Leading cryptocurrency pioneer, Bitfury, is set to expand its horizons beyond traditional mining, unveiling a significant investment strategy aimed at future-forward technologies.

Recent insights reveal the firm’s plan to initiate a groundbreaking $1 billion technology fund. This marks a pivotal shift for Bitfury, which has primarily dedicated its resources to mining and hardware development since it was established in 2011.

Investment Timeline for the $1B Initiative

The company intends to allocate around $200 million in the inaugural year, gradually rolling out the remaining funds in the ensuing years, as disclosed in a announcement. Initial investments could emerge as early as Q4 2025. It’s stated that the financial sources will come from a combination of revenue streams derived from mining and external partnerships.

Val Vavilov, the company’s CEO, is reportedly a key advocate for this strategic pivot.

Key Focus Areas for the Fund

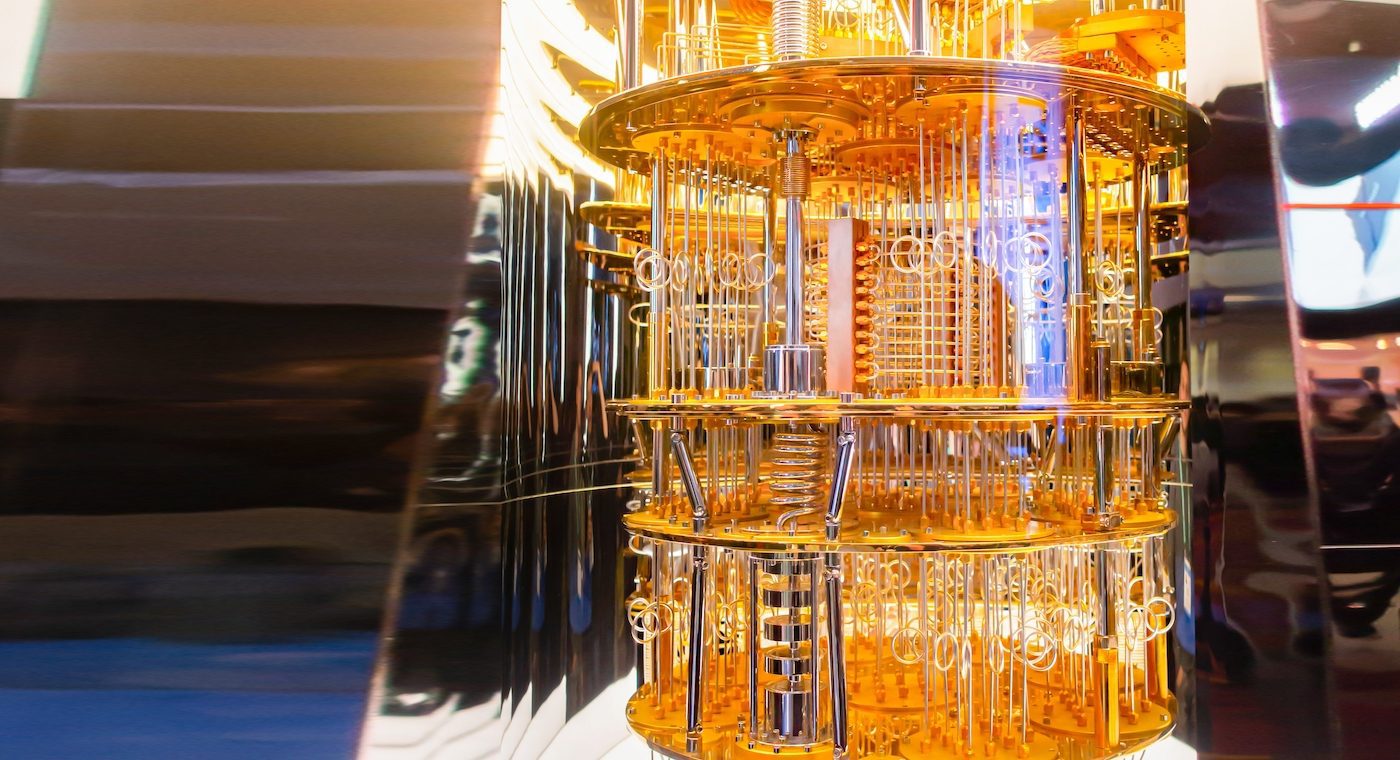

Bitfury has made preliminary strides into AI, quantum computing, and identity verification technologies, as highlighted in various reports. Their reputation for developing data center cooling solutions and AI hardware positions them well to collaborate with emerging startups requiring significant processing capabilities.

Industry insiders praise Bitfury’s robust background in infrastructure as a potential asset for funding demanding innovations. Yet, the challenges of identifying promising startups amid fierce competition from established venture capitalists remain substantial.

Why Bitfury Is Changing Its Strategy

Company leadership underscores a critical connection between secure systems and the evolving landscape of artificial intelligence. They assert that as AI growth accelerates, ensuring user identity and privacy will become increasingly vital.

The fund is designed to support what Bitfury terms “ethical emerging technologies,” emphasizing the necessity of combining innovation with user protection.

Assessing Strengths and Challenges

Bitfury’s historical achievements illustrate its capability in developing essential hardware and managing expansive operations. Its relationships with pioneers in immersion cooling and AI chip technology could serve as a significant advantage for startups looking for both funding and infrastructure support.

However, navigating a large investment strategy presents unique challenges. The task of selecting winning ventures in saturated markets such as AI and quantum computing is inherently risky. Rapid market shifts, evolving technologies, and complex regulatory landscapes surrounding cryptocurrency further complicate these endeavors.

Future Considerations and Strategic Timing

While details regarding the fund’s governance and operational rules remain limited, as reported by analysts, these factors will be crucial for attracting startups and investors alike.

Bitfury’s cautious yet ambitious approach is evident in their commitment to substantial early-year investments, signaling a proactive outlook. Observers from both investment circles and the broader tech community are keenly watching how Bitfury will transition from mining operations to a prominent position in the investment landscape.

Image courtesy of Shutterstock; data visual from TradingView