The world of cryptocurrency is in a state of flux as Bitcoin navigates through tumultuous market conditions. Recently, a sharp sell-off pushed Bitcoin’s price below the $90,000 mark, instilling a sense of trepidation among investors. This downturn has led many to speculate that we are on the brink of a more profound bearish phase, significantly impacting global liquidity and investors’ risk appetite.

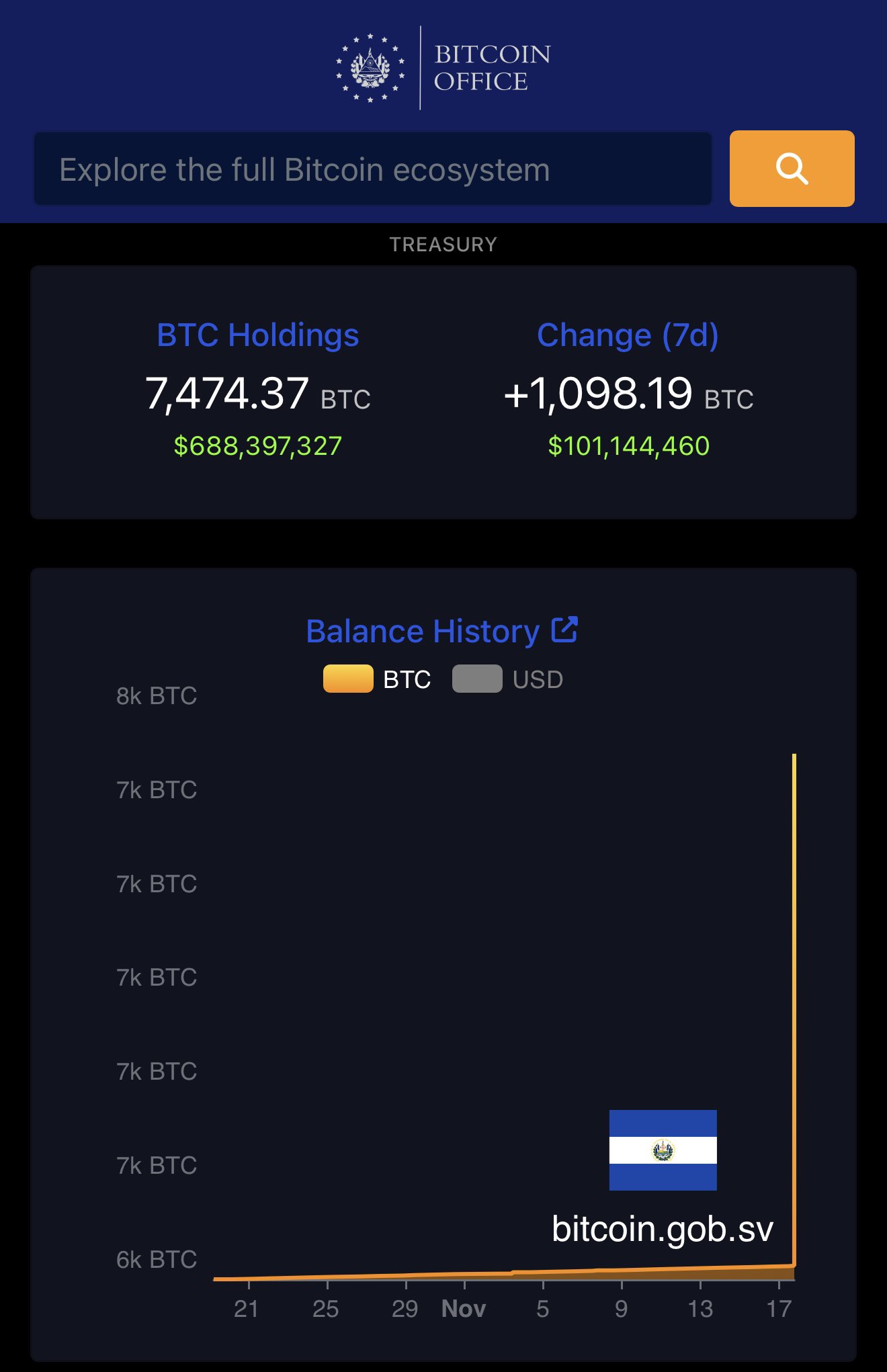

However, amidst all this uncertainty, an interesting trend is emerging. Key institutional players are displaying unwavering commitment to Bitcoin. In a notable move, reports indicate that El Salvador is actively seizing the opportunity to accumulate Bitcoin during this dip. Their government has initiated a daily purchasing program that includes acquiring significant amounts recently, reaffirming their strategy even as the market experiences volatility.

While the mood among everyday investors leans toward cautiousness, such bold moves indicate a clear distinction between short-term sentiments and the long-term strategies of major holders. As Bitcoin encounters critical support thresholds, the broader sentiment is being tested: will we see capitulation or increased accumulation?

El Salvador’s Strategic Acquisition During Market Turbulence

El Salvador’s recent decision to bolster its Bitcoin reserves has added tension to an already fluctuating market landscape. President Nayib Bukele took to social media to unveil this purchase, sharing a snapshot that highlighted the state’s growing cryptocurrency assets. With a total holding of over 7,474 BTC, Bukele’s response, though simple, encapsulates a powerful affirmation of both resilience and commitment.

The timing of this announcement stands out. As fears permeate the market and traders are pulling back, Bukele’s confidence signals a stark contrast to prevalent concerns. His engagement illustrates a mindset driven by fundamental belief in Bitcoin’s future, rather than by momentary price movements.

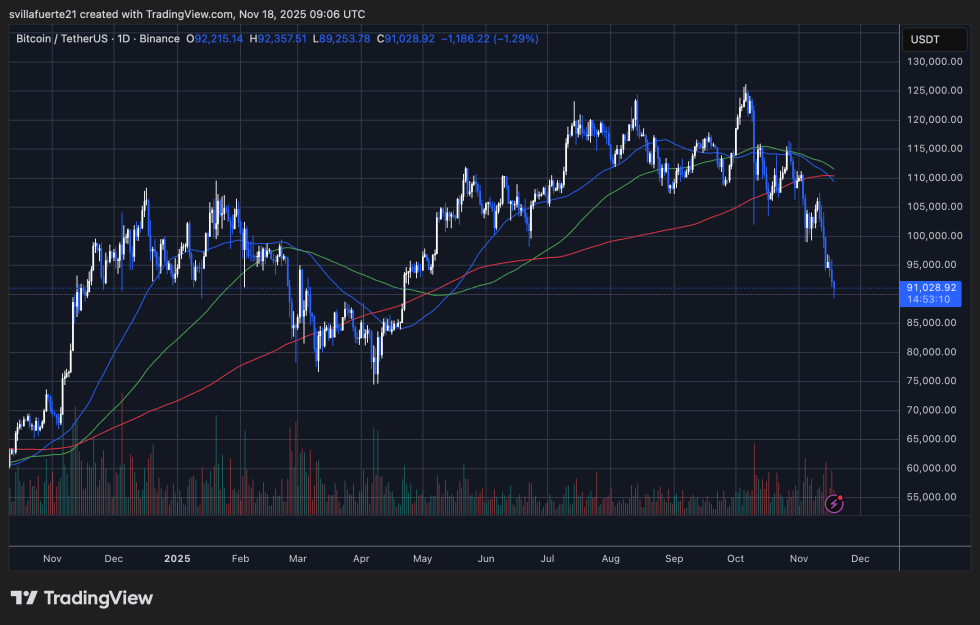

As Bitcoin dipped below the crucial $90,000 mark, many interpreted this scenario as a precursor to an impending bear market. This speculation led to a surge in liquidations and a spike in volatility, marking an extreme shift in market sentiment.

Importantly, long-term investors and sovereign entities view this recent downturn as a prime opportunity for strategic buy-ins. Historically, such contrasting perspectives have signaled watershed moments, shifting from a phase of distribution to a chapter of accumulation.

Bitcoin’s Market Performance: A Cautious Forecast

In recent trading, Bitcoin has exhibited signs of deteriorating market dynamics, now navigating around the $91,000 area following a swift rejection from the $110K–$115K range. Current charts illustrate waning momentum through lower highs and increased selling pressure, coupled with a notable breach of the 200-day moving average — a pivotal level of macro support through 2025.

The most alarming indicator is the decisive drop below $95K, a previously robust demand zone. This decline has paved the way for potential bearish outcomes, with Bitcoin now exploring an essential support bracket between $88K and $90K, characterized by the 300-day moving average and previous consolidation stages from early 2025.

The recent sell-off has triggered a significant uptick in trading volume, highlighting that this decline is not a mere blip in low liquidity but an expression of a broader risk-off market sentiment. The situation mimics a series of liquidations that could exacerbate the decline further.

Despite ongoing bearish trends, Bitcoin is still situated above a foundational bull market range from $80K to $85K. This positioning indicates that while the immediate pressure is palpable, the overarching trend has not definitively turned. However, bulls need to reclaim the $95K mark swiftly to halt the erosion of momentum.

Stay tuned for ongoing updates as the situation develops.