As of late July, Bitcoin has showcased an impressive recovery, surging over 20% since the end of June and approaching a remarkable peak of $123,000. Currently, it appears to be navigating a consolidation phase, maintaining resilience above the critical $117,000 level. This stabilization comes as the market takes a breather following its recent gains. While the immediate momentum may have tapered off, interest from institutional investors remains robust, and significant on-chain indicators point towards potential upward movement in the months to come.

Moreover, speculative interest has heightened following recent transactions observed by blockchain analytics provider Arkham, which disclosed that SpaceX executed a Bitcoin transfer after a three-year hiatus. The motivations behind this transaction are debated, with potential implications regarding custody strategies or indicators of intensified institutional engagement stirring conversations within the crypto space.

The interplay of technical indicators, rising corporate involvement, and heightened mainstream acceptance creates an optimistic outlook for Bitcoin’s mid-term trajectory. Although the price is currently consolidating, market participants are keenly monitoring trends for an anticipated breakout or breakdown that could set the tone for future movements.

Significant Transactions and the Bullish Wave of Institutional Involvement

According to Arkham, SpaceX transferred 1,300 BTC, equating to around $153 million, to a new wallet. This marks the first movement of Bitcoin by the aerospace giant in three years, quickly becoming a hot topic in the cryptocurrency community. While some analysts view the transaction as a customary update of custody practices, others contemplate the possibility of it signaling an imminent sale. Regardless, the context is pivotal.

Bitcoin continues to stabilize just under its recent all-time high of $123,000, holding steadfast above the $117,000 threshold. The SpaceX transaction contributes to a rising trend of institutional activities, enhancing confidence and participation from major players in the market. Whether this move indicates a change in strategy or simply a routine adjustment, it affirms Bitcoin’s pivotal role in corporate financial strategies and institutional investments.

At the same time, the larger market climate supports a continued bullish outlook. Legal frameworks in the U.S. are evolving positively, creating a conducive environment for substantial inflows of capital into the cryptocurrency sector. As institutional engagements grow and foundational metrics strengthen, many traders speculate that Bitcoin might be entering a new phase of expansive growth.

Bitcoin Price Overview: Strength in Consolidation

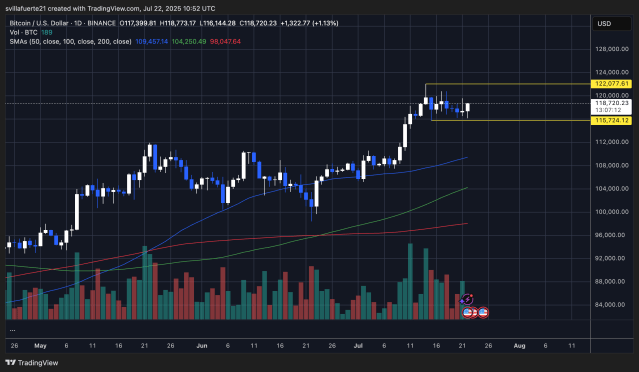

Analyzing the daily chart reveals that Bitcoin has been consolidating within the $115,724 to $122,077 range after achieving its new all-time high of $123,000 this month. Currently, Bitcoin remains above significant moving averages, with the 50-day simple moving average (SMA) situated around $109,457 and continuing to rise, serving as an indicator of ongoing bullish sentiment. Despite recent stagnation in price, there has been no breakdown from this range, indicative of solid buyer support.

During this phase of consolidation, trading volumes have seen a slight decrease, a common occurrence following vigorous market rallies. Nevertheless, buyers are consistently safeguarding the $116,000 mark each time prices dip toward the lower end of the tested range, reflecting the tenacity of the bulls unwilling to concede their position.

A successful move beyond the $122,077 mark could ignite another rally, potentially steering toward the $130,000 to $135,000 range in the short term. Conversely, should there be a decisive drop below $115,724, we may witness immediate selling pressure. However, significant support levels remain intact, particularly near the 50-day SMA and critical psychological zones around $110,000.

Image sourced from Dall-E, data visualizations from TradingView.