The world of cryptocurrency continues to evolve, and few figures exemplify this transformation as vividly as Michael Saylor, founder of Strategy. His strategic investment in Bitcoin has significantly impacted both his personal wealth and the broader perception of digital currencies.

As the adoption of Bitcoin Hyper ($HYPER) gains traction, the promise of enhanced transaction efficiency and cost-effectiveness is capturing widespread interest among investors.

Michael Saylor’s Strategic Bitcoin Investments

Currently, Michael Saylor boasts a position among the wealthiest individuals globally, with a net worth exceeding $7 billion. His financial strategy includes a substantial portion in Bitcoin, solidifying his stature within the cryptocurrency community.

In recent years, particularly during 2025, Saylor’s net worth saw remarkable growth, attributed largely to his concerted efforts to accumulate over 600,000 Bitcoins. This strategic accumulation not only benefited his fortune but also underscored Bitcoin’s viability as a long-term investment.

In a notable announcement, Saylor revealed owning 17,732 Bitcoins, purchased at an average price below $10,000 each. This revelation sparked extensive discussions about Bitcoin’s investment potential.

Despite the upward trajectory of Saylor’s net worth, it’s essential to highlight that not all assets are accounted for in traditional wealth assessments. His substantial holdings in Bitcoin, while influential, remain difficult to verify, potentially adding billions more to his wealth statement.

Influencing Bitcoin’s Mainstream Acceptance

Saylor’s bold moves have sparked a ripple effect within the investment community, leading to increased institutional interest in Bitcoin. His approach has exemplified how strategic Bitcoin acquisition can yield significant returns, thereby instilling confidence in the asset among traditional investors.

According to recent data on volatility trends, 2025 has been pivotal for Bitcoin, showcasing substantial growth and resilience. This period saw Saylor’s company acquiring tens of thousands of Bitcoins, further solidifying his influence on the market.

This aggressive acquisition strategy has not only raised awareness but has also prompted governmental bodies, like El Salvador, to invest in Bitcoin, showcasing the burgeoning acceptance at a national level.

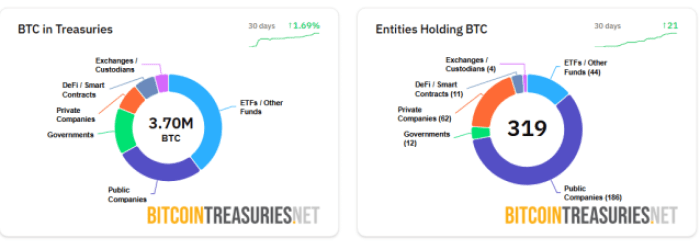

Currently, numerous organizations are accumulating Bitcoin, heralding a new era of corporate participation within the crypto space. It is projected that as institutional holdings grow, Bitcoin’s volatility will diminish, leading to a more robust market.

This evolutionary phase, characterized by growing faith in Bitcoin, aligns perfectly with innovations like Bitcoin Hyper, which aim to elevate Bitcoin’s scalability and transaction efficiency dramatically.

The Future with Bitcoin Hyper ($HYPER)

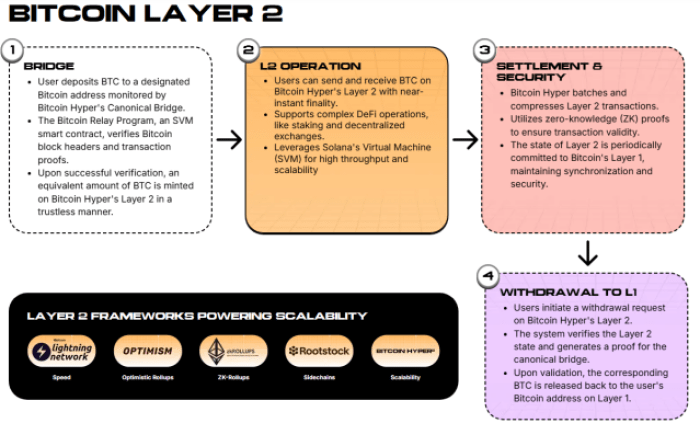

Among the significant advancements is Bitcoin Hyper ($HYPER), spotlighted as a transformative Layer 2 upgrade designed to optimize Bitcoin’s transaction capabilities.

Presently, Bitcoin’s transaction speed is limited, creating a bottleneck for its potential use in high-volume sectors. With payment processors like Visa boasting speeds of up to 65,000 transactions per second, there is pressing demand for technological advancements in Bitcoin’s architecture.

Bitcoin Hyper seeks to enhance these capabilities through its innovative Canonical Bridge, which connects Bitcoin’s primary blockchain with a high-speed processing layer, streamlining transaction execution.

By facilitating the minting of wrapped BTC tokens for rapid transactions, Bitcoin Hyper positions itself as a core solution for DeFi applications and large-scale use. This dual-layer functionality promises to make Bitcoin a serious contender for institutional adoption.

As the presale gains momentum, attracting significant investment, prognostications suggest exponential growth potential for $HYPER in the coming years.

Michael Saylor’s Vision for Bitcoin

The ongoing endeavors led by Saylor aim to transform Bitcoin from a speculative asset to a cornerstone of the global financial ecosystem. If the trajectory of institutional investment continues, Bitcoin may redefine financial landscapes.

With the integration of technologies like Bitcoin Hyper ($HYPER), the potential for Bitcoin to reach unprecedented heights becomes more tangible.

Investors are encouraged to explore and educate themselves about this dynamic market. Conducting personal research is vital for anyone looking to enter the cryptocurrency realm wisely.

Authored by Alex Johnson, Crypto Insights –