Investment management expert Jan van Eck, CEO of VanEck, recently asserted on Fox Business that Ethereum (ETH) is firmly establishing itself as “the token of choice on Wall Street.” His remarks coincide with ETH nearing a new peak, igniting interest from both retail and institutional stakeholders.

The Vital Role of Ethereum in Stablecoin Transactions

During a recent interview, van Eck elaborated on ETH’s current momentum, emphasizing its importance for stablecoin transactions within the banking sector. He argued that for banks to effectively utilize stablecoins, they must integrate with Ethereum’s smart contract technology.

Stablecoins, for those unfamiliar, are digital currencies backed by stable assets such as the US dollar. They provide rapid transaction capabilities combined with the reliability of conventional currencies, making them ideal for a range of applications including payments and remittances.

Historically, banks hesitated to embrace stablecoins, largely influenced by regulatory ambiguity and their connections to the more volatile aspects of the cryptocurrency landscape. However, post-development of the GENIUS Act, perspectives seem to be changing.

Regulators are now providing a more transparent operational structure for digital assets, prompting financial institutions to reconsider the role of stablecoins in their frameworks.

Jan van Eck stressed that adopting blockchain technology for stablecoin transactions is crucial for today’s banks. He views Ethereum as the front-runner among potential blockchain platforms, noting:

The key players will be those who build on these blockchains, and it is likely to be Ethereum or frameworks influenced by Ethereum’s methodologies, known as EVM.

This isn’t the first mention of Ethereum’s significance by VanEck; recent analyses by the firm suggest that Ethereum may one day overtake Bitcoin (BTC) in terms of preference for store of value, attributed to its waning issuance rates and enhanced network capabilities.

The adoption of stablecoins has surged significantly since the 2024 U.S. presidential elections, notably with Wyoming’s introduction of FRNT, setting a precedent as the first stablecoin launched by a state government.

Furthermore, projections from Treasury Secretary Scott Bessent estimate that by 2030, the stablecoin market could swell to approximately $3.7 trillion, with Citigroup predicting a sevenfold growth for the sector in the next five years.

Ethereum’s Dominance Over Bitcoin

Ethereum’s diverse functionality grants it a competitive edge against Bitcoin. While Bitcoin predominantly serves as a hedge against inflation and a store of value, Ethereum’s capabilities extend into decentralized finance (DeFi), non-fungible tokens (NFTs), and act as an essential settlement layer for digital transactions.

In light of this expanding utility, numerous enterprises are beginning to integrate ETH into their asset portfolios. A recent example is SharpLink Gaming, which increased its ETH holdings by another 56,533, pushing its total to nearly 800,000 tokens.

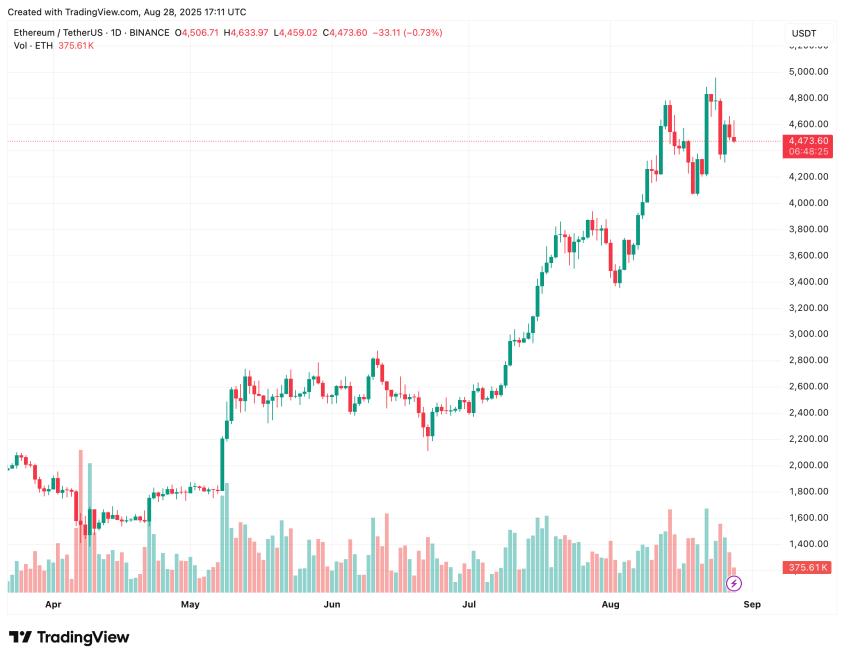

Additionally, recent data on exchange-traded funds (ETFs) indicates that ETH ETFs have outperformed their Bitcoin equivalents consistently over the past week. Currently, ETH trades at $4,473, reflecting a decline of 3.2% in the last 24 hours.