In a significant legal development, a federal judge in New York has mandated that Eddy Alexandre, the creator of the now-closed cryptocurrency platform EminiFX, must return $228 million to compensate investors for orchestrating a fraudulent Ponzi scheme affecting thousands.

EminiFX Founder Ordered to Repay Investors

As highlighted in a court document dated August 19, US District Judge Valerie Caproni has directed both Alexandre and EminiFX to collectively pay a substantial total of $228 million in restitution, in addition to $15 million in disgorgement fees. The court statement contained the following:

The defendants Alexandre and EminiFX are jointly responsible for restitution totaling $228,576,962, with Alexandre facing an additional $15,049,500 in disgorgement obligations.

This summary judgment was achieved by the US Commodity Futures Trading Commission (CFTC) after more than three years of legal proceedings, with Alexandre previously pleading guilty to charges of commodities fraud in a different criminal case from 2023.

For context, EminiFX launched in 2021 and reportedly raised over $262 million in less than a year, appealing to over 25,000 investors eager for enticing returns.

The platform boasted a promise of weekly returns ranging from 5% to 9.99% through its so-called “Robo-Advisor Assisted Account,” which purportedly utilized automated strategies for trading across crypto and forex markets.

Documentary evidence uncovers that EminiFX incurred net losses exceeding $49 million. Additionally, it was revealed that the trading technologies advertised to investors were never implemented. Investigations indicated that Alexandre misappropriated at least $15 million for personal expenses, including luxury vehicles, credit card balances, and cash withdrawals, while payouts to earlier investors were funded by new participants—an archetypal characteristic of Ponzi schemes.

Judge Caproni’s ruling conclusively wraps up the EminiFX case, stipulating that Alexandre must fulfill the $228 million restitution requirement. Any payments towards this restitution will also count against his disgorgement obligations.

The Ongoing Battle Against Crypto Scams

The persistence of scams and fraudulent activities continues to undermine the credibility of the cryptocurrency sector, despite growing regulatory frameworks and stringent security protocols. Recently, an individual from Wellington, New Zealand, was apprehended in connection with a staggering $265 million crypto scam.

Moreover, a Brazilian court made headlines by sentencing the orchestrator of a Ponzi scheme to 128 years behind bars for promising investors guaranteed monthly returns of 8%.

A recent report revealed that the crypto landscape faced a staggering loss of $3.1 billion due to hacks in the first half of 2025—an alarming 100% increase relative to a year prior.

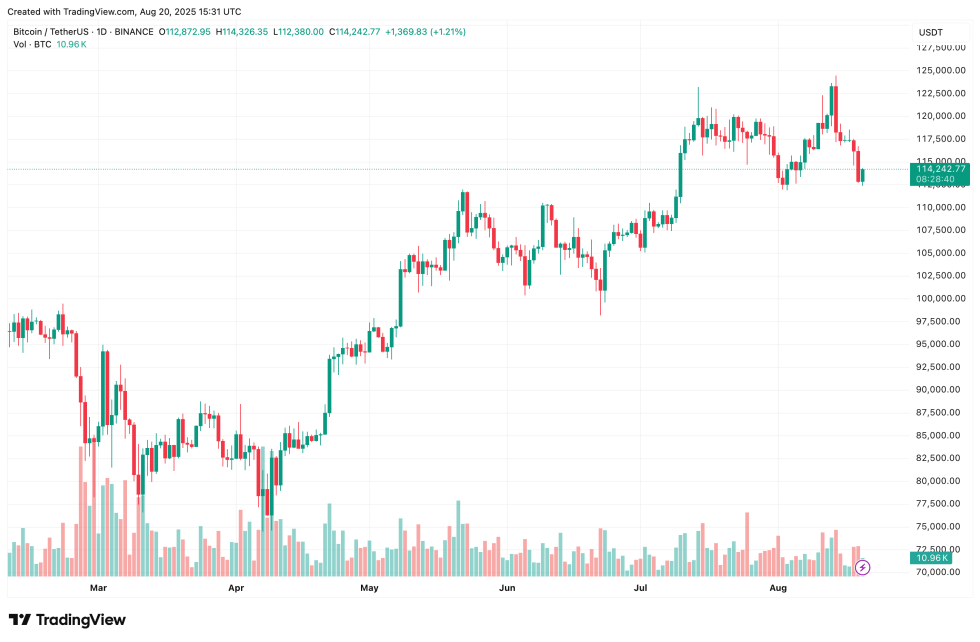

In another turning point, federal prosecutors in Nevada indicted a Las Vegas entrepreneur for their involvement in a multimillion-dollar orchestrated crypto fraud earlier this year. As of the latest data, Bitcoin (BTC) is trading at $114,242, reflecting a modest 0.2% increase over the past day.