New Hampshire has stepped into the spotlight by approving the first municipal security in the United States that utilizes Bitcoin as its backing mechanism. This $100 million “conduit” bond represents a significant shift, relying on Bitcoin over traditional funding channels such as tax revenue or cash flows from projects. This initiative positions New Hampshire as a pioneering state in the integration of digital assets with the expansive $140 trillion global bond market.

New Hampshire Propels Bitcoin Integration in Municipal Finance

Governor Kelly Ayotte emphasized the initiative as a means to attract new investors while minimizing risk to the state’s finances. She expressed her pride in New Hampshire being the first state to adopt such an innovative approach, stating, “This historic Bitcoin-backed bond positions us as leaders in digital finance while safeguarding taxpayer funds.”

The bond adheres to a conventional conduit framework: while the Business Finance Authority (BFA) oversees the bond’s issuance, the repayment responsibility lies solely with the private borrower, thereby not affecting the state’s general revenue. What sets this bond apart is its collateral mechanism. The borrower is required to deposit approximately 160% of the bond’s value in Bitcoin, safeguarded by BitGo, a digital asset custodian. Should the value of Bitcoin decline, the framework triggers an automatic liquidation to ensure bondholder protection and maintain principal amounts.

BREAKING: New Hampshire Launches the Nation’s First Bitcoin-Backed Municipal Bond

The Granite State has just set a new precedent by approving a municipal bond backed by $BTC, potentially revolutionizing how digital assets are approached within the $140 trillion debt market.

— Eleanor Terrett (@EleanorTerrett) November 19, 2025

Expertly structured by Wave Digital Assets and Rosemawr Management, the initiative also counts BitGo and Orrick, Herrington & Sutcliffe among its partners. Les Borsai, co-founder of Wave, views this bond issuance as the dawn of a new debt market, showcasing a successful collaboration between public and private sectors to tap into the value of digital assets. Similarly, Orrick partner Orion Mountainspring noted the significance of this bond as a groundbreaking moment for decentralized currency and municipal finance.

Gains and any associated Bitcoin appreciation from this transaction will benefit a dedicated Bitcoin Economic Development Fund aimed at promoting innovation and economic growth in New Hampshire, rather than contributing to the general budget. This development aligns with the recently established Strategic Bitcoin Reserve, which permits the state treasury to allocate up to 5% of its funds into high-capital digital assets, predominantly Bitcoin given current market conditions.

Representative Keith Ammon, a pivotal figure behind New Hampshire’s Bitcoin legislation, has framed this bond as a prudent way to test Bitcoin’s viability as reliable collateral in public finance. The bond’s structured design, focused on over-collateralization and specified liquidation thresholds, aims to mitigate exposure to Bitcoin’s inherent volatility.

The future of this model hinges on investor appetite, pricing, and evaluation once the first borrower approaches the market. At this moment, New Hampshire has driven the concept of Bitcoin-backed public debt beyond theoretical discussions, establishing a functioning template for other states and entities seeking to explore similar avenues.

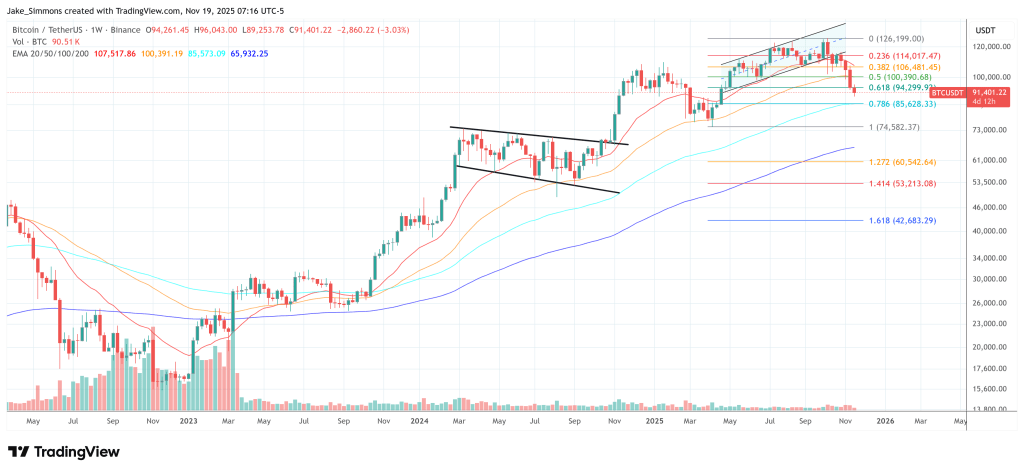

As of the latest market data, Bitcoin is trading at a price of $91,401.