Recent data from multiple sources indicates a significant decline in Bitcoin’s Open Interest, illuminating trends in risk appetite among futures traders.

Current Trends in Bitcoin Futures Open Interest

According to the latest analytics from various on-chain resources, the Open Interest in Bitcoin futures is currently experiencing a downturn. This metric reflects the total volume of active perpetual futures positions related to Bitcoin across several prominent derivatives exchanges.

When Open Interest is on the rise, it generally signifies that investors are eagerly entering the market by opening fresh positions. This increase in leverage can lead to heightened market volatility, as more positions can lead to more significant price swings.

Conversely, a decline in this indicator points to a reduction in market engagement, suggesting that investors may be pulling back from riskier bets or that exchanges are executing forced liquidations. This reduced leverage typically leads to more stable price movements for Bitcoin.

Here is a graphical representation illustrating the yearly trend of Bitcoin Open Interest:

As shown in the above chart, Bitcoin’s Open Interest experienced a notable dip last month following a significant price crash that triggered a wave of liquidations. Since then, this metric has continued its downward trajectory in tandem with Bitcoin’s persistent price decline.

The sustained drop in Open Interest suggests that there is a significant hesitance among investors to initiate new long positions to replace those that have been liquidated. “This cautious approach among market participants corresponds to the prevailing sentiment of diminishing demand within risk-sensitive trading groups,” the analysis states.

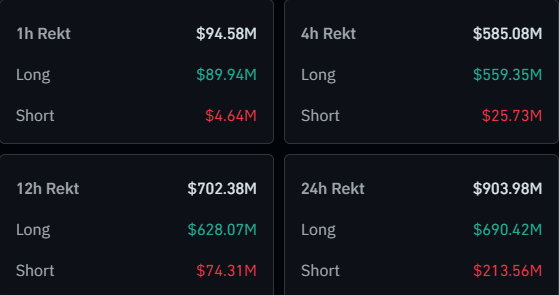

In the last 24 hours, Bitcoin has faced another bearish shift, resulting in further liquidations across the futures market. As indicated by data from reliable liquidation trackers, the entire cryptocurrency market has seen approximately $904 million in liquidations during this period.

The market has overall declined during this timeframe, meaning a substantial $690 million of those liquidations originated from long positions.

Looking at specific cryptocurrencies, both Bitcoin and Ethereum have contributed the most to the liquidation crisis, with $370 million and $235 million in liquidations, respectively.

Interestingly, Solana led the pack with $37 million in liquidations despite broader market declines. It stands out as one of the few assets registering slight positive returns over the last day, showcasing its resilience amidst downturns.

Current Bitcoin Price Dynamics

As of the latest figures, Bitcoin has retraced its price to around $86,900, following the recent volatility.