Ethereum has emerged as a focal point in the cryptocurrency landscape, especially as Bitcoin struggles to surpass its historical high marks. With BTC’s recent stagnation, altcoins are finding it challenging to gain momentum, positioning Ethereum uniquely in a potential market shift. Currently trading above $4,400, ETH is less than 10% away from its all-time high, capturing investor attention.

The sentiment among bulls is optimistic, bolstered by data pointing to strengthening on-chain activity and accumulating trends. A notable decrease in exchange reserves alongside thinning liquidity on over-the-counter (OTC) desks implies that demand is surpassing supply, a scenario often preceding significant price surges.

Nonetheless, the market is navigating through a delicate phase. Bitcoin’s prolonged weakness near its peak could influence Ethereum’s trajectory and that of the broader altcoin sector. While some market analysts predict an upcoming altseason, others caution that a failure to maintain upward momentum could lead to a market correction.

Ethereum MVRV Ratio Indicates Potential Short-Term Retraction

Prominent analyst On-Chain Mind has highlighted that Ethereum’s MVRV ratio has entered the +3σ to +4σ territory. This level often signals overheated conditions, suggesting that traders may initiate profit-taking between $4,600 and $5,200, which will be a pivotal moment for ETH in the coming days.

Despite these emerging risks, Ethereum’s strength remains prominent, sitting close to its record high, and many analysts predict that a breakout could soon occur. Depending on trader behavior, consolidation phases may arise as short-term investors cash in on their gains, while other analysts see the current momentum as setting the stage for a decisive rally above earlier highs.

Further fueling Ethereum’s market confidence is the increasing institutional accumulation of ETH, viewed as both an investment and a strategic asset. Additionally, legal developments across significant markets have fostered a more predictable trading landscape, supporting long-term investment. The declining exchange supply indicates strong confidence among existing holders, reducing the likelihood of selloffs.

Should Ethereum successfully navigate resistance levels despite its current MVRV state, it may ignite a robust rally, potentially influencing the wider altcoin market. However, if profit-taking prevails, a pullback might not impede the overall bullish trend but could cultivate more sustainable growth patterns in the future.

Technical Insights: Essential Levels to Maintain

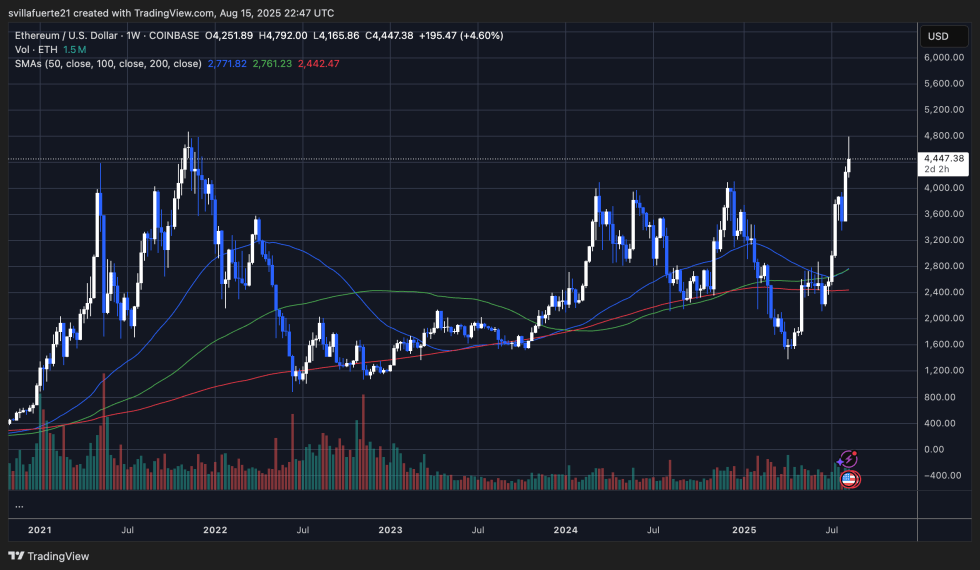

Ethereum exhibits impressive upward momentum on weekly charts, recently trading at $4,447 after approaching a peak of $4,792, which is just shy of its previous all-time high from 2021. Currently, prices are comfortably above the 50, 100, and 200-week moving averages, with the 50-week SMA ($2,771) crossing above these longer-term indicators. This pattern signals a healthy bullish trend that typically leads to extended upward price movements.

Trading volume has also significantly increased during this bullish phase, indicative of strong demand and commitment from buyers. The breakout from the $3,600–$3,800 resistance area has been met with explosive upward momentum, confirming that buyers currently dominate the market. However, Ethereum is approaching critical resistance in the $4,800–$4,900 range, where sellers may attempt to take control.

A successful weekly close above $4,800 may pave the way for new all-time highs exceeding $5,000. Conversely, if Ethereum fails to maintain its position above current levels, a healthy correction back to the $4,200–$4,000 support area, where the 50-week SMA supports the price, might be anticipated.

Featured image from Dall-E, chart from TradingView