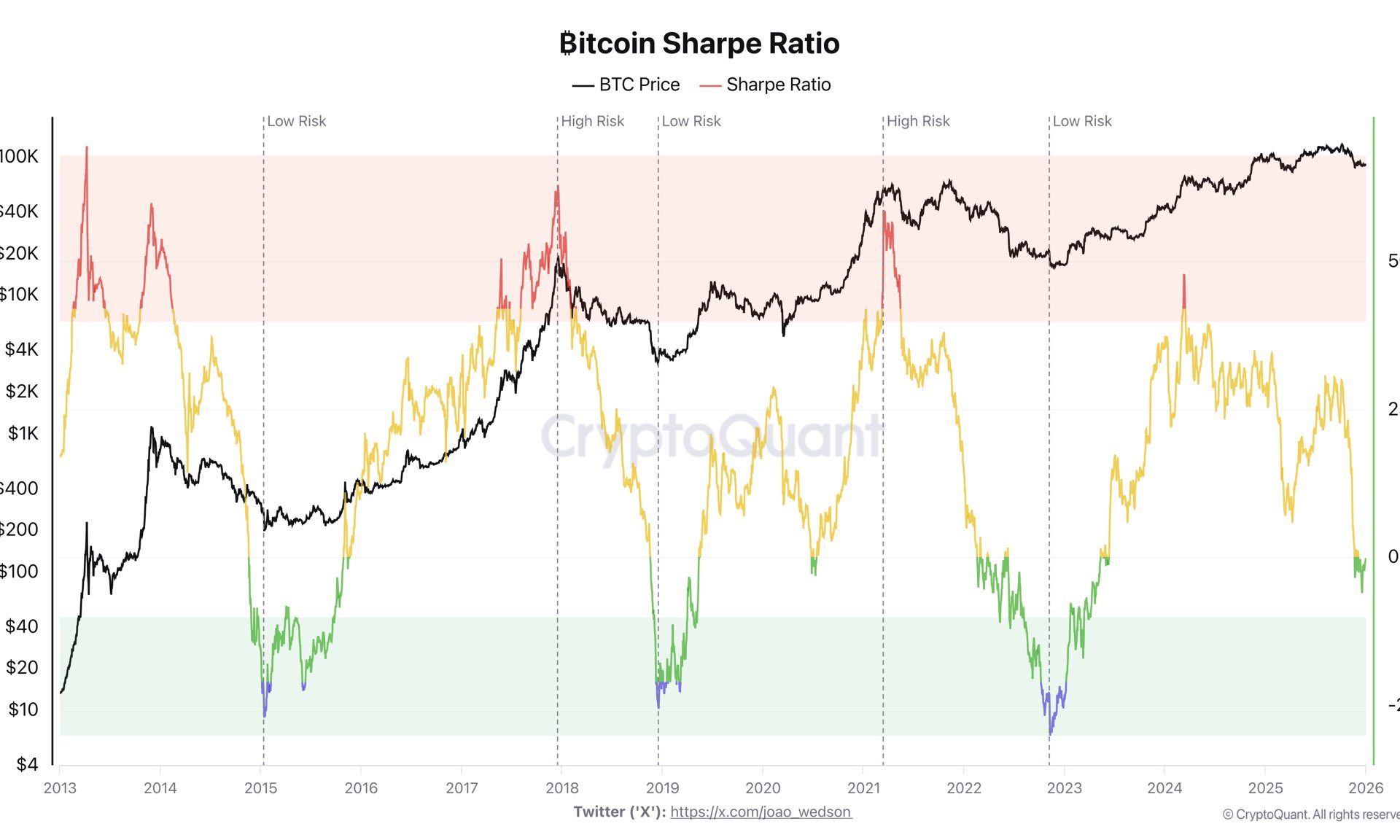

As the cryptocurrency landscape continues to evolve, Bitcoin has found itself navigating turbulent waters, with its value still hovering under the $90,000 mark. This scenario has led to various key metrics drifting into unfavorable zones, signaling a complex market environment at the start of this year. One critical metric is the BTC Sharpe Ratio, a vital tool for assessing the risk associated with investing in Bitcoin.

Emerging Risk-Reward Dynamics in Bitcoin

The persistent volatility surrounding Bitcoin has created challenges for its price recovery, keeping it anchored below $100,000. While this may sound alarming at first glance, a deeper analysis of the risk-adjusted returns unveils a more nuanced scenario.

Market analysts such as Darkfost from CryptoQuant have closely examined Bitcoin’s risk profile through the lens of the Sharpe Ratio. His findings highlight a significant shift, using the ratio to evaluate the relationship between volatility and potential returns. This approach helps investors gauge when to enter or exit the market based on risk levels.

According to Darkfost’s analysis, the Sharpe Ratio has recently dipped into negative territory, plummeting to -0.5. Such a trend often indicates a turbulent market, typically unfolding during transitional phases. His accompanying chart details how this currently places the metric in a historically low-risk zone.

Historically, low Sharpe Ratios signal elevated risk levels. Nevertheless, such conditions could mean that investors have faced considerable losses while still confronting high volatility. Essentially, this suggests that while the market appears weak, it may be transitioning into a more favorable landscape for long-term investments.

This development might indicate a shift in the Bitcoin market, hinting that we are approaching a stage of lower downside risks and potentially lucrative long-term opportunities. Indeed, Darkfost emphasizes that the best prospects usually arise after a significant drop has occurred, creating a fertile ground for recovery.

A negative Sharpe Ratio like the current -0.5 can serve as a pivotal moment that signals a buying opportunity for Bitcoin. Historically, similar ratios have marked the inception of profitable buying phases for savvy investors.

Long-Term Holders’ Insights: Are They Accumulating BTC?

A recent study conducted by Axel Adler Jr. reveals that Bitcoin’s long-term holders continue to display resilience amid ongoing market fluctuations. His research focuses on the BTC LTH Distribution Pressure metric, which has shifted significantly and may influence future market trends.

The data indicates that the LTH Distribution Pressure Index is at -1.628, suggesting a movement into the Accumulation zone. This highlights a decrease in selling activity among long-term holders, showcasing renewed faith in Bitcoin’s future potential.

Currently, the daily expenditure by long-term holders stands at an average of 221 BTC, one of the lowest observed in several months. Furthermore, Darkfost pointed to the Spent Output Profit Ratio (SOPR), which is currently at 1.13. This shows that holders remain profitable, indicating a favorable environment for Bitcoin investment.

In conclusion, while Bitcoin’s current price action may imply caution, key indicators and long-term holder behavior suggest that there are potential opportunities on the horizon. Understanding these metrics is crucial for investors looking to navigate the complex crypto landscape effectively.