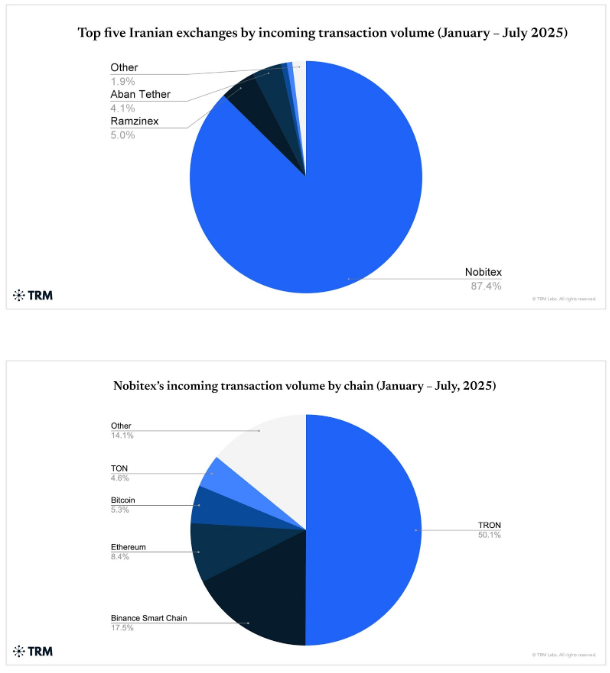

The crypto landscape in Iran saw a notable downturn during the first half of 2025, as data indicates a remarkable reduction in on-chain activity. Total inflows dropped to $3.7 billion over the initial seven months, representing a decline of 10% when compared to the previous year. The downturn became even more pronounced post-April, with June experiencing a staggering 50% decline year-on-year and July facing a dramatic 75% fall.

Significant Security Breach Erodes Confidence

A recent report from TRM Labs highlighted a major breach at Nobitex on June 18. The incident resulted in approximately $90 million being siphoned from hot wallets, with sensitive source code also being compromised, leading to some of the stolen assets being linked to addresses associated with the Islamic Revolutionary Guard Corps.

Consequently, the exchange witnessed a surge in outflows — exceeding 150% in the week leading up to increased tensions — as users sought to transfer their funds to safer locations. This breach left a deep scar on an already fragile trust among traders and investors.

Inbound Transactions Plummet as Users Secure Assets

Following the breach, Nobitex’s inbound transaction volume witnessed an alarming decrease of about 70% compared to the previous year. In a surprising turn, some previously inactive Bitcoin wallets associated with mining operations were revived and redirected funds to newly established hot wallets.

In an attempt to manage the fallout, regulators introduced restrictions on overnight trading to curb panic selling; however, many users had already begun pulling their assets abroad. There was a noticeable uptick in transfers to foreign exchanges and payment systems with less stringent identity verification processes.

Stablecoin Freezes Impact Market Liquidity

In July, Tether made waves by freezing 42 wallets associated with Iran, which significantly reduced the available stablecoin liquidity within local markets. Notably, a majority of the affected wallets were suspected to be connected to Nobitex or flagged addresses linked to the IRGC, although the exact ownership remained ambiguous.

Further complicating matters, Tether also froze $27 million in USDT related to Garantex, a cryptocurrency exchange subject to sanctions from the U.S. Treasury since 2022. This development reflects a wider trend of compliance regulations having significant repercussions on market dynamics.

Regional Conflicts Exacerbate Market Volatility

The decline in activity coincided with heightened instability in the region, following a 12-day conflict with Israel that erupted in mid-June and disrupted nuclear negotiations. A series of Israeli airstrikes, alongside internal strife, led to widespread power outages across the nation.

Mining operations faced severe interruptions, forcing traders to either relocate assets offshore or pivot towards alternative stablecoins or blockchain networks. The uncertainty in the market coupled with infrastructural challenges led many traders to explore various exit strategies to secure their investments.

New Tax Regulations Tighten Market Control

In a significant policy shift, Iran introduced the Law on Taxation concerning Speculation and Profiteering in August. This new legislation mandates capital gains taxes on cryptocurrencies, gold investments, real estate, and foreign exchange activities.

Although enforcement will be phased, government officials have indicated there will be increased scrutiny. This new taxation framework, alongside the aforementioned freezes and security breaches, has further contributed to a cautious atmosphere, leading many enterprises to reconsider their operational strategies in the crypto market.

Featured image from Getty Images, chart from TradingView