In recent times, Ethereum has stood out from the broader cryptocurrency landscape, achieving positive gains even as the larger market struggled with declines.

In the last 24 hours, while the global cryptocurrency market dropped by 5.3%, Ethereum managed a 2.4% rise, recently trading at approximately $3,719. This price movement has captured the attention of many analysts, especially with on-chain metrics indicating shifting trader behaviors and strategies.

Influential Factors Driving Ethereum’s Price Surge

Notable cryptocurrency analyst, Amr Taha, highlighted the crucial role of recent market dynamics on Ethereum’s price trajectory. He reported that a significant breakout past the $3,700 threshold led to a liquidation of over $160 million in short positions on Binance, a major trading platform.

Following this, an earlier wave of $195 million in liquidations happened close to the $3,500 level, demonstrating a pattern of cascading short squeezes. The increased purchasing by short-sellers seeking to mitigate losses helped fuel a temporary surge in Ethereum’s price.

Furthermore, Taha pointed out a marked divergence in the actions of cryptocurrency whales. Data from the Whales Screener revealed a net inflow exceeding $300 million in Bitcoin to centralized exchanges, while over $300 million was withdrawn in stablecoins.

This juxtaposition signals a cautious sentiment among significant market players, as whales may be gearing up to offload Bitcoin while concurrently tightening liquidity for immediate buying opportunities.

Taha warned that although short squeezes can momentarily elevate prices, they are often succeeded by phases of consolidation or correction.

He identified several indicators that could suggest potential challenges in the short term: a decline in open interest post-liquidation, whale movements of BTC likely in preparation for selling, and diminishing stablecoin balances on exchanges, hinting at a slowdown of new capital entering the market. “If fresh inflows do not occur, these factors could lead to a price pullback,” Taha elaborated.

Looking Ahead: Ethereum’s Potential in 2025

In a different analysis, another contributor to CryptoQuant, known as Crypto Dan, shared a more extensive outlook on Ethereum’s future. He recognized that while the recent price uptrend might pose short-term risks of correction, market indicators suggest that any decline would be limited.

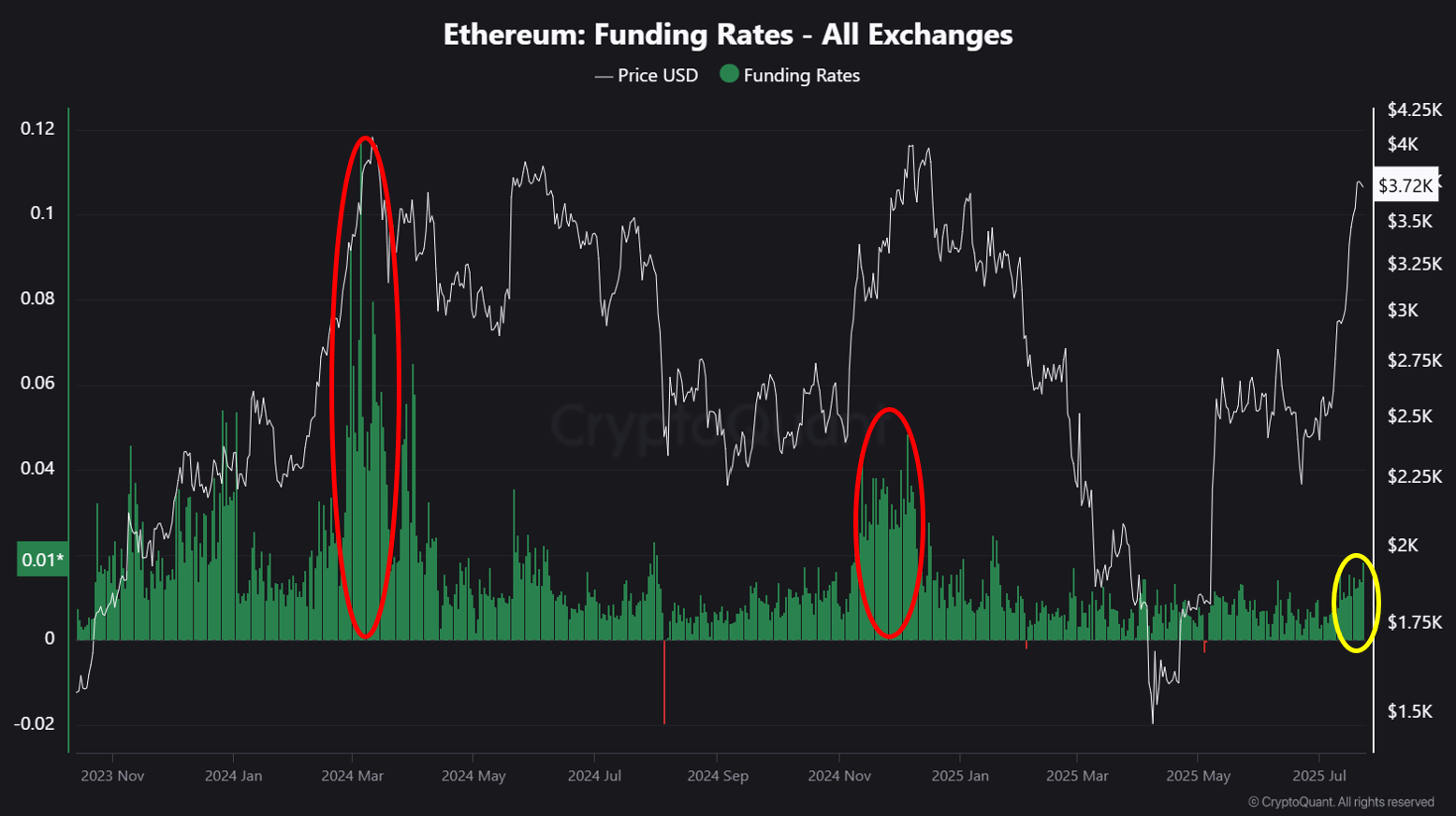

Drawing comparisons to previous periods of market overheating in March and November 2024, Dan highlighted that current leverage and trader sentiment are still relatively subdued.

He further noted that Ethereum’s past performance during this bull cycle has been restrained at times, suggesting that there is potential for further growth, particularly as 2025 progresses.

Should Ethereum continue its upward movement, Dan posited that it could act as a springboard for altcoins, considering their inclination to mirror ETH’s price shifts during bullish trends.

Image created with DALL-E; Chart illustrates data from TradingView