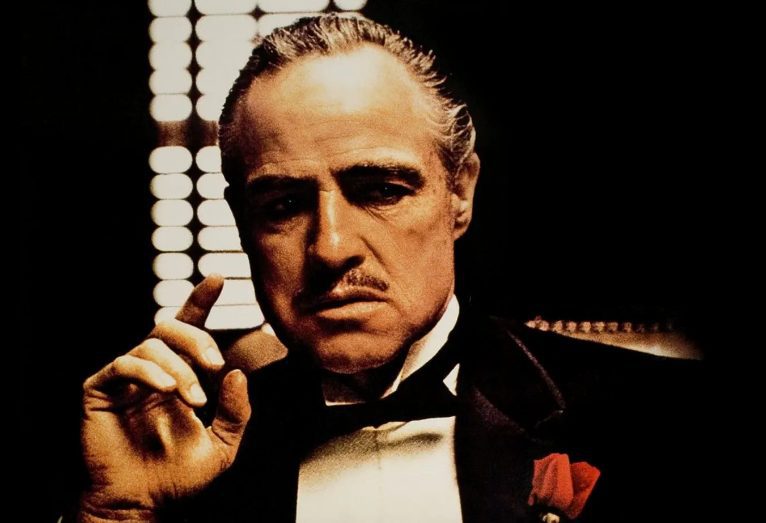

On August 4, 2025, the cryptocurrency landscape was ignited by a powerful tweet from Strategy’s chairman, Michael Saylor: “Bitcoin — An Offer You Can’t Refuse.”

This bold statement, echoing a line from The Godfather, reflects Saylor’s unwavering conviction that Bitcoin is an unparalleled asset that cannot be overlooked.

The tweet rapidly gained traction on various social media platforms, reigniting discussions about Strategy’s substantial cryptocurrency investments and Saylor’s optimistic forecasts regarding Bitcoin’s trajectory.

Massive Cryptocurrency Investments

Recent reports reveal that Strategy acquired an additional 21,021 BTC for approximately $2.46 billion, averaging around $117,256 per Bitcoin. This significant transaction has increased the firm’s total holdings to a staggering 628,791 BTC.

Currently, those Bitcoin holdings equate to about $71.4 billion, illustrating the impressive growth seen in Strategy’s portfolio. This year alone, Strategy has reported a remarkable 25% yield on its Bitcoin investments, consistent with the upward market trend.

Saylor’s aggressive buying strategy underscores his belief in Bitcoin’s long-term potential as a reliable asset.

Bitcoin — An Offer You Can’t Refuse. pic.twitter.com/XEWWt2ZTXu

— Michael Saylor (@saylor) August 4, 2025

Saylor’s eloquent metaphors often capture attention. He has described Bitcoin as “a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth.”

Such vivid language elevates Bitcoin from mere digital currency to a dynamic influence capable of transforming financial behaviors and approaches to wealth.

Corporate Cryptocurrency Accumulation

Strategy is not alone in its drive to accumulate significant Bitcoin assets. Corporations such as BlackRock’s iShares and Grayscale’s trusts are also major players in the cryptocurrency market.

Collectively, these institutions manage nearly a quarter of all Bitcoin in circulation, a dramatic shift from just a few years ago when no single entity possessed substantial holdings. Today’s corporate treasuries and investment funds are becoming leading stakeholders in cryptocurrency.

This surge of institutional interest has helped stabilize Bitcoin’s price volatility. Large investors typically remain committed during market downturns, providing liquidity that can mitigate swings caused by retail traders fleeing during uncertainty.

However, the concentration of assets within a single commodity carries potential risks. An abrupt decline in Bitcoin’s value could significantly impact Strategy’s financial position, rendering initial gains ephemeral should market sentiment shift swiftly. Yet, that’s a discussion for a different day.

Bitcoin: The Indispensable Asset

For Saylor, invoking The Godfather serves a higher purpose. He views Bitcoin’s limited supply coupled with escalating demand as an irresistible prospect—an investment opportunity that promises substantial returns.

Image credit: Paramount Pictures, chart credit: TradingView