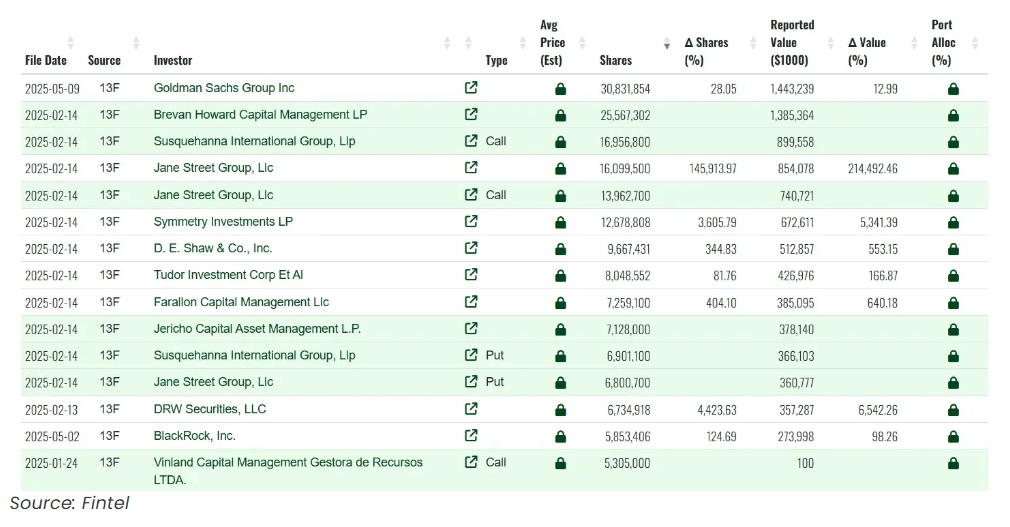

Goldman Sachs has expanded its investment in Bitcoin ETFs by acquiring nearly 6 million more shares in BlackRock’s iShares Bitcoin Trust. According to the bank’s latest submission to the US Securities and Exchange Commission, its ownership has risen to almost 31 million shares from the previous 24 million.

This considerable stake is estimated to be worth over $1.4 billion, positioning Goldman as the largest institutional holder of IBIT to date, as noted by MacroScope, a financial analyst.

Goldman Sachs Expands Bitcoin ETF Position

Goldman’s 30.8 million IBIT shares, outlined in the SEC filing, reflect a 28% increase from its previous 24 million shares. At the current market valuation, this investment is valued at more than $1.4 billion.

MacroScope was first to draw attention to this development. In comparison, rival hedge fund Brevan Howard holds just over 25 million shares, which is also valued at nearly $1.4 billion.

Goldman Shifts Focus to BTC

As of last December, Goldman had options on IBIT consisting of call and put options, with approximately $157 million in calls and over $527 million in puts, alongside $84 million in puts on Fidelity’s FBTC.

These hedges appear to have expired and are not detailed in the current filing, suggesting that Goldman may be making a strategic shift towards a more straightforward investment in Bitcoin’s market performance.

JUST IN: Goldman Sachs has just reported owning $1.65 BILLION $BTC through Bitcoin ETFs— [@MacroScope17] pic.twitter.com/do4VBuhntN

— Bitcoin Archive (@BTC_Archive) May 9, 2025

IBIT Dominates ETFs with $63 Billion

As per Farside Investors data, BlackRock’s iShares Bitcoin Trust has surged to nearly $63 billion in assets under management. Since its launch, it has garnered approximately $44 billion in net inflows. Just this week, it received an additional $674 million. On Friday, the shares of IBIT climbed by $1.04 to a closing value of $58.66, coinciding with Bitcoin’s recovery exceeding $60,000.

Wall Street Players Join In

Goldman is not alone in this venture. Other influential firms such as Jane Street, D.E. Shaw, and Symmetry Investments also hold considerable IBIT shares. Additionally, Goldman has reported $1.2 billion in IBIT and $288 million in FBTC as of its February filing.

This transaction signals that large trading platforms and hedge funds prefer investing in Bitcoin through regulated ETFs rather than futures or unregulated trading platforms.

The increase in Goldman Sachs’ ETF holdings reflects a rising trust in Bitcoin as a viable component of standard investment portfolios. With over $60 billion in IBIT alone, it’s clear that spot Bitcoin ETFs are gaining traction among institutional investors.

It will be interesting to see if other major banks emulate this trend and how it impacts Bitcoin’s market price in the upcoming months.

Featured image from Unsplash, chart from TradingView