As August 2025 draws to a close, Ethereum (ETH) exchange-traded funds (ETFs) are showcasing impressive performance, dominating the market with over $4 billion in total net inflows. This figure starkly contrasts with Bitcoin (BTC) ETFs, which experienced significant outflows exceeding $600 million during the same timeframe.

The Rise of Ethereum ETFs

Recent analysis from SoSoValue indicates that Ethereum ETFs have grabbed the spotlight this month, with $4.04 billion being funneled into spot Ethereum funds. In comparison, Bitcoin spot ETFs recorded an outflow of $628 million in August.

The forefront of Ethereum funds is led by BlackRock’s ETHA ETF, boasting an impressive $16.88 billion in net assets as of August 28. Following closely is Grayscale’s ETHE with $4.80 billion, and Fidelity’s FETH holding $3.56 billion.

The cumulative net assets for spot Ethereum ETFs have surpassed $29.5 billion, representing about 5.5% of Ethereum’s overall market capitalization.

Meanwhile, Bitcoin ETFs are still leading in overall value with BlackRock’s IBIT holding $83.8 billion in net assets, followed by Fidelity’s FBTC at $22.45 billion and Grayscale’s GBTC at $20.01 billion.

The gap between Bitcoin and Ethereum investment products is gradually closing. With the current market dynamics, August 2025 may very well be the month when Ethereum ETFs achieve their most favorable performance against Bitcoin ETFs to date.

A key driver behind the influx into Ethereum ETFs is its rising acceptance as a viable asset for balance sheets. The corporate world’s growing adoption of Ethereum this year has been pivotal in strengthening confidence in its future role in institutional portfolios.

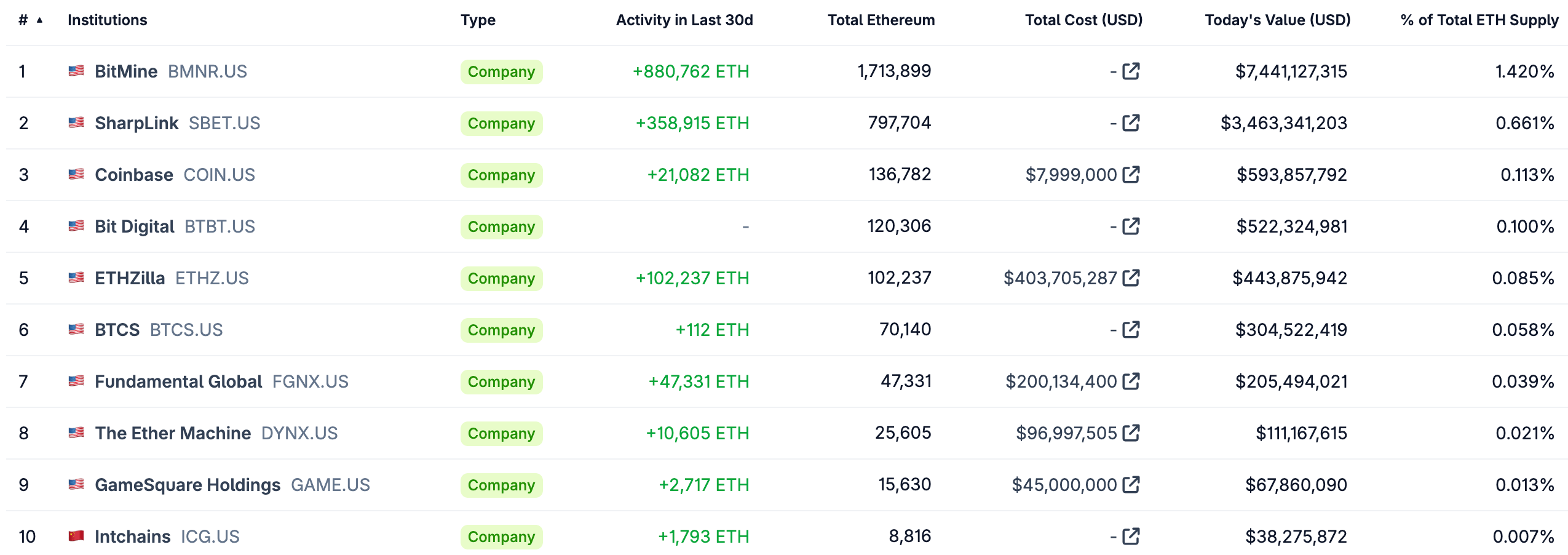

This year has seen major firms recognizing the potential of Ethereum, with SharpLink Gaming notably increasing their ETH exposure by adding another 56,533 ETH to their reserves.

Similarly, Ethereum treasury company ETHZilla has ramped up its holdings to over 102,000 ETH. Data from CoinGecko reveals that BitMine currently leads among publicly-listed companies with an impressive total of over 1.7 million ETH in reserves.

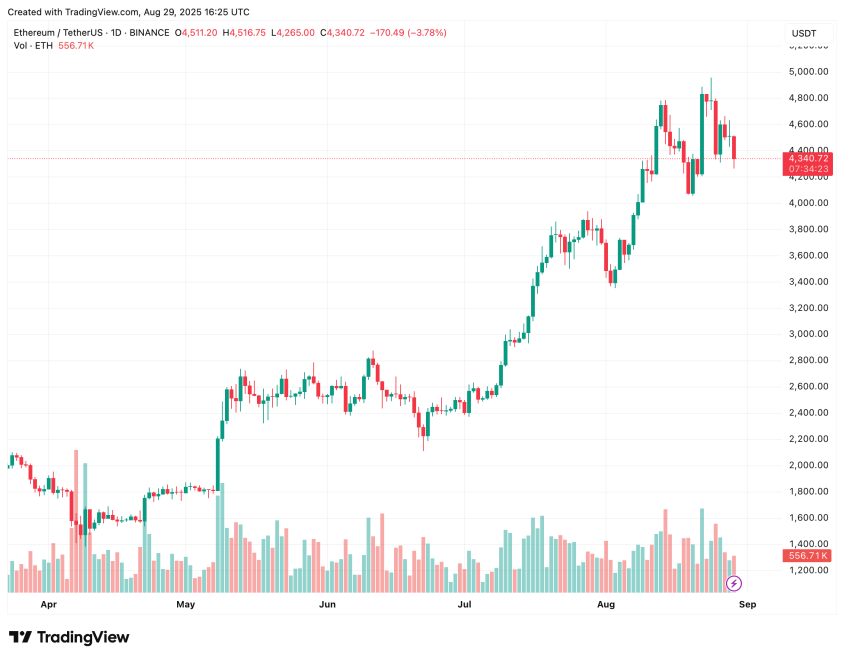

Price Predictions: Will ETH Exceed $5,000?

Institutional attitudes toward Ethereum continue to gain traction. VanEck CEO Jan van Eck has characterized ETH as “the Wall Street token,” emphasizing its expanding significance in facilitating stablecoin transactions among financial institutions.

Despite its recent inability to sustain prices near $5,000, the demand for Ethereum remains robust. This scarcity on exchanges is projected to create opportunities for rapid price increases in the near term. Currently, ETH is trading at around $4,340, reflecting a 4% decline over the last 24 hours.