The cryptocurrency world is buzzing with insights as reports reveal a significant revival of old Bitcoin in 2025. The numbers are staggering, prompting a deeper look into the dynamics surrounding this resurgence.

Revived Bitcoin Supply Surpasses $52 Billion in 2025

Recent findings from blockchain analyst Checkmate highlight that 2025 has been a remarkable year for the revival of dormant Bitcoin. Coins are classified as “old” when they have been inactive for five years or more, and this year, a massive influx of these coins has re-entered circulation.

Old tokens can be grouped into various categories based on their inactivity timeline. The first category includes coins that have been dormant for 5 to 7 years, reflecting the commitment of long-term holders from previous market cycles who have yet to sell.

The next group consists of coins that are 7 to 10 years old. Within this range, there is a higher likelihood that these tokens have become lost, rather than simply held. Finally, we have the oldest category, which encompasses coins that have been inactive for over a decade, representing the truly ancient supply of Bitcoin.

In the current year, the different cohorts have shown significant movements, amounting to: $22.7 billion for the youngest group, $16.2 billion for the middle group, and $13.3 billion for the oldest. In total, over $52 billion worth of old Bitcoin has emerged from dormancy this year. Below is a visual representation comparing this year’s data to previous years.

The chart illustrates that while 2024 previously held the record for total 5+ year old revived supply, 2025 is on track to potentially surpass that amount by year-end.

Interestingly, this year has already seen more 10+ year old Bitcoin come back into circulation compared to 2024. Notably, a substantial amount, totaling $9.5 billion, can be traced back to a single holder with 80,000 BTC.

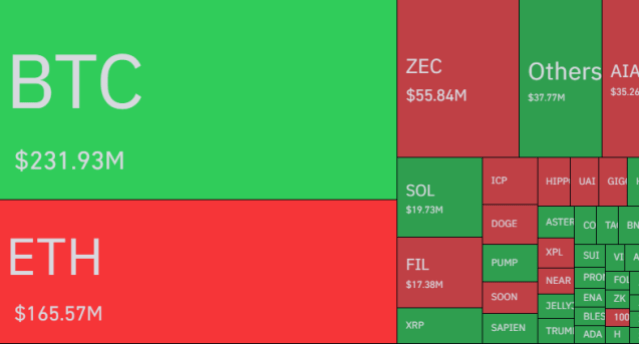

In related developments, the cryptocurrency derivatives market has faced significant liquidations due to recent volatility. According to data from CoinGlass, around $686 million in liquidations have occurred in just 24 hours.

Liquidations of long contracts have outweighed short contracts during this tumultuous period. Specifically, bullish positions resulted in $363 million in liquidations, while bearish positions accounted for $318 million.

The market has experienced fluctuations, including Bitcoin initially dipping below $100,000 before rebounding to its current value.

In terms of market liquidations, BTC contracts led the way with $231 million, while Ethereum followed with $165 million.

Current Bitcoin Price Analysis

As of now, Bitcoin is trading close to $101,500, reflecting a nearly 8% decline over the past week—a potential point of interest for traders and investors alike.