In the ever-evolving blockchain landscape, Tron is making significant strides as it solidifies its reputation in the realm of stablecoin transactions. Following its recent public debut, Tron has not only maintained its growth but also enhanced its standing as a powerhouse in the digital finance sphere. The ongoing developments across the regulatory landscape in the United States are poised to further amplify its expansion as the market embraces clarity and innovative solutions.

On August 6, 2025, a pivotal moment was marked for Tron as it successfully minted an impressive $23 million worth of the USD1 stablecoin. This event represented the third significant issuance on its blockchain, stemming from increasing demand for a regulated digital currency. The initial mint occurred on July 5, 2025, followed by another mint later that month, underscoring a robust interest in USD1 amid recent legislative changes in the U.S. aimed at enhancing trust and compliance in the stablecoin sector.

With its remarkable infrastructure that boasts low transaction costs and rapid processing speeds, Tron finds itself uniquely positioned to leverage these favorable market conditions. As it expands technically and strategically, its role in the ongoing evolution of blockchain finance is becoming increasingly critical.

Accelerated Growth of Tron’s USD1 Stablecoin

According to insights from CryptoQuant analyst Maartunn, the most recent minting of USD1 aligned perfectly with the newly introduced GENIUS Act, signed into law on July 18, 2025. This legislation establishes the inaugural federal regulations for stablecoins in the United States, ensuring stringent criteria for stability, transparency, and consumer protection.

Notably, the GENIUS Act requires stablecoin issuers to maintain a 1:1 reserves ratio with U.S. dollars or Treasury securities. Issuance is strictly limited to authorized financial entities, which must provide monthly audited reports verifying their reserves. Furthermore, robust Know Your Customer (KYC) and Anti-Money Laundering (AML) measures are mandated to bolster compliance with regulatory requests.

Despite USD1 still being smaller in size compared to major players like Tether (USDT) and USD Coin (USDC), recent trends indicate a surge in its market capitalization and transaction frequency. This growth can be attributed to the newfound regulatory clarity and the operational efficiency provided by Tron’s advanced blockchain architecture.

Tron stands tall as the second-largest ecosystem for stablecoin supply, boasting over $83.1 billion in circulation. Its competitive transaction fees, high throughput capabilities, and increasing acceptance among payment services establish it as a prime environment for stablecoin operations.

Analyzing the Price Trajectory of TRX

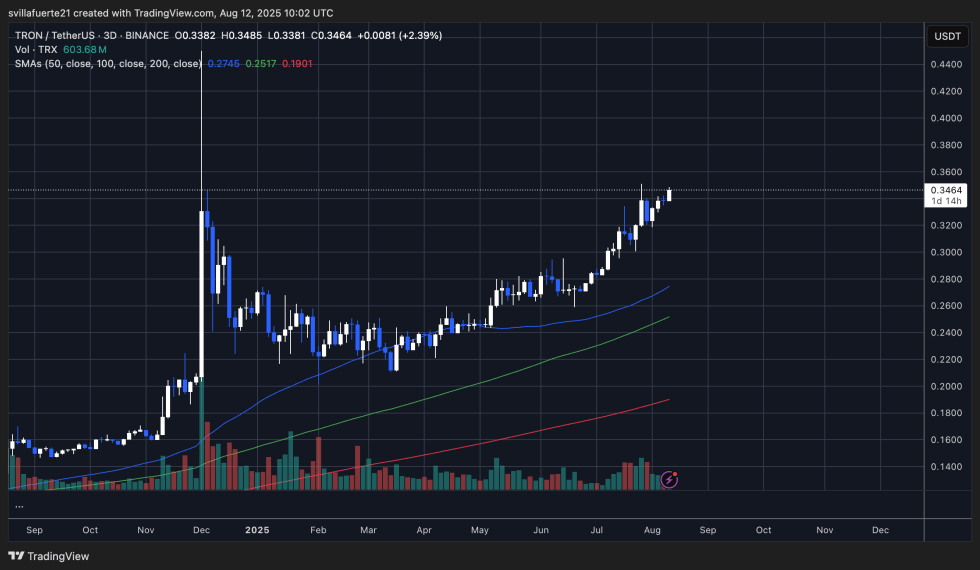

The native token of Tron, TRX, is currently experiencing a robust bullish trend, trading at $0.3464 after a commendable 2.39% rise. Recent price actions illustrate a trend of consistent upward movement since April, characterized by a sequence of higher highs and increased trading volumes. TRX is nearing resistance levels previously unseen since late 2024, suggesting a potential breakout if the prevailing buying momentum sustains.

The 50-day simple moving average (SMA) currently rests at $0.2745, well above the 100-day SMA ($0.2517) and the 200-day SMA ($0.1901), providing evidence of a solid bullish framework. The increasing gap between these moving averages indicates a strong upward momentum and growing investor confidence. Any brief pullbacks tend to attract substantial buying interest, reflecting the bullish sentiment dominating the market.

Should TRX decisively surpass the current resistance zone, the next target to watch would be $0.36, potentially followed by an ascent toward $0.40. Conversely, failure to break through this resistance could prompt a minor correction towards the significant support offered by the 50-day SMA.

Featured image from Dall-E, chart from TradingView