Cryptocurrency markets are currently navigating a tumultuous wave marked by increased selling pressure and significant price fluctuations, prompting experts to categorize this phase as an extensive correction. Investors are experiencing considerable losses, while those who are heavily leveraged face liquidation challenges as Bitcoin searches for stability. Interestingly, despite the prevailing downturn, there is evidence of fresh capital entering the market, indicating not all market participants are withdrawing.

According to recent data from on-chain analytics, around $5.4 billion has been funneled into the crypto ecosystem over the last month. This statistic underscores a crucial divergence: while short-term investors are booking losses, larger capital sources seem poised to take advantage of current price dislocations.

This complex landscape highlights the intricate dynamics at play. Retail traders and overleveraged individuals may be panicking; conversely, institutional players and seasoned investors are strategically accumulating assets. As Bitcoin hovers near critical support zones, the ongoing struggle between panic sellers and savvy buyers will likely shape the future direction of the market.

Market Resilience and Potential for Recovery

Reputable analyst Jordan Lee recently presented findings indicating that approximately 52,000 BTC were purchased at price points exceeding $100,000 in just the last month. Lee interprets this as an encouraging sign for the Bitcoin ecosystem, suggesting sustained demand despite the recent downturn.

Such investment patterns often reflect confidence from institutional players, who may perceive current price weakness as a lucrative opportunity rather than a threat. The influx of new capital signals enduring positivity, hinting at long-term convictions remaining strong. Historically, similar conditions during market corrections have predicated significant rebounds after selling pressure diminishes.

Furthermore, analysts are optimistic that the anticipated reopening of U.S. governmental activities could act as a stimulus for market recovery. This event is projected to enhance liquidity and diminish uncertainties surrounding fiscal policies, potentially reigniting risk appetites among investors. Together with ongoing accumulation trends, these elements could set the stage for Bitcoin to recover toward the $110K resistance zone in the near future.

Bitcoin’s Key Support Levels Under Scrutiny

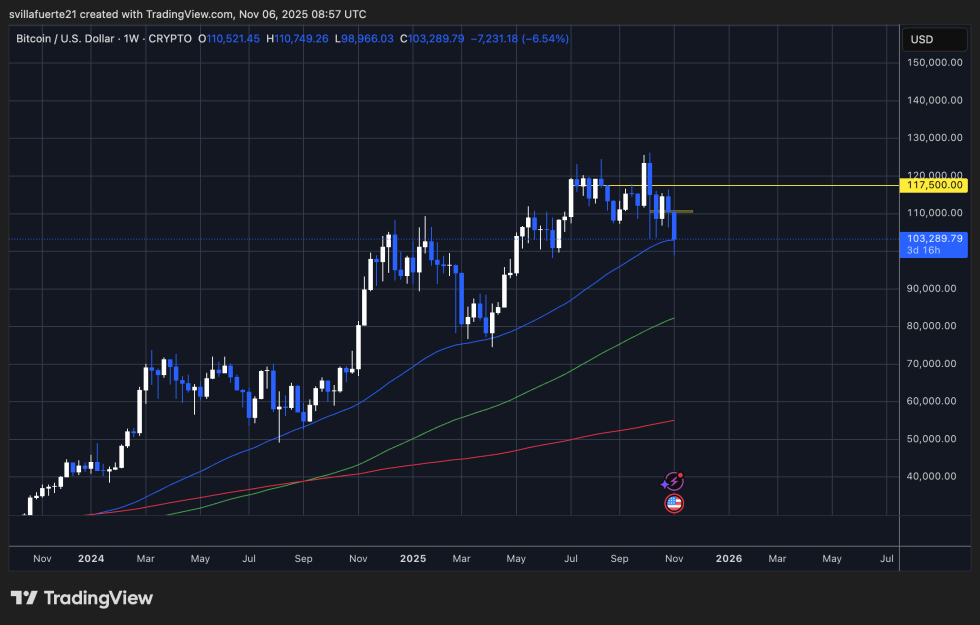

Currently, Bitcoin’s weekly performance indicates the asset is testing a significant support region following one of the year’s most severe pullbacks. After declining from $110,000 down to below $100,000, BTC is stabilizing around $103,000, just above the critical 50-week moving average—historically a pivotal level that has characterized mid-cycle adjustments.

If this support holds, it may pave the way for a potential recovery trend. On the contrary, a weekly close below the 50-week MA could heighten the likelihood of a more significant decline toward the 200-week MA at around $80,000, a level not encountered since early 2023.

The market sentiment appears to remain cautiously pessimistic in the near term. Bitcoin has struggled to maintain levels above the $117,500 resistance—a previously crucial support area—indicating a loss of bullish momentum. Confirmed volume surges during this selloff illustrate considerable liquidation occurring, particularly among short-term holders.

For sentiment to shift, Bitcoin needs to reclaim the $110,000–$112,000 range to counteract the current bearish outlook. Until this happens, the focus will remain on the ability of buyers to maintain their footing above $100,000, as this psychological barrier will likely dictate the next significant price movement.

Latest insights reflect a cautious optimism for the broader crypto landscape, encouraging a focus on long-term potentials amidst short-term trading volatility.