The landscape of cryptocurrency investment continues to be dynamic, with market participants closely monitoring trends in asset inflows and outflows. Despite initial enthusiasm, Bitcoin and Ethereum spot exchange-traded funds (ETFs) are currently experiencing a decline in demand.

The Status of Bitcoin & Ethereum Spot ETFs

Recent insights from the analytics platform Glassnode reveal that both Bitcoin and Ethereum spot ETFs are currently facing a negative trend in their net flows. Spot ETFs enable investors to gain exposure to cryptocurrencies without directly engaging with the underlying blockchain technology. As a result, these funds manage and securely hold digital assets on behalf of their investors.

Globally, the popularity of ETFs and similar digital asset investment products has surged, yet the most significant growth is seen in the United States. The US Securities and Exchange Commission (SEC) approved spot ETFs for Bitcoin in early 2024 and for Ethereum later the same year. These ETFs have played a crucial role in attracting investments from traditional financial institutions.

For context, the following chart illustrates the trend of the 30-day simple moving average (SMA) of Bitcoin spot ETF net flows in recent years:

As illustrated in the graph, the 30-day SMA net flow for US Bitcoin spot ETFs turned negative in November, indicating a shift towards capital outflows. This trend has largely persisted, although there has been a recent slowdown in outflow rates. Earlier this month, the 30-day SMA briefly returned to positive territory, but this uptake was short-lived, quickly reverting back to net outflows.

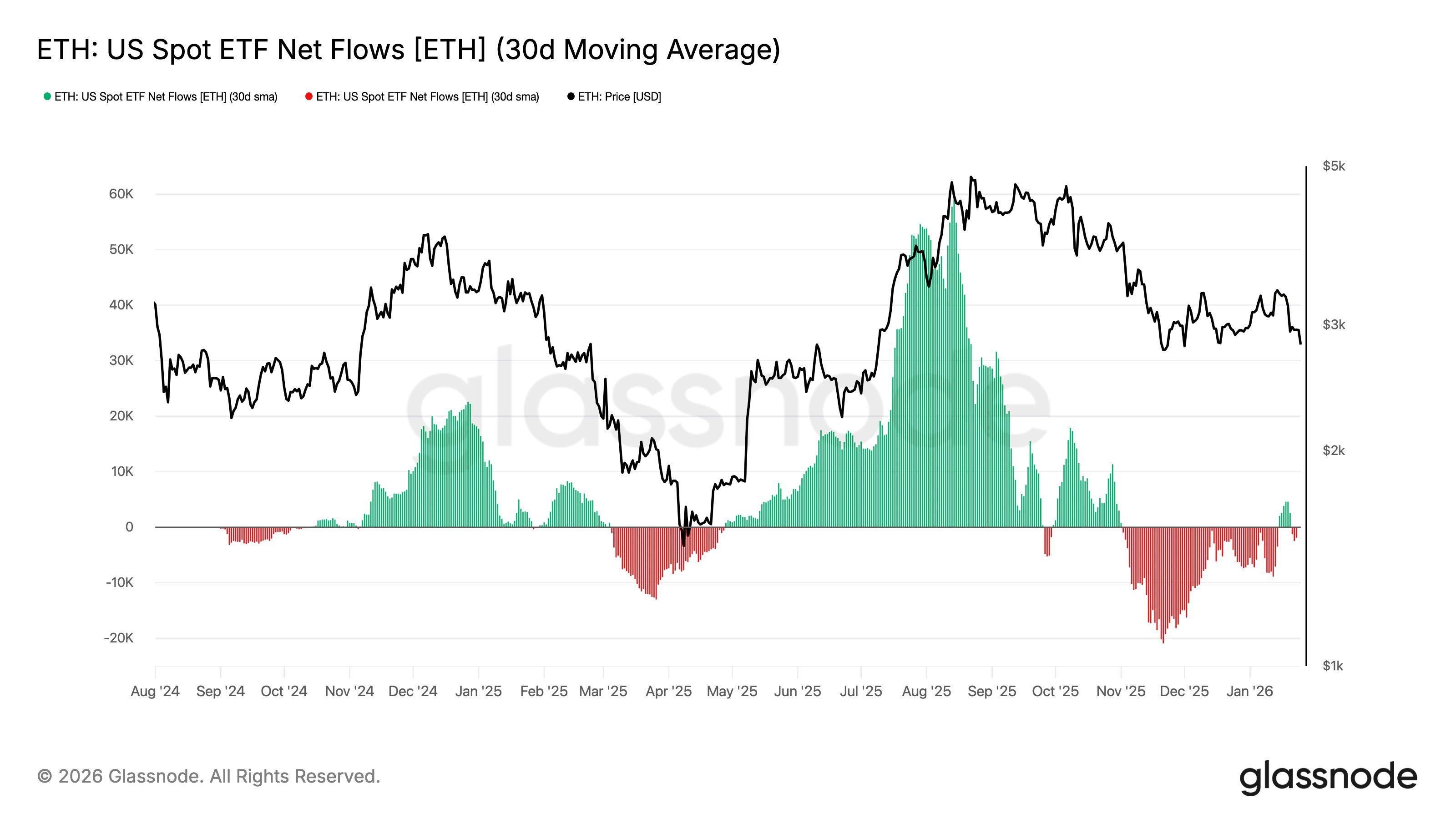

A parallel trend is evident in Ethereum spot ETFs, as shown in the chart below.

The graph indicates that the 30-day SMA net flow for US Ethereum spot ETFs has also drifted back into negative territory after experiencing a brief increase in net capital inflows. This suggests continued waning interest among ETF investors in the digital asset space.

As noted by Glassnode, “There is no evidence of renewed demand,” which raises questions about the duration of this outflow pattern and its implications for market sentiment.

Current Bitcoin Pricing Trends

At present, Bitcoin is trading at approximately $88,000, reflecting a decrease of 3.5% over the past week. This trend highlights the volatility that often accompanies cryptocurrencies.