In the ever-evolving landscape of cryptocurrency, a significant surge has been observed in Bitcoin Hyper ($HYPER), which successfully attracted a whopping $100K in investments from major wallets in just two hours. With a remarkable presale taking its total funding beyond $18 million, both novice traders and experienced investors are beginning to take notice of this new contender.

Typically, large-scale investors, known as whales, prefer to invest in well-established cryptocurrencies like $BTC and $ETH. Their participation in presales is rare, which indicates that they perceive substantial potential in the $HYPER project. This trend could suggest a pivotal shift in how major players view emerging blockchain technologies.

Bitcoin Hyper ($HYPER) aims to tackle one of the longstanding issues with Bitcoin: its inefficiency in speed and usability. While Bitcoin has solidified its reputation as a reliable store of value, its practicality for everyday transactions remains questionable.

Evaluating Bitcoin’s Challenges

Currently sitting at a market cap of around $2.25 trillion, Bitcoin ($BTC) has established itself as a dominant force in the cryptocurrency realm, gaining acceptance through various financial instruments and widespread institutional adoption. However, its operational model presents significant hurdles in real-world application.

A single Bitcoin transaction can take upwards of 10 minutes for confirmation, with the network managing a mere ~7 transactions per second (TPS). In contrast, modern blockchains such as Solana showcase a staggering TPS of nearly 800, with theoretical limits reaching as high as 65,000 TPS. This stark disparity highlights Bitcoin’s limitations, akin to waiting at a coffee shop while your payment processes.

Consequently, Bitcoin has largely missed out on various technological advancements such as decentralized finance (DeFi), non-fungible tokens (NFTs), and numerous emerging meme coins. As a result, this underscores Bitcoin’s status primarily as a store of value while falling short as an everyday currency. The gap that exists here is precisely what Bitcoin Hyper ($HYPER) intends to bridge.

Introducing the Bitcoin Hyper Approach

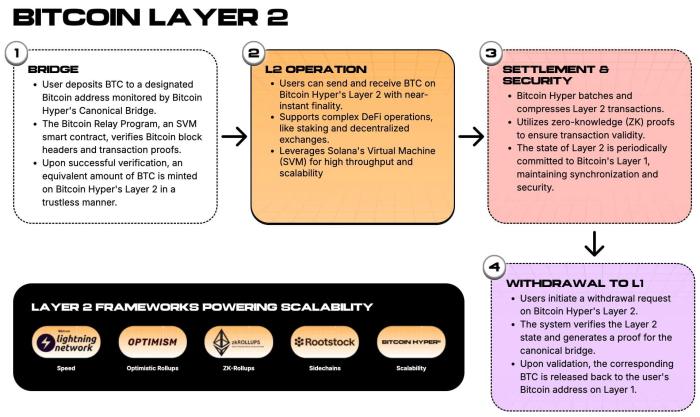

Bitcoin Hyper aims to establish itself as a state-of-the-art Layer 2 solution for Bitcoin. It offers more than a traditional sidechain; it presents a robust execution layer designed to operate seamlessly with Bitcoin’s foundational blockchain.

The process is straightforward: Bitcoin holders can bridge their $BTC into the Hyper ecosystem. Smart contracts validate the deposit on Bitcoin’s blockchain, leading to the minting of an identical amount of $BTC on the Hyper chain. This method ensures both security and verifiability.

Once you’ve entered the Hyper ecosystem, transaction speeds improve drastically, thanks to the Solana’s Virtual Machine (SVM) framework, with near-instant transactions and minimal fees. This is a game-changer compared to Bitcoin’s sluggish transaction speeds.

Each transaction within the Hyper network is secured and aggregated through zero-knowledge proofs, maintaining synchronization with Bitcoin’s Layer 1 while enhancing operational speed. When users decide to withdraw, they can easily bridge back to Layer 1, unlocking their $BTC upon exit.

This advancement means that transactions like purchasing a coffee with Bitcoin can be completed almost instantaneously. Additionally, functionalities like lending, staking, and yield farming can finally be integrated into the Bitcoin ecosystem, while developers will benefit from a fully-featured dApp layer compatible with Solidity.

With Bitcoin Hyper, Bitcoin shifts from merely being a digital storage of value to a practical execution platform. Think of Bitcoin as the central bank’s secure base, while the Hyper network operates akin to rapid payment systems like Visa or Mastercard, ensuring higher throughput without compromising safety.

Explore more about Bitcoin Hyper on their official site.

Revolutionizing Bitcoin’s Position in the Crypto Ecosystem

Bitcoin currently dominates the cryptocurrency market, boasting over 50% market share, yet its functionalities have remained limited. Provided that Bitcoin Hyper delivers on its promises, it could redefine the landscape: $BTC may transition from being simply an asset to becoming a cornerstone of payments, DeFi, and meme culture.

Institutional products like ETFs have made Bitcoin investment more accessible, while Bitcoin Hyper emphasizes real-world utility. This sentiment echoes Ethereum’s trajectory—once smart contracts were introduced, $ETH transformed into a core platform for DeFi and NFTs.

Hyper could serve as Bitcoin’s transformational leap. Envision Bitcoin becoming not just an asset for preservation of wealth but also engaging in daily transactional activities traditionally dominated by $ETH and $SOL. If this transition occurs, Bitcoin’s market dominance could further expand.

The Surge of Bitcoin Hyper ($HYPER) in Presale

The presale of Bitcoin Hyper ($HYPER) has seen unprecedented success, already surpassing $18 million in funding. Tokens are currently priced at $0.012965, and projections suggest it could spike to $1.50 by 2030.

Interest from whales is notable, with one wallet acquiring $87K and another $12.7K in just two hours, indicative of a strong belief in Hyper’s potential beyond being a speculative asset.

Beyond just acquiring tokens, presale participants enjoy lucrative benefits such as priority access to staking with an attractive 65% APY, alongside governance rights. Eager to seize these opportunities? Dive into our comprehensive guide on purchasing Bitcoin Hyper.

TL;DR? Investing in $HYPER represents a strategic move toward enhancing Bitcoin’s usability, scalability, and competitiveness. With its grand presale exceeding $18 million and notable whale activity nearing $100K, this emerging project merits attention.

Given its momentum, community engagement, and significant utility, the most optimistic predictions suggest $HYPER might see up to a 24x increase shortly after its anticipated listing this year.

Join the $HYPER presale today.

Please note: This article does not provide financial advice. Cryptocurrency investments carry risks; do your due diligence and invest wisely.

Written by Alex Rivera, Bitrabo —