In the dynamic sphere of blockchain technology, Ondo Finance has emerged as a pivotal player in the realm of tokenization, specifically focusing on Real World Assets (RWA). Since the debut of its token in January 2024, Ondo Finance has experienced remarkable growth, actively bridging the gap between decentralized finance (DeFi) and traditional finance (TradFi).

The project achieved a significant milestone recently, as it was officially recognized by the White House in a detailed report from the President’s Working Group on Digital Asset Markets. This report emphasized the integral roles of tokenized securities and stablecoins, positioning Ondo Finance as a key contributor to this evolution in the financial landscape.

This acknowledgment not only validates Ondo’s endeavors but also highlights the increasing importance of RWA tokenization within institutional and regulatory discussions. With a focus on equity tokenization facilitated by the innovative Ondo Chain and its flagship tokenized US Treasury offering, the project has garnered notable attention from both individual and institutional investors. As policies and technological advancements converge, Ondo Finance serves as a crucial link between traditional markets and a decentralized future, indicating promising prospects for the entire tokenization movement.

Recognition from the White House

The recent report outlined by the President’s Working Group provides a critical analysis of how tokenization is reshaping the economy. It cites Ondo Finance as a primary example of effective tokenized systems, underscoring the potential for over $600 billion in RWAs to be tokenized by 2030. This includes a diverse array of assets like money market fund shares, fixed-income instruments, and private credit.

The report identifies two predominant strategies employed by firms in the tokenization realm: the creation of private, permissioned blockchains or the utilization of permissioned layers atop public, permissionless networks. Ondo Finance stands out with a hybrid strategy that combines public infrastructure with stringent compliance measures, illustrated in the report’s comprehensive charts detailing the tokenization process.

Importantly, the regulatory categorization of tokenized assets hinges on the characteristics of the underlying asset, rather than the tokenization method itself. This means that many tokenized securities, such as fixed income and private credit, fall under existing securities regulations. The report also draws attention to the increasing emergence of tokenized commodities and unique assets, such as real estate and collectibles, expanding the landscape of what can be digitized.

Ondo Finance’s inclusion in this official report signifies a growing consensus around tokenized finance within both the mainstream and regulatory realms. With its US Treasury-backed products and the advent of tokenized equities via the Ondo Chain, the project is well-positioned to influence the evolving digital financial ecosystem significantly.

Current Market Trends: Analyzing Price Movements

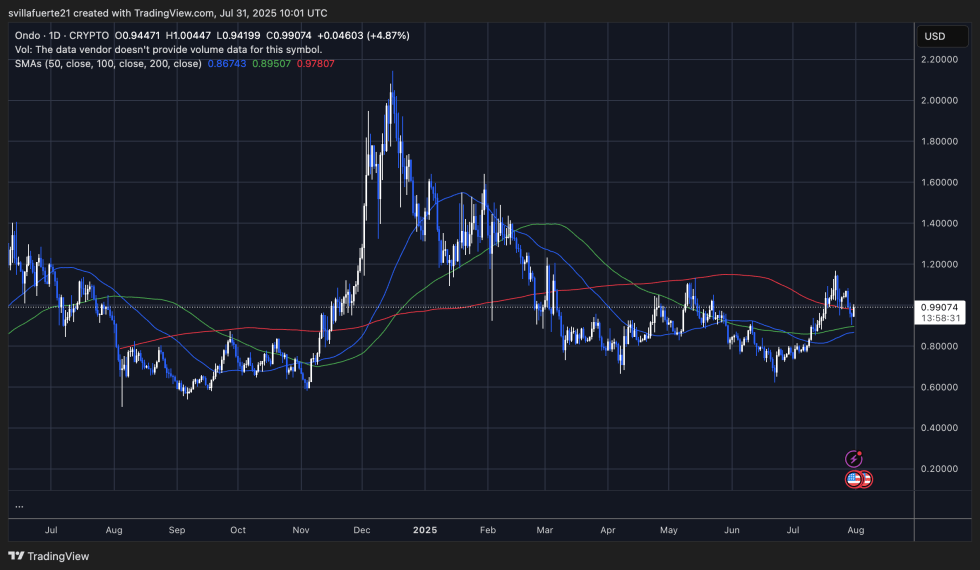

Recently, the price of ONDO has seen a resurgence, reclaiming the $0.99 mark after a period of fluctuations, hence reflecting an almost 5% daily increase. This recovery follows a previous test of the 50-day moving average (MA) at approximately $0.86, identified as a crucial support level and a psychological barrier for investors.

However, ONDO is still navigating challenges as it remains beneath the critical 200-day MA at $0.97, which now functions as a key resistance level. The token previously surpassed this threshold during a bullish rally, peaking above $1.20, only to face profit-taking from traders, which hindered its continued ascent. A stable close above the 200-day MA may reaffirm bullish sentiment and could pave the way for a return towards the $1.20 resistance zone.

The market structure indicates an ongoing recovery from the extended downtrend that commenced in January 2025. If ONDO can maintain its position above $0.95 and target $1.05, it might establish a new higher low and signify the continuation of an upward trend. Conversely, if the price slips below the 50-day MA again, it could indicate a deeper correction, potentially revisiting support zones around $0.85 or $0.78.

Images sourced from Dall-E, charts provided via TradingView.