In a recent announcement, Nasdaq-listed SharpLink Gaming revealed significant strides in its cryptocurrency investment strategy, acquiring an additional 56,553 Ethereum (ETH) during the week ending August 24. This latest investment elevates the company’s total Ethereum holdings to a staggering total of approximately $3.7 billion.

SharpLink Gaming Expands Ethereum Holdings

SharpLink Gaming’s commitment to ETH acquisition remains firm, even amidst market fluctuations. The company’s recent purchase signifies its fourth consecutive week of increasing its digital asset portfolio, demonstrating strategic foresight in the evolving crypto landscape.

Co-Chief Executive Officer Joseph Chalom commented on the company’s unwavering approach, stating that:

Our consistent execution of SharpLink’s ETH strategy showcases the robustness of our mission and the dedication of our team. As we approach the landmark of 800,000 ETH in our reserves, our commitment to enhancing shareholder value while nurturing the broader Ethereum network remains resolute.

Current Holdings and Strategy

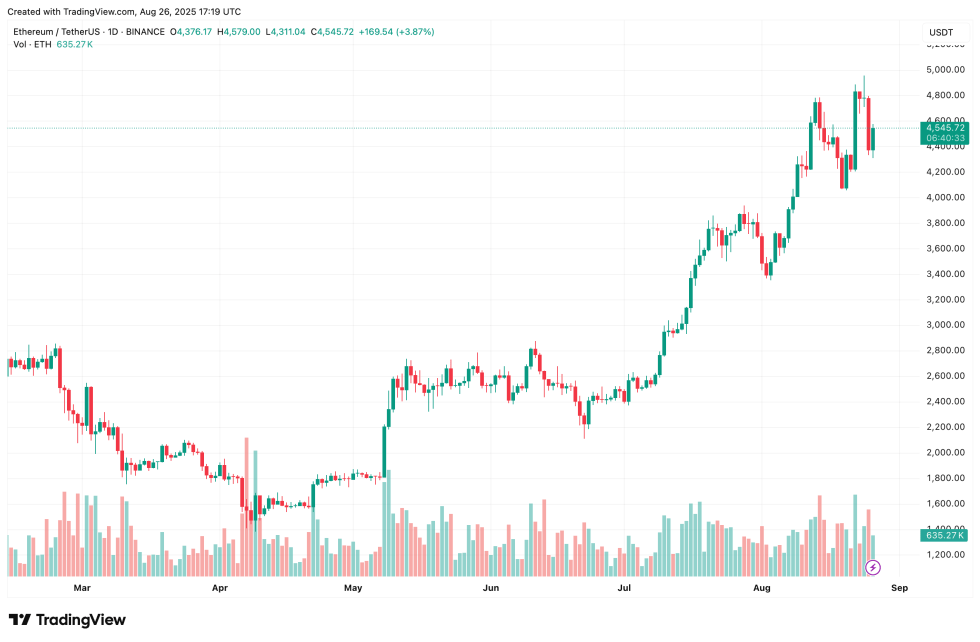

Currently, SharpLink’s ETH reserves are just shy of the 800,000 threshold, standing at 797,704 ETH. The average price per Ethereum during the most recent acquisition was recorded at $4,462. Additionally, since June, the firm has accrued an extra 1,799 ETH through staking activities.

The firm is also bolstered by approximately $200 million in cash reserves specifically allocated for future Ethereum investments. This financial buffer equips SharpLink with the agility to navigate the cryptocurrency market effectively.

Understanding the Ethereum Concentration Ratio

SharpLink Gaming has developed a unique metric known as the Ethereum concentration ratio, which has recently increased to 3.80. This metric provides valuable insights into asset density per share, offering shareholders a clear perspective on their ETH exposure overall.

As of the latest trading data, SharpLink Gaming’s shares are valued at $19.42, reflecting a 1.3% increase for the day. Impressively, over the last six months, the stock price has surged by 315%, largely driven by the company’s strategic acquisition of Ethereum.

The Future of ETH on Corporate Balance Sheets

While Bitcoin (BTC) continues to reign as the leading cryptocurrency with a market capitalization exceeding $1 trillion, there is a growing sentiment among corporations regarding the inclusion of Ethereum as a viable asset in treasury management.

A report by VanEck suggested that Ethereum could potentially establish itself as a more reliable store of value compared to Bitcoin. Additionally, ETHZilla, a treasury-focused firm, has recently announced an increase in its ETH holdings to over 102,000 units.

However, some market participants remain skeptical about ETH’s potential supremacy. For instance, during Q2 2025, Galaxy Digital made headlines by adding 4,272 BTC to its balance sheet while simultaneously decreasing its ETH holdings. As of the latest figures, Ethereum is trading at $4,545 and has witnessed a modest decrease of 0.8% in the previous 24 hours.