Recent observations in on-chain metrics reveal a significant uptick in exchange inflows for Bitcoin and Ethereum, likely linked to market fluctuations.

Tracking Exchange Inflows: Bitcoin & Ethereum’s Recent Surge

According to a recent analysis by CryptoQuant, there has been a remarkable increase in the Exchange Inflow metrics for both Bitcoin and Ethereum. This metric measures how much of a cryptocurrency (in USD) is being deposited into wallets associated with centralized exchanges.

A high value in this metric typically indicates that traders are moving significant amounts of their assets onto exchanges. This behavior usually occurs when investors plan to trade, sell, or otherwise utilize services offered by these platforms. Therefore, spikes in this metric may signal a heightened demand for trading activities.

Below is a visual representation provided by CryptoQuant illustrating the 7-day cumulative Exchange Inflow trends for Bitcoin and Ethereum over recent months:

The chart indicates that the combined inflow of Bitcoin and Ethereum has recently surged to over $40 billion. This influx of deposits seems to correlate with recent market declines, suggesting that these transactions were possibly aimed at liquidating assets.

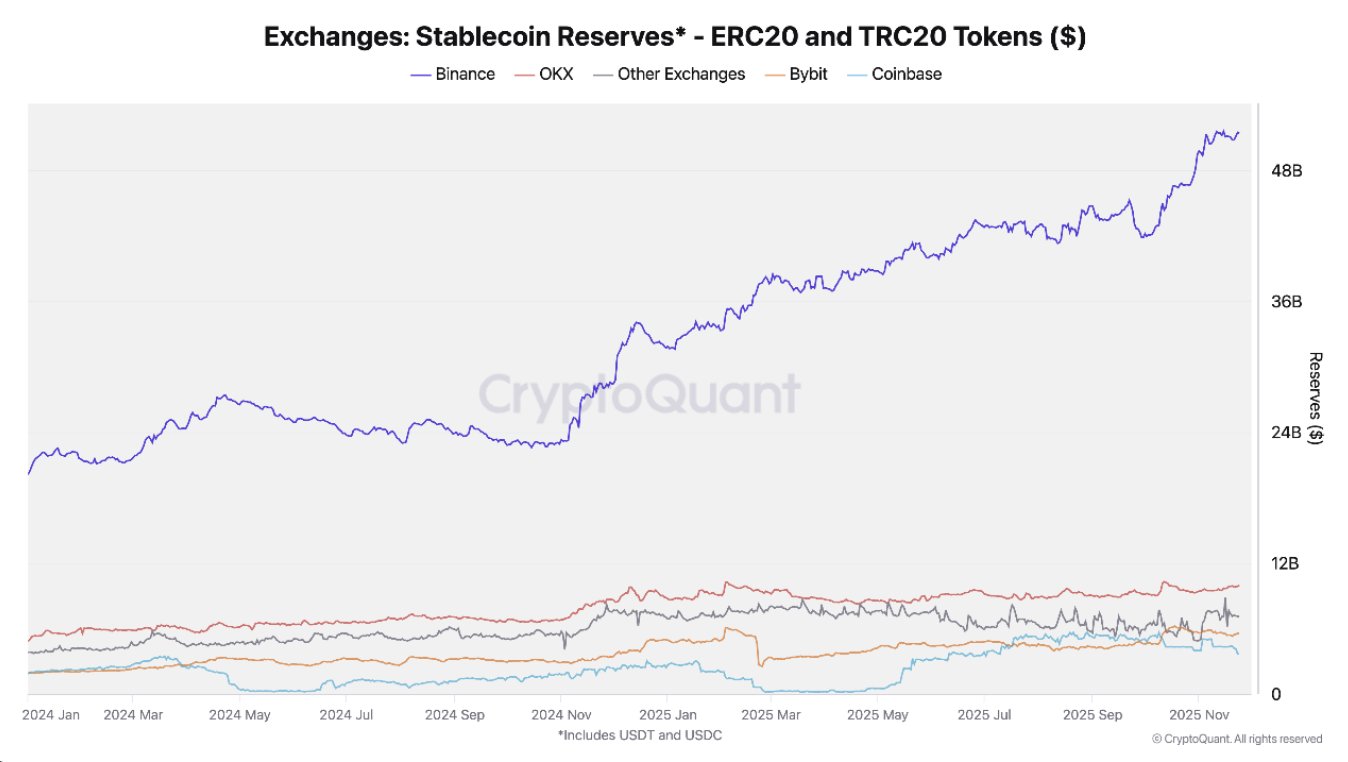

Interestingly, Bitcoin and Ethereum are not alone in experiencing significant inflows; stablecoins have also seen increased deposits into exchange wallets. However, unlike Bitcoin and Ethereum, the trend for stablecoins varies across different exchanges.

The accompanying chart details the stablecoin Exchange Reserve levels across various centralized exchanges, tracking the total amount of these coins held in exchange wallets.

Recent data indicates that stablecoin reserves at Binance have surged, suggesting that more investors are choosing this platform for their stablecoin deposits. The analytics firm highlights that “Binance’s stablecoin reserves just reached a record $51.1 billion, the highest in its history.”

While inflows of Bitcoin and Ethereum may signal bearish trends, stablecoin deposits often paint a more optimistic picture as traders generally use these assets to pivot towards more volatile cryptocurrencies like Bitcoin.

In summary, while Bitcoin and Ethereum inflows can indicate market caution, stablecoin deposits may reflect a desire for investment opportunities.

Current Bitcoin Pricing Trends

At this moment, Bitcoin is valued at approximately $90,000, marking a retreat of over 2% in the past week.