial advice.