In 2025, the embrace of Ethereum (ETH) by public corporations is evident, with a notable surge in acquisitions. Recently, Bit Digital, a firm listed on Nasdaq, made headlines by acquiring 19,683 ETH, increasing its overall Ethereum holdings to over 120,000 ETH.

Bit Digital Makes Strategic ETH Purchase

Bit Digital revealed its latest acquisition, funded by proceeds from a successful $67.3 million share offering. This move underscores the company’s commitment to enhancing its exposure to Ethereum, the leading cryptocurrency by market capitalization after Bitcoin.

With this recent investment, Bit Digital joins the ranks of significant public ETH holders. As per the latest reports, while Bit Digital holds around 120,000 ETH, it trails only behind SharpLink’s 353,000 ETH and BitMine Immersion’s 300,657 ETH holdings. Sam Tabar, CEO of Bit Digital, commented:

“Our position with approximately 120,000 ETH places us among the foremost institutional Ethereum treasuries in the public markets. We recognize Ethereum’s role as critical to the evolution of digital financial systems. The attributes of Ethereum, including its programmability and increasing utilization, signal a bright future for digital assets.”

Ethereum’s role has expanded significantly, now serving as a backbone for stablecoins, fueling decentralized finance (DeFi) operations, and enabling innovative financial applications.

Furthermore, Bit Digital pointed out that Ethereum’s capacity for generating yield through staking uniquely positions it against traditional digital assets like Bitcoin (BTC). Currently, Ethereum’s market valuation stands at an impressive $429.86 billion.

Despite the announcement, Bit Digital’s stock experienced a minor decline, trading at $3.96, down 1.13%. Nevertheless, year-to-date performance remains robust, reflecting a 34.64% increase overall.

Growing ETH Accumulation Among Corporations

While Bitcoin has traditionally dominated the crypto landscape for corporate investments, Ethereum’s adoption is on the rise. Businesses are increasingly viewing ETH as an integral component of their diversified asset portfolios.

For example, SharpLink, another Nasdaq-listed entity, has been actively increasing its Ethereum holdings, recently adding 10,000 ETH to its reserves.

Additionally, blockchain entity BTCS Inc. made headlines when it acquired 14,522 ETH. Overall, companies have amassed around 550,000 ETH in the last month, reflecting a burgeoning institutional confidence in Ethereum as a viable asset.

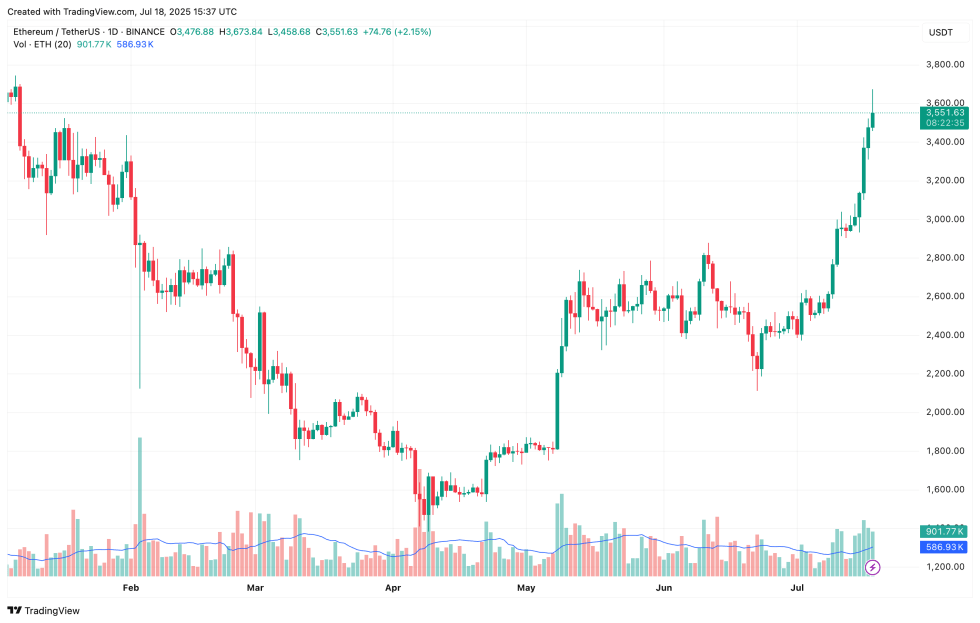

Moreover, GameSquare Holdings has revealed an investment of $5 million in ETH, moving towards a larger $100 million strategy focused on Ethereum. As such, ETH is currently trading at $3,551, marking a 3.8% increase over the past day.