Bitcoin (BTC) is currently navigating a tumultuous market landscape, trying to maintain its position above the crucial $110,000 mark as we approach the month’s end. Recent fluctuations have left the market structure feeling unstable, prompting analysts to caution that BTC could be poised for another dip in demand zones before it can solidify its footing. The presence of liquidity levels beneath the current price, coupled with a steadfast group of sellers near resistance, raises the possibility of short-term price declines as traders reevaluate their strategies following changes from the Federal Reserve.

Despite these pressures, there are glimmers of hope. A portion of investors continues to embrace optimism as macroeconomic factors begin to tilt in favor of risk assets once more. The Fed’s latest decision to cut rates by 25 basis points, along with the announcement that quantitative tightening will cease by December 1st, fosters a sentiment that some believe could signal the start of a fresh liquidity cycle. Historically, this phase has been advantageous for Bitcoin’s long-term growth.

Moreover, analysis of on-chain data reveals a more stable market atmosphere. In the last month, the activity surrounding older coins has remained modest, with seasoned holders demonstrating no inclination to engage in panic selling. This behavior indicates a certain level of confidence among veteran market players, even as Bitcoin experiences short-term fluctuations. Together, these factors result in a transitional market: one that is cautiously tactical yet strategically aligned for prospective upward movement.

Indicators of Strong Holder Confidence in Bitcoin

Recent observations from on-chain analyses by standout analyst Axel Adler underline the stability of Bitcoin’s spending among long-term holders, reinforcing robust market confidence despite ongoing price challenges. Adler highlights the Average Spent Output Lifespan (ASOL)—a critical measure reflecting the average age of coins being transacted—showing that slight spikes to 245 days on October 8 and 209 days on October 21 present weaker signals than those observed during previous active periods among long-term holders.

This differentiation is vital: in prior instances of older coins being moved, it often indicated significant distribution events that typically foreshadowed corrective outcomes. Conversely, the recent gentle upticks suggest there is no widespread urgency among long-term holders to liquidate their positions. Currently, the 30-day ASOL moving average stands at around 111 days—characterized by Adler as a fundamental baseline that aligns with healthy market consolidation efforts rather than distribution phases.

In practical terms, this denotes that experienced holders are opting for patience instead of immediate profits, despite the uncertain macro environment and erratic short-term price actions. Simultaneously, incoming liquidity continues to effectively manage supply, as elucidated in recent weekly commentary. This liquidity absorption is significant; it reflects a market where the available Bitcoin is gradually becoming more constrained, thus facilitating price stability even while speculative interest remains limited.

Altogether, these on-chain dynamics imply a foundational growth phase rather than one of market exhaustion. As liquidity conditions improve and macroeconomic hurdles diminish, the quiet assurance exhibited by long-term holders could serve as the cornerstone for the next significant upward movement—once demand begins to considerably accelerate. As it stands, the market continues to exude calmness, historically a sign of accumulation and forthcoming expansion rather than large-scale distribution or capitulation.

Bitcoin Attempts to Stay Above $110K While Facing Resistance

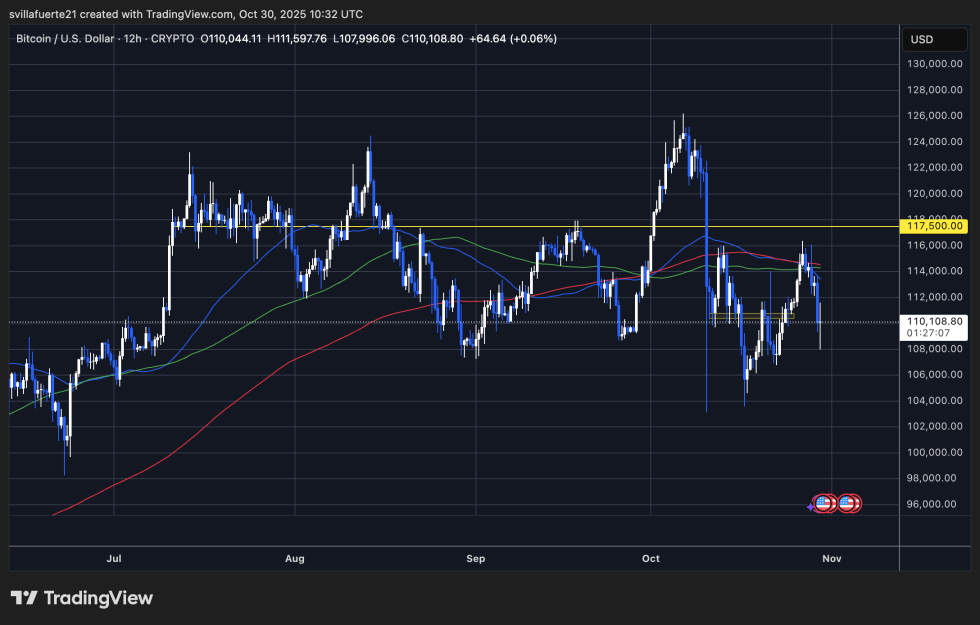

At present, Bitcoin (BTC) is hovering around $110,100, making efforts to stabilize following a forceful rejection from the $117,500 resistance level—a barrier that has consistently prevented upward mobility since mid-August. The 12-hour charts depict a recurring trend: each attempt to surge toward the upper range gets thwarted near a cluster of moving averages, with sellers keenly reasserting their position at resistance points and pushing BTC back into its mid-range support territory.

BTC is currently trying to stay above a critical demand zone between $108,500 and $110,000, an area that previously served as a pivotal point in late September and early October price dynamics. Maintaining this zone is crucial for market bulls. A breakdown below this level could expose Bitcoin to prices within the $104,000 to $106,000 range, which was touched during the liquidation event on October 10.

To catalyze a structural shift, BTC must reclaim the 50- and 100-period moving averages on the 12-hour timeframe while securing a firm footing above the $114,500 mark. Only then would the potential for a renewed challenge toward $117,500 materialize, with a confirmed breakout opening pathways leading toward the $120,000 to $123,000 region.

As it stands, Bitcoin remains ensnared within its established trading range, balancing macroeconomic optimism against persistent selling pressure. With a reduction in volatility, the next significant price movement is likely to emerge once traders fully digest the recent policy adjustments and liquidity flows start to shift more decisively.

Featured image from ChatGPT, chart from TradingView.com