Ethereum has made headlines by reaching an impressive peak of $4,330, a milestone unseen since late 2021. This resurgence not only solidifies Ethereum’s leading role in the cryptocurrency arena but also reinstates its co-founder, Vitalik Buterin, as a billionaire, given that his publicly accessible wallets now exceed a valuation of one billion dollars.

Since April of this year, Ethereum has skyrocketed with more than 200% returns—remarkably outpacing many other cryptocurrencies—which has reignited bullish sentiment in the market. Market analysts credit this upward trend to robust fundamentals, including soaring adoption rates in decentralized finance (DeFi), the rapid expansion of layer-2 scaling technologies, and increased interest from institutional investors.

The current price surge coincides with a notable decrease in available supply, as exchange balances have plummeted to their lowest levels in years. This trend indicates that long-term investors and institutions are aggressively acquiring ETH, which is further supported by on-chain data highlighting sustained network activities and diverse use cases, strengthening the optimistic outlook for Ethereum.

Many experts in the crypto space are optimistic that Ethereum is on the verge of further price appreciation, potentially revisiting its all-time highs in the foreseeable future. With ongoing ecosystem developments and clearer regulatory frameworks, ETH seems well-positioned to be at the forefront of the impending cryptocurrency growth surge.

Buterin’s Holdings Boosted as Ethereum Gains Traction

Insights from blockchain analytics provider Arkham Intelligence reveal that Buterin possesses around 240,000 ETH, along with several other cryptocurrencies such as MOODENG and DINU. As of now, the market value of his Ethereum holdings approaches the billion-dollar mark, further entrenching his status as one of the richest individuals in the crypto sector.

The recent increase in ETH’s price follows a series of erratic movements earlier this year, during which some investors questioned the sustainability of the gains. However, the recent breakout above $4,300 indicates a strong momentum shift. Notably, institutional adoption has accelerated, with companies like Sharplink Gaming including Ethereum in their asset portfolios. This change points to a larger trend where ETH is viewed as a solid long-term asset rather than merely a speculative one.

As on-chain analytics continue to show healthy network behavior, the supply-demand dynamics appear favorable for ongoing price increases. With institutions and individual investors persistently acquiring Ethereum, the bullish narrative remains strong—mirroring Vitalik Buterin’s substantial financial stake in the crypto landscape.

Ethereum Price Insight: Major Breakthrough to New Highs

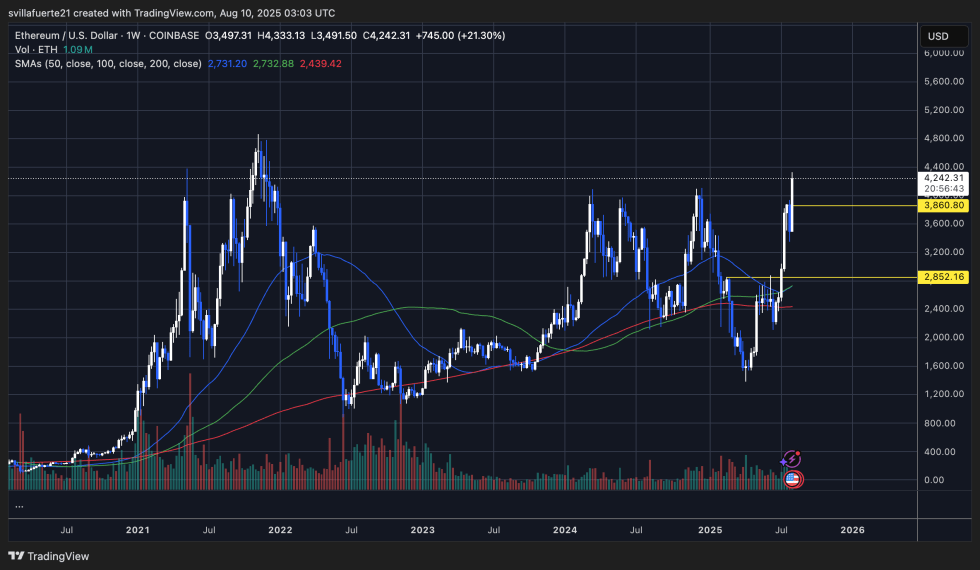

Ethereum (ETH) has recently surged to $4,242, marking a breakthrough reminiscent of its peak in November 2021. This significant uptick confirms a critical breakout on the weekly chart, and within the last week alone, ETH has gained over 21%, decisively overcoming the $3,860 resistance level which previously hindered its advance.

The breakout is bolstered by increasing trading volumes, indicating strong buying enthusiasm. Presently, ETH trades above its 50-, 100-, and 200-week moving averages—all of which show an upward trend—an established pattern reflecting a solid bullish trajectory.

Should this trend persist, targets around the $4,800–$4,900 range loom as the next significant milestones, aligning with previous all-time highs. Nevertheless, following such a sharp ascent, a phase of short-term consolidation could ensue, making the $3,860 level a pivotal support benchmark. In the event of a more profound market correction, a retracement to around $2,852 may be conceivable, although such a scenario would likely necessitate broader market factors at play.

Featured image from Dall-E, chart from TradingView