The latest announcement from blockchain innovator TeraWulf has captured the market’s attention, leading to a remarkable surge in its stock price. This comes after TeraWulf revealed its strategic shift towards AI infrastructure hosting, marking a significant pivot from its core focus on cryptocurrency mining.

In collaboration with Fluidstack, an AI cloud provider supported by Google, TeraWulf is setting the stage for a new revenue stream. This decision is timely, given the growing difficulties within the cryptocurrency mining sector, where competition and energy costs continue to escalate.

As TeraWulf joins the ranks of crypto ventures embracing this AI trend, like the promising SUBBD Token ($SUBBD), it highlights a broader shift towards a market projected to surpass $1 trillion by 2030.

This development illustrates the industry’s adaptability; here’s what the future might hold.

TeraWulf’s Strategic Move: Stock Surge and Google Partnership

In a bold move, TeraWulf disclosed that it had inked a groundbreaking agreement with Fluidstack, securing two 10-year high-performance colocation contracts valued at an estimated $3.7 billion.

Furthermore, the agreement includes two options for five-year extensions, which could raise the total contract value to an impressive $8.7 billion.

Under the terms, TeraWulf will dedicate over 200 MW of essential IT power capacity from its New York data center to support this endeavor. Google’s commitment to back $1.8 billion of Fluidstack’s lease obligations enhances this partnership, while the tech giant will obtain warrants for approximately 41 million shares of TeraWulf, reflecting an 8% equity stake.

The financial markets reacted enthusiastically to this news, driving TeraWulf’s stock price higher during the trading session.

On August 14, the share price notably reached $8.71, a significant rebound after languishing below $6 since early January.

The Challenges of Cryptocurrency Mining

TeraWulf’s pivot underscores the escalating hurdles associated with Bitcoin mining.

Designed with built-in mechanisms like a ‘difficulty adjustment’ and periodic ‘halvings’, the Bitcoin mining process is inherently resource-hungry and increasingly costly.

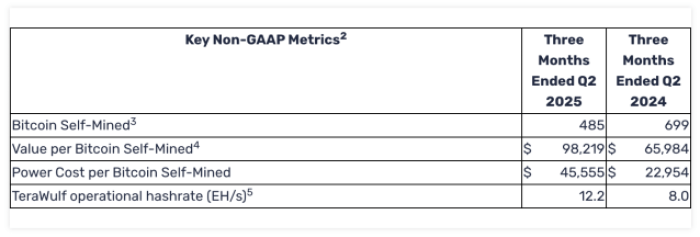

For reference, TeraWulf managed to mine just 485 BTC in Q2 2025, a drop from the 699 BTC mined in the same quarter of the previous year.

Concerningly, the cost of generating each Bitcoin surged to $45,555 in Q2 2025, markedly up from $22,954 the year before.

As mining proves to be less profitable, companies like TeraWulf are diversifying their revenue streams, hence the strategic move toward AI technology.

Artificial intelligence is not just a passing phase; it’s anticipated to become one of the most lucrative sectors in the near future. Forecasts indicate that the AI market will explode from $244.22 billion in 2025 to more than $1 trillion by 2030, achieving a compound annual growth rate (CAGR) of 26.6%.

In essence, TeraWulf is strategically aligning itself with lucrative market trends.

SUBBD: A New Player in AI Innovation

TeraWulf is not alone in this pursuit; projects like SUBBD Token ($SUBBD) are also targeting the AI landscape.

Designed for creators, this innovative platform allows users to build personalized digital influencer profiles using AI-driven content generation tools. The versatility of the SUBBD platform positions it as a strong player in the creator economy.

At the core of this platform is the $SUBBD token, which is currently in presale, and holding this token affords various benefits such as platform discounts, loyalty rewards, and access to exclusive features.

Moreover, token holders gain governance rights, enabling them to participate in key decisions such as platform upgrades and creator approvals.

As the creator economy matures, interest in tokens like $SUBBD is bound to rise. AI is identified as a primary catalyst for growth in this sector, as noted in a recent report by Grand View Research.

With a current price of $0.056175, this token offers potential for appreciation, with future values speculated to reach up to $2.50 by 2030. For those considering investment, options for passive income through staking rewards are also available.

This model promises a fixed 20% return in the first year, with additional benefits such as acquiring more tokens and special bonuses.

Explore SUBBD’s AI platform for more information.

Embracing the AI Frontier

The once-thriving world of cryptocurrency mining is evolving, with TeraWulf’s strategic shift towards AI reflecting a broader industry trend.

As profit margins shrink and operational costs soar, TeraWulf’s decision to venture into AI infrastructure hosting appears timely. Not only could this yield substantial revenue, but it also positions Google as a significant stakeholder.

Much like TeraWulf, SUBBD Token ($SUBBD) also recognizes the potential of AI-driven solutions, empowering creators to capitalize on this burgeoning field.

This article is intended for informational purposes only and does not constitute financial advice. Always conduct individual research before investing in cryptocurrency.