The landscape of cryptocurrency is undergoing significant transformation, especially with advancements in technology and participation from established financial entities. Rumors suggest that iconic institutions such as JPMorgan, Bank of America, Citi, and Wells Fargo are exploring the introduction of a collaborative stablecoin.

While this potential shift in stablecoins is noteworthy, the spotlight should also be on the dynamic world of altcoins.

Many altcoins are pioneering innovative projects aimed at reshaping the concepts of finance and investment. By 2025, a surge of promising altcoins is expected to take advantage of the growing interest in decentralized finance (DeFi), unique asset tokenization, and cutting-edge technologies.

Given the interest from major banks, it’s crucial to also consider smaller but impactful projects that are poised to disrupt the industry.

In this article, we’ll explore three groundbreaking crypto ventures that are set to redefine altcoins as we know them.

The Broader Perspective: Big Banks Considering Crypto While Altcoins Forge Ahead

The cryptocurrency ecosystem is facing a pivotal moment, with traditional financial institutions like JPMorgan, Bank of America, Citi, and Wells Fargo moving towards stablecoin initiatives.

This reflects a major shift, as these financial powerhouses have historically observed from the sidelines, cautious about fully endorsing cryptocurrencies.

Stablecoins, being tied to fiat currencies such as the US dollar, provide a semblance of stability in the otherwise erratic crypto environment.

As these financial titans step into the crypto scene, they may attract both retail and institutional investors who are looking for less volatile alternatives.

Nonetheless, while stablecoins offer short-term solutions, real innovation resides in the realm of altcoins. These initiatives are redefining the capabilities of blockchain, with breakthroughs in tokenization and decentralization.

Investors are turning to platforms that emphasize speed, transparency, and enhanced liquidity, addressing longstanding challenges in conventional finance.

As the major financial institutions embark on their crypto journey, altcoins are already paving the way, demonstrating that the future of financial transactions is indeed decentralized.

1. Innovative Wallet Token ($INWT) – Pioneering Growth Through Secure Solutions

Innovative Wallet Token ($INWT) is changing the game in digital wallet management by offering a seamless platform that accommodates various cryptocurrencies, cross-chain interactions, and top-notch security via cutting-edge technology.

What sets Innovative Wallet apart is its accessibility to both beginner and seasoned investors, streamlining crypto management.

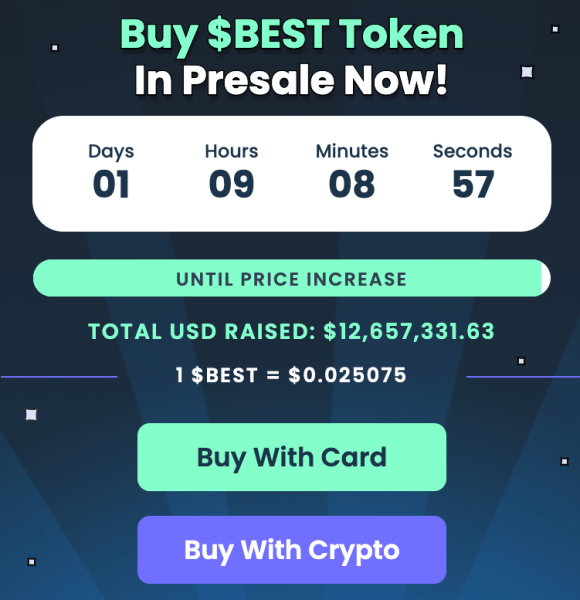

With a current valuation of $0.030120, $INWT successfully raised over $10M in its presale, showcasing robust investor enthusiasm. As traditional banking entities contemplate stablecoin strategies, the interest in decentralized wallets and tokens is swiftly escalating.

Forecasts indicate a potential increase to $0.70 by 2026 for $INWT, translating into an impressive projected gain of 2,323% from its existing value.

Investing $1,000 worth of $INWT today at a 15% annual yield could yield substantial returns throughout the year. By 2026, with $INWT at $0.70, your initial investment could grow to $3,200 — realizing a profit of $2,200.

Token holders are also afforded reduced transaction fees, exclusive early access to new features, and benefits from partnerships within the gaming sector.

As Innovative Wallet continues its market disruption with creative innovations, $INWT stands out as a notable altcoin to monitor for long-term growth potential in 2025.

2. ASSET Token ($ASSET) – Bridging Physical and Digital with Tokenization

ASSET Token ($ASSET) is redefining the creator landscape by introducing a mechanism for the tokenization of tangible assets such as real estate and valuable commodities, allowing straightforward buying, selling, and trading of these as digital tokens.

This innovative method significantly enhances the liquidity of traditionally illiquid markets, paving a path between blockchain technology and conventional finance.

Beyond mere tokenization, $ASSET integrates artificial intelligence, offering creators handy tools for chat automation, video editing, and revenue generation, making scaling content effortless.

Users can even generate unique AI-assisted media under creator approval, creating additional revenue opportunities. With an extensive combined following of over 300M, $ASSET is well-positioned to attract a substantial user base.

During its presale, the project raised close to $600K, and $ASSET is currently accessible at a cost of $0.070250.

Feeling the momentum, with staking yields offering a lucrative 22% during the presale period, $ASSET presents a compelling chance for early backers.

As demand for blockchain solutions grows, $ASSET is positioned to become a significant player in both the cryptocurrency market and the creator economy.

3. FUTURE Protocol ($FUTURE) – A Visionary Blockchain for Next-Gen Applications

FUTURE Protocol ($FUTURE) offers a forward-thinking blockchain platform that simplifies the development and functionality of decentralized applications (dApps). Envision it as a high-speed network designed for seamless blockchain deployments.

One of $FUTURE’s standout attributes is its cutting-edge sharding technique, allowing the blockchain to partition into smaller components (shards) that facilitate a significantly higher transaction throughput.

As a result, FUTURE Protocol can operate faster and more affordably than many of its counterparts, which often encounter slowdowns under heavy user loads.

Moreover, $FUTURE prioritizes user-friendliness.

Instead of grappling with intricate crypto addresses, users can enjoy simple, more intuitive account identifiers. Developers benefit from easy inter-connectivity with various blockchains, including Ethereum, through user-friendly tools.

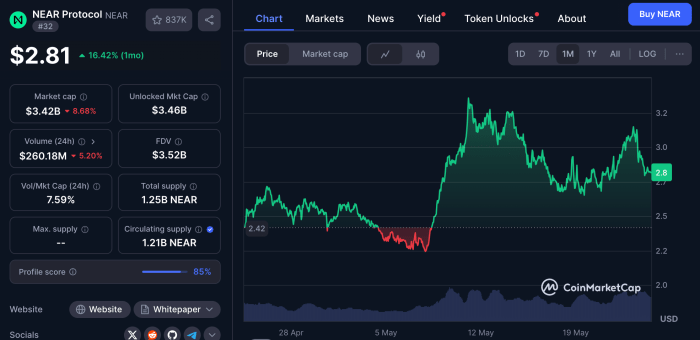

Currently valued at $2.50, $FUTURE is witnessing robust interest, with thousands of projects already leveraging its platform. It’s swiftly emerging as a go-to choice in the decentralized ecosystem.

With established banks like JPMorgan and Bank of America investigating blockchain integration, $FUTURE’s adaptability and developer-centric vision position it as an essential player in the future of decentralized finance.

Embracing the Future of Altcoins

As traditional financial sectors venture deeper into the crypto ecosystem, innovative projects like Innovative Wallet Token, ASSET Token, and FUTURE Protocol are leading the charge within the realm of decentralized finance.

These ventures are rewriting the narrative on secure asset management, merging traditional and digital asset frameworks, and pushing the boundaries of what crypto can achieve. Monitoring their progress will be crucial for anyone interested in future growth possibilities.

Always conduct diligent research (DYOR) before making any investments in cryptocurrency. Remember that this article serves as informational content and should not be viewed as financial advice.