Recent trends indicate that Ethereum’s spot exchange-traded funds (ETFs) have been experiencing noteworthy success, surpassing Bitcoin funds for an entire week.

Ethereum’s Spot ETF Performance Surges Ahead of Bitcoin

In a recent update from X, the DeFi platform Sentora (previously known as IntoTheBlock) delved into the dynamic performance of Ethereum’s spot ETF netflows. Spot ETFs serve as vehicles that enable investors to gain exposure to an underlying asset such as ETH without the need for direct ownership.

These ETFs are accessible through standard trading platforms, allowing those unfamiliar with crypto wallets and exchanges to invest in digital currencies seamlessly.

This method of accessing the digital asset market is relatively fresh, with BTC obtaining spot ETF approval from the SEC in early 2024 and ETH later that same year.

Historically, Bitcoin spot ETFs have garnered more capital than Ethereum’s due to Bitcoin’s larger market capitalization and broader interest. However, recent data reveals a surprising shift. As noted by Sentora,

Remarkably, Ethereum ETFs have outperformed Bitcoin ETFs for a continuous period of seven days; this trend may indicate a significant shift in investor interest and an optimistic outlook for ETH.

Although ETH has taken the lead over BTC during this time, it hasn’t been devoid of challenges. Data from SoSoValue indicates that Ethereum’s ETFs experienced outflows just prior to this uptick.

Despite earlier outflows, Ethereum’s spot ETFs performed better relative to Bitcoin’s, experiencing less severe declines. Recently, the net flows shifted positively, with a substantial inflow of $455 million recorded on a single Tuesday.

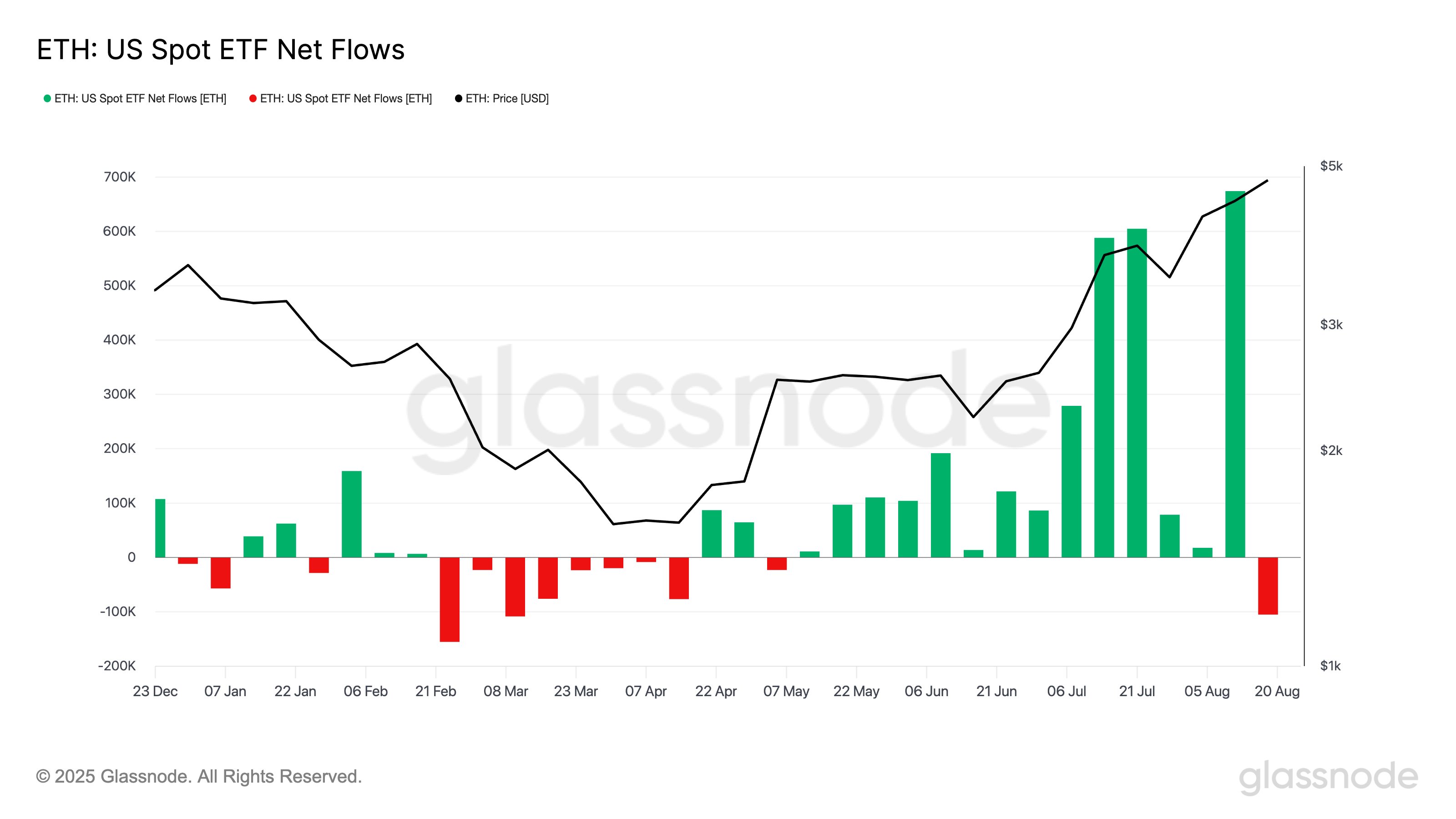

Prior to the recent outflow fluctuations, Ethereum spot ETFs had consistently amassed weekly net inflows since May, as evidenced by a chart from on-chain analytics firm Glassnode.

The week marked by significant movements saw approximately 105,000 ETH translating to a net outflow of around $486 million. The question now lies in whether the upcoming week will bring a positive reversal in these trends.

On the subject of weekly performance, another critical metric to observe is the decline in Active Addresses associated with Ethereum, as pointed out by Sentora in a different X update.

The chart indicates that around 3.8 million Ethereum addresses were active last week, a decline from the early August peak but still robust compared to previous bull market periods.

Ethereum’s Current Market Standing

As of now, Ethereum’s trading price hovers around $4,600, reflecting an increase of over 7% in the past week.