Bitcoin has been navigating a period of tight range-bound trading for over two weeks, hovering just below its recent peaks. Although volatility has eased, it suggests that either a breakout to the upside or a corrective move could be on the horizon. Notably, on-chain analytics reveal an intriguing narrative beneath the surface. Data from CryptoQuant indicates that significant profit-taking has occurred among large holders throughout the past year, particularly during Bitcoin’s robust performance from 2024 and into 2025.

This trend of profit realization signifies a healthy phase in market dynamics. Not only are whales and long-term investors cashing in on their positions, but the market’s ability to absorb this selling pressure is equally crucial. Fresh demand keeps flowing into the ecosystem, thereby preventing dramatic price declines and preserving a bullish sentiment during this consolidation period. This interplay between seasoned investors securing profits and new capital entering the market indicates a solid foundation for Bitcoin’s long-term trajectory.

As the market balances supply and demand, the upcoming weeks may prove pivotal in determining Bitcoin’s next decisive move. The current tight trading range might indicate a market in transition—stable yet quietly poised for the next big price movement.

Shifting Dynamics: Whales Reduce Holdings, Institutional Interest Rises

Recent analyses by expert Axel Adler shed light on the shifting landscape of Bitcoin’s supply dynamics. Adler points out a noteworthy decrease of 502,000 BTC held by wallets containing over 1,000 BTC. This reduction highlights a significant trend—long-term holders and influential investors have been actively realizing profits during Bitcoin’s impressive rally throughout 2024.

Despite the potential for a volatile sell-side pressure stemming from these whales, the market remains resilient. Increased institutional demand has effectively counterbalanced this dynamic, ensuring stability in Bitcoin’s price. Entities such as funds and corporations have entered the space, contributing to a sustained upward trajectory throughout the year.

The accompanying chart illustrates burgeoning demand: while Bitcoin trades just shy of its all-time high of $123,000, its market structure shows no signs of slowing. Rather than experiencing a correction, Bitcoin appears to be consolidating, signaling that the bullish cycle remains intact and is entering a more developed stage. This inflow of new capital reinforces a robust supply-demand balance, setting the stage for potential future gains.

Adler emphasizes that this transition from whale dominance to institutional participation is vital for the market’s long-term viability. Should this trend persist, Bitcoin not only has the potential to revisit its historic highs but could also form a more fortified base due to broader ownership. As BTC continues to trade near its peak levels, the market seems prepared for further movement, driven more by informed investment rather than mere retail excitement.

BTC Price Dynamics: Analyzing Key Support and Resistance Levels

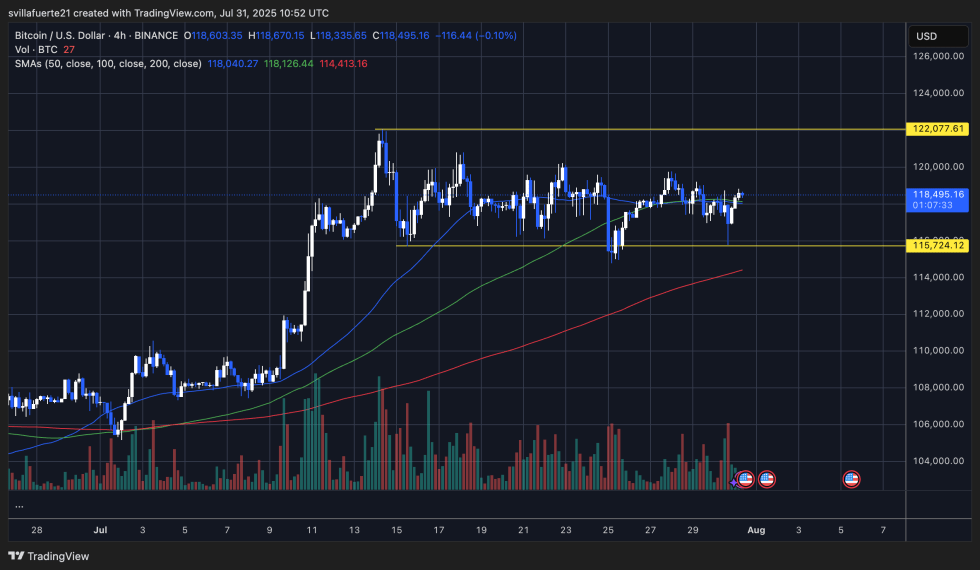

Currently, Bitcoin is trading in a narrow range between $115,724 and $122,077, as illustrated in the 4-hour chart. Price action has been stuck just below the all-time high of $123K for more than two weeks, suggesting that the market is coiling up for a significant price movement. The overall trend remains bullish, with BTC comfortably above critical moving averages: the 50 SMA ($118,040), 100 SMA ($118,126), and 200 SMA ($114,413). This convergence of moving averages indicates decreasing volatility and builds pressure for a breakout.

Trading volume has shown some signs of a resurgence, especially during a recent test of the $116K support level, indicating renewed interest from buyers. However, repeated attempts to push past the $122K resistance have met with selling pressure, implying that a strong catalyst may be needed to achieve a breakout.

The longer Bitcoin stays within this trading range, maintaining support above $115K, the more probable it is that the cryptocurrency will experience a breakout with momentum. Conversely, if bearish sentiment returns and a close happens below the 200 SMA, the market might face deeper retracement risks. Market participants should closely monitor both volume and volatility to predict the next directional move.

Featured image from Dall-E, chart from TradingView