As the cryptocurrency market evolves, Ethereum continues to capture the attention of investors and analysts alike, notably following a significant surge that showcased its potential. Despite a recent pullback—it has risen over 80% since late June—the overall sentiment surrounding ETH remains optimistic. This enthusiasm is fueled by ongoing acquisitions from prominent figures and institutions in the financial sector.

In a recent development, a noteworthy acquisition by a notable player in the decentralized finance space has emerged. World Liberty Financial (WLFI), a burgeoning DeFi platform established in 2024 and owned by US President Donald Trump, has just invested an additional $2,010,000 into Ethereum. This move highlights their commitment amidst a trend of increasing wallet activity that signals growing confidence in Ethereum’s future prospects.

The significance of such purchases can’t be underestimated. Ethereum appears poised for growth, underpinned by strengthening fundamentals and a burgeoning interest from institutional investors. Even though market fluctuations are expected in the short term, the backing from influential investors may herald a resurgence for Ethereum as it embarks on a new phase of expansion.

Key Drivers Behind a Bullish Ethereum Outlook

Industry analyst Ted Pillows indicates that WLFI’s total Ethereum holdings have reached an impressive $281 million. This significant increase reflects the pattern of escalating institutional engagement with ETH, suggesting continued growth in this area may be on the horizon. Pillows emphasizes that the persistent accumulation by giants like WLFI reinforces a structurally bullish outlook on the asset.

Moreover, recent legislative advancements within the US are creating a more favorable regulatory environment for Ethereum. The passage of the GENIUS Act and the Clarity Act signifies a watershed moment, aiming to enhance legal frameworks for decentralized finance and cryptocurrencies. Such developments offer the potential for increased adoption and significant capital inflows into the crypto ecosystem.

In addition to the regulatory landscape, the current macroeconomic conditions are proving supportive. The anxiety surrounding recession risks is subsiding, and stock indices like the S&P 500 and Nasdaq are witnessing record highs. This optimistic turn is fostering a risk-on sentiment, encouraging both institutional and retail investors to reconsider their positions in Ethereum and other cryptocurrencies.

Ethereum Price Dynamics: Navigating Market Corrections

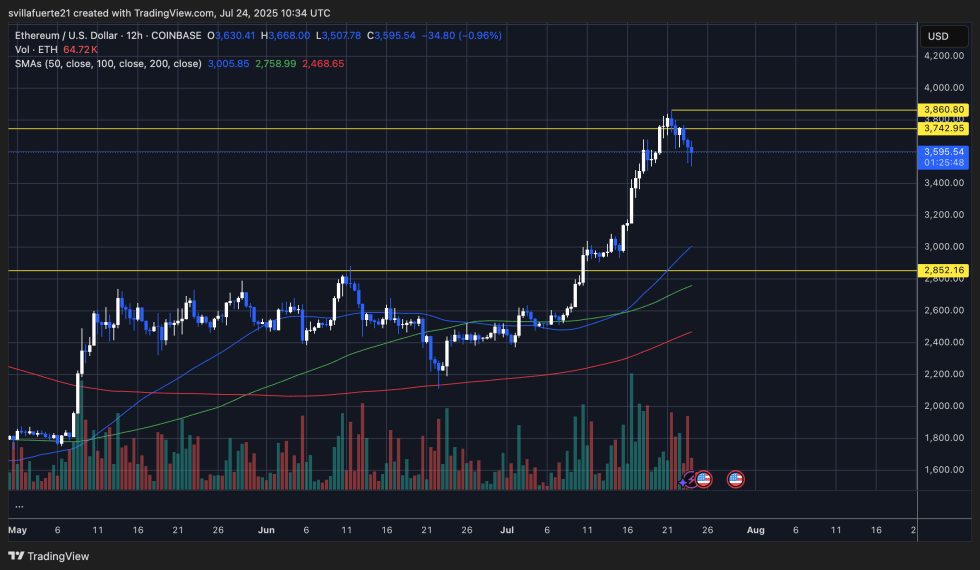

At present, Ethereum (ETH) is trading near $3,595 after facing resistance around the $3,860 level, as indicated in the latest 12-hour chart analysis. Having reached a peak just beneath $3,900, ETH has entered a correction phase. However, the broader trajectory remains positive, with critical moving averages (50 SMA at $3,005, 100 SMA at $2,759, and 200 SMA at $2,469) all trending upward—substantially below the current trading range.

Previously strong support at the $3,742 level has now shifted to a pivotal point in this consolidation phase. Ethereum is currently seeking to stabilize within the range of $3,750 to $3,500, with bulls needing to maintain momentum to fend off a deeper correction. If this level fails to hold its ground, the next significant support appears at approximately $3,000, which previously acted as a barrier during the earlier consolidation phase.

Trading volume has slightly decreased post-breakout, which suggests a momentary cooldown is occurring. Nevertheless, as long as ETH remains above the robust support at the $3,000 mark, it preserves its upward momentum. A breakthrough beyond $3,860 could initiate a new rally towards the $4,000 milestone, while a decline below $3,500 may necessitate a retest of the $3,000 to $3,200 demand zone.

Featured imagery sourced from Dall-E, chart insights derived from TradingView.