Ethereum, a staple in the cryptocurrency world, is witnessing a resurgence in investor interest, even as its price grapples with resistance levels. A notable increase in accumulation by significant investors hints at an underlying bullish sentiment amid the price fluctuations.

Navigating Ethereum’s Price Stagnation

While Ethereum’s price may be showcasing a lack of momentum, the underlying investor dynamics tell a different story. Increased participation in the market is particularly evident, with a marked uptick in Ethereum holders during these tumultuous times.

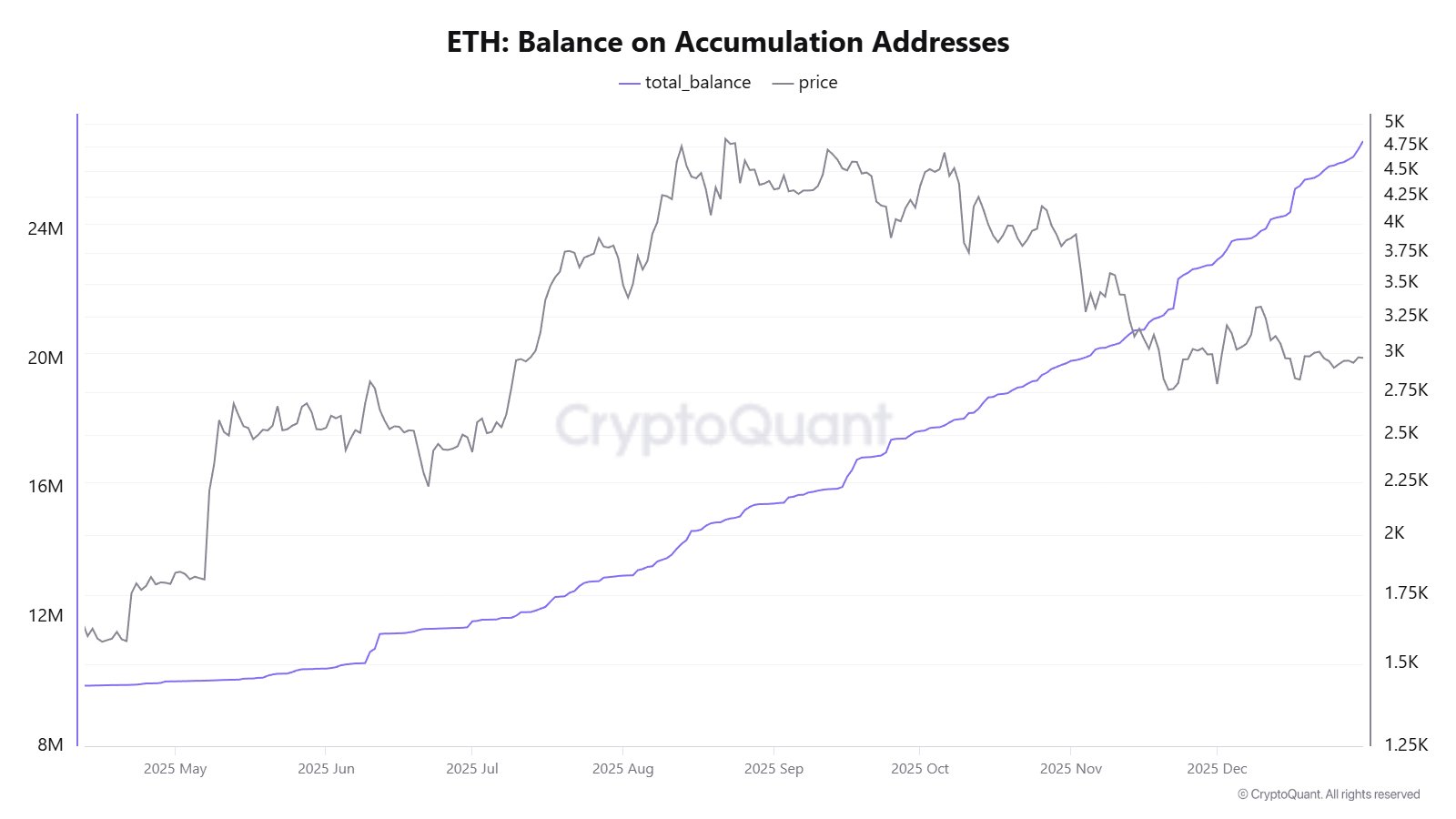

According to recent analyses, there has been a discernible rise in accumulation wallets, which suggests that seasoned investors are adopting a long-term strategy. This behavior typically correlates with an optimistic outlook, indicating that investors are holding firm despite the market’s unpredictable nature.

Particularly since Ethereum reached a pivotal price point of around $2,800, accumulation trends have drastically changed, culminating in an increase of approximately 5.2 million ETH in the hands of dedicated holders. Cumulatively, this has pushed the total ETH held by these addresses well past 27 million.

As Ethereum’s price experienced a downward trend, significant buying activity from large-scale investors, often referred to as “whales,” intensified. Their combined holdings have surged to approximately 26.78 million ETH, showcasing a vital signal that confidence in Ethereum’s future remains robust.

This buying wave is not an isolated phenomenon; it is reflected across the cryptocurrency landscape, with similar trends observed in other leading assets like Bitcoin. Experts maintain that this accumulation phase is a positive indicator for the overall market trajectory, reinforcing the notion that bullish conditions may still prevail.

Prominent Investors Strengthen Their Positions in ETH

Recent studies reveal that large investors are increasingly turning their attention back to Ethereum. Insights from Milk Road, a respected market analyst, illustrate a significant trend where major wallet addresses are bolstering their Ethereum holdings.

The research focuses on wallets containing between 10,000 ETH and 100,000 ETH. Observations indicate that there has been an exponential rise in their holdings recently, suggesting that these strategic players are preparing for potential market shifts, even amidst a lack of short-term price progress.

The data also indicates that after enduring a prolonged period of decline, the largest Ethereum wallets are gaining momentum and approaching historical highs once more. This trend could signify a pivotal moment; should this accumulation persist, it could serve as a precursor to Ethereum’s next substantial price movement.